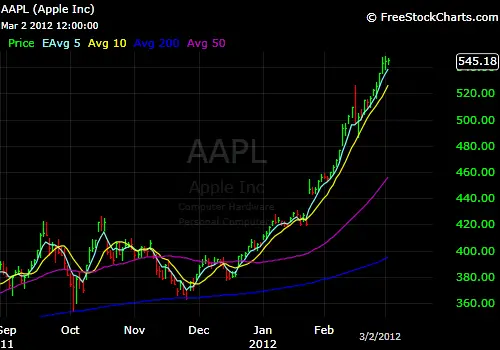

I was fortunate enough this year to catch the majority of the Apple move, not because I was lucky but because I have spent many years studying the greatest stocks in history and how they behave and also how the greatest traders of all time traded them. I have been waiting for this kind of an opportunity and knew what to do when this opportunity presented itself. However others did not and missed most this move or all of it. Here are the top ten mistakes I believe new traders made and why they missed this easy money.

- It is safe to buy a monster stock when it breaks above its 50 day moving average in an up trending market. This is a key resistance level to watch. A long bull candle on a chart with increased volume is a big green light to buy. You can even use the 50 day itself as a stop to get back out if it fails to run, which does happen, so you risk a little to make a lot. This is a pocket pivot entry if you missed it last time.

- When a stock gaps up after earnings and forms a trading range for a few days then breaks out to all time highs from that range that is also a key buy point. A stock that grows earnings and sales by 50%-100% will begin a new repricing to account for these new fundamentals. Professional money managers will begin to move in.

- DO NOT TRY TO PREDICT a top, do you think you are smarter than the majority of all participants in the market that create the chart? Sell only when you get your signal to sell, let the chart tell you. My signal is a loss of the 5 day ema that is not retaken by the close, a 100% expansion of volatility to the down side, or closing at the low of the day.

- Instead of using $54,500 to trade 100 share of stock use $2,500 to trade front month in-the-money call options on Apple. The risk to your capital is much less, and you still can capture the majority of the profits dollar for dollar in the long run. It also keeps your capital free for other trades. (However, you must learn how to trade options first to know what you are doing.)

- Only risk 1% of your total trading capital on the trade. If you are trading with $60,000 you can buy 100 shares and risk $600. Or you can risk that much through call options. Going on margin or risking your entire account on any one trade in any one stock will eventually lead to you losing it all. Don’t let Apple turn you into a gambler, stay a business person and manage your business.

- I will be the first to say that you did an excellent job picking Apple as your stock. So you are an excellent stock picker. However you must also be an excellent trader by using a trading plan and proper risk management. I have seen many stock pickers make a lot of money only to give it all back when the party ends abruptly and they really do not know what to do, or their next pick does not work and they lose all their Apple money trading stock number 2.

- Even the biggest Apple Bulls must have an exit strategy. You must define at what price reversal you will know the story on Apple has changed or if you are an investor, at what earnings or sales news will tell you to sell and take your profits because the fundamental story’s trend has changed?