This is a guest post from Stock Pair Trading, creator of the website StockPairTrader.net. This was originally posted at Nature of pair stock trading, history and is republished here with permission.

Trading on stock exchanges around the world is one of the most profitable and “sexiest” enterprises one can come across. It does not require any employees, office, or customers. In business terms, relatively low capital is required for the start, and it can be quickly converted into real riches. Who would not want to make millions?

There is a myriad of instruments that can be traded on exchanges around the world. From currency pairs to stock, options, to futures contracts. Each instrument has its characteristics, risks, and profit potential. Equity is the most easily comprehensible for a beginning trader: when I buy stock, I buy a share in the given company. When things go well, the value of the stock goes up. When things turn for the worse, the value of the stock (company) goes down. With a bit of foresight and interest in the segment, it is possible to follow trends and made money trading, using this simple method.

But what about unexpected events that shake up the entire (not only trading) world? The attack against the WTC in New York, the 2008 financial crisis, Brexit? All these are events that knock exchanges around the world down to their knees and rid the trader of his laboriously attained profit, if not of his entire account.

Attack at the WTC in September 2001

Every professional trader knows that risk management is the foundation of long-term prosperity. Banks and investment funds around the world pay generously for their team of experts that has only one task: to minimize risks, to minimize risks and, once more, to minimize risks! A stable strategy that makes a few percent per year is incomparably better for a professional than aggressive scalping that can make 100% in one month, but can also ruin your account within a few days… With a strategy that makes a reliable 5% per year, the amount of absolute profit is only a matter of capitalization.

Trading stock pairs

Banks have looked for reliable and stable exchange trading strategies since the beginning of their existence. Dozens, or even hundreds of more or less successful methods have been devised over the years. Some strategies have only worked on a short-term basis, others made money for decades. A strategy that has worked on an extended basis is pair stock trading, also known as statistical arbitrage.

Statistical arbitrage was described in theory in the 1950s by the Australian investor and hedge fund manager Alfred Winslow Jones. But it did not get used in practice until the introduction of powerful computers that made it possible to process enormous volumes of data in real time and to search for profitable equity pairs. The boom of the strategy came in the 1980s thanks to

Gerry Bamberger, Nunzio Tartaglio, and their

expert team from Morgan Stanley.

In 1987, Morgan Stanley announced that it made 50 million dollars on Tartaglio’s team’s automated systems. That was an incredible profit for that era. Although the group was dissolved in 1989, stock pairs have remained one of the pillars of the bank’s strategy. Over time, as details of the strategy reached the general public, stock pairs became one of the most popular neutral strategies around. Today, they constitute the foundation of trading portfolios of professional traders, banks, and funds around the world.

Gerry Bamberger at Morgan Stanley

The principle of pair equity trading

The concept of pair trading is surprisingly simple: we find two shares whose price ratio has been stable on a sustained basis and speculate whether it will continue to remain stable. In other words: if the price ratio (stable in the long-term) sways outside of the usual range, we speculate on it returning back to normal after some time.

The figure below shows an example of two highly correlated shares – SMLP and ENLC (both shares are from the natural gas distribution sector). We can see that the stock prices have taken a very similar course.

Figure – example of two highly correlated shares

SMLP – Summit Midstream Partners LP

ENLC – EnLink Midstream LLC

When trading stock pairs, we do not speculate on the fluctuation in the price of one stock title, but on the relative fluctuation of the prices of two stock titles (pair) with respect to one another – the return of a short-term sway in their price ration back to the long-term normal. In the next article in our series, we will describe in greater detail what makes this approach better than separate stock trading. At this point, lest us focus on the practical aspects of pair trading.

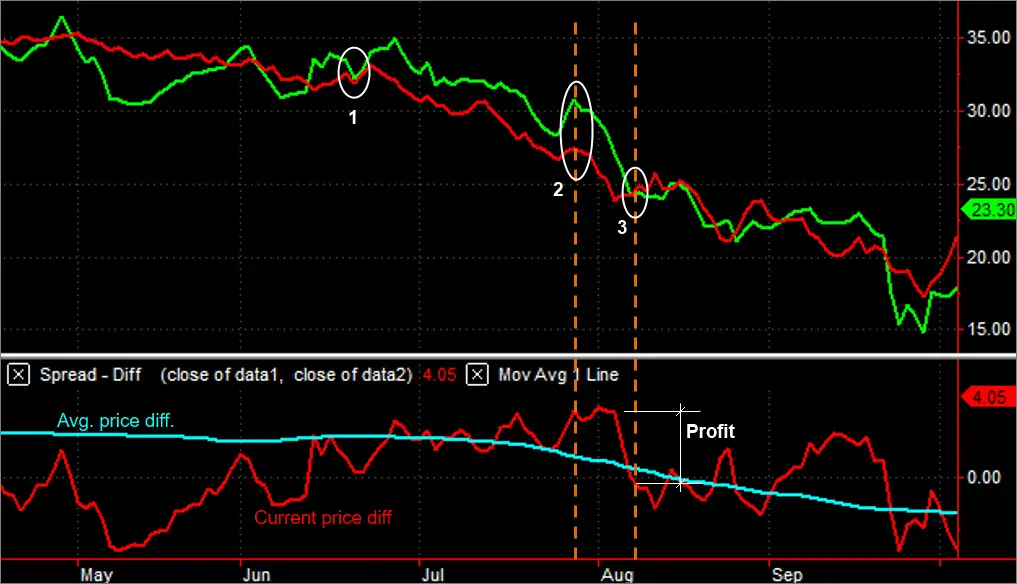

In practice, a pair transaction works as follows: at one time, we buy the undervalued stock title and sell the overvalued. If the assumption of the reunification of their prices is confirmed (which has been statistically proven), we collect the profit. It is irrelevant whether the profit is generated by the growth of the undervalued stock title, a drop in the overvalued one, or any other combination of price fluctuations. What matters is that we collect our profit when the difference in prices is reduced.

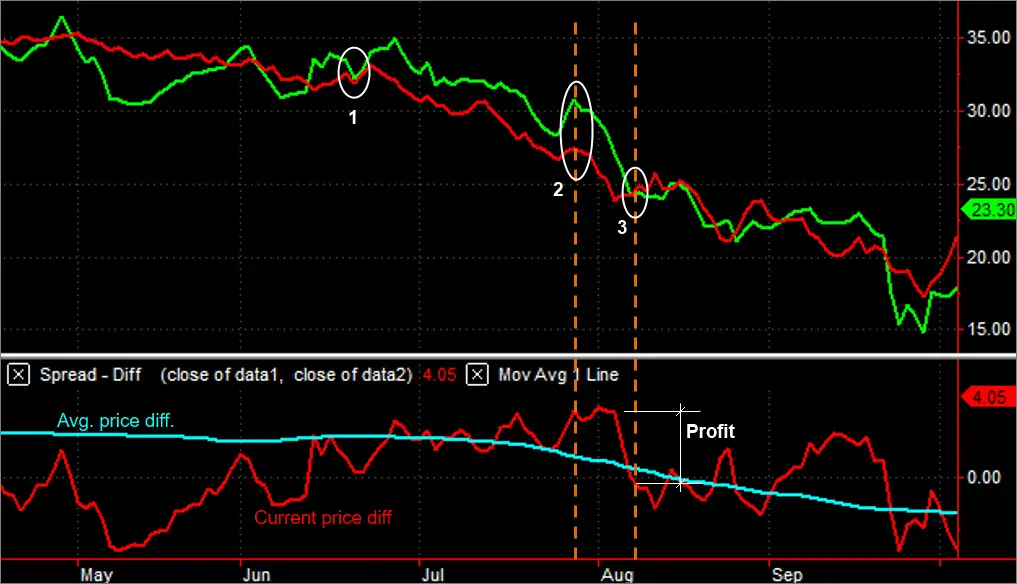

For greater clarity, we show a figure that demonstrates in simplified terms the principle of trading on the difference in stock prices. The difference in stock prices in this case is expressed in simplified terms as a simple difference in the prices of stock the titles used (there are several ways of expressing that difference). Again, we are using SMLP and ENLC stock for our example:

The principle of pair trading

Point 1: The difference between stock prices is very small

Point 2: The difference between prices is unusually high – you can expect a return to long-term average

Item 3: The prices really became closer again

It is difficult to believe that this simple a strategy, based exclusively on Close prices and their past behavior, can make money. If equity markets were 100% effective, the trading of equity pairs could not be profitable. But the real behavior of markets is far from the ideal and hence, this strategy has yielded consistent profits with a minimum risk for more than 40 years. Actually, pair trading itself contributes to market effectiveness – hence the name “statistical arbitrage”.

Abundance of trading opportunities

A stock pair may be made up of any two stock titles. With a view to hedging the risk of the impact of fundamental news (we will talk about this in greater detail in our next article), stock titles from the same sector of the economy are usually chosen. Understandably, a pair comprised of the stock of two companies doing business in the same sector will be better hedged than one comprising the stock of two entirely incompatible companies.

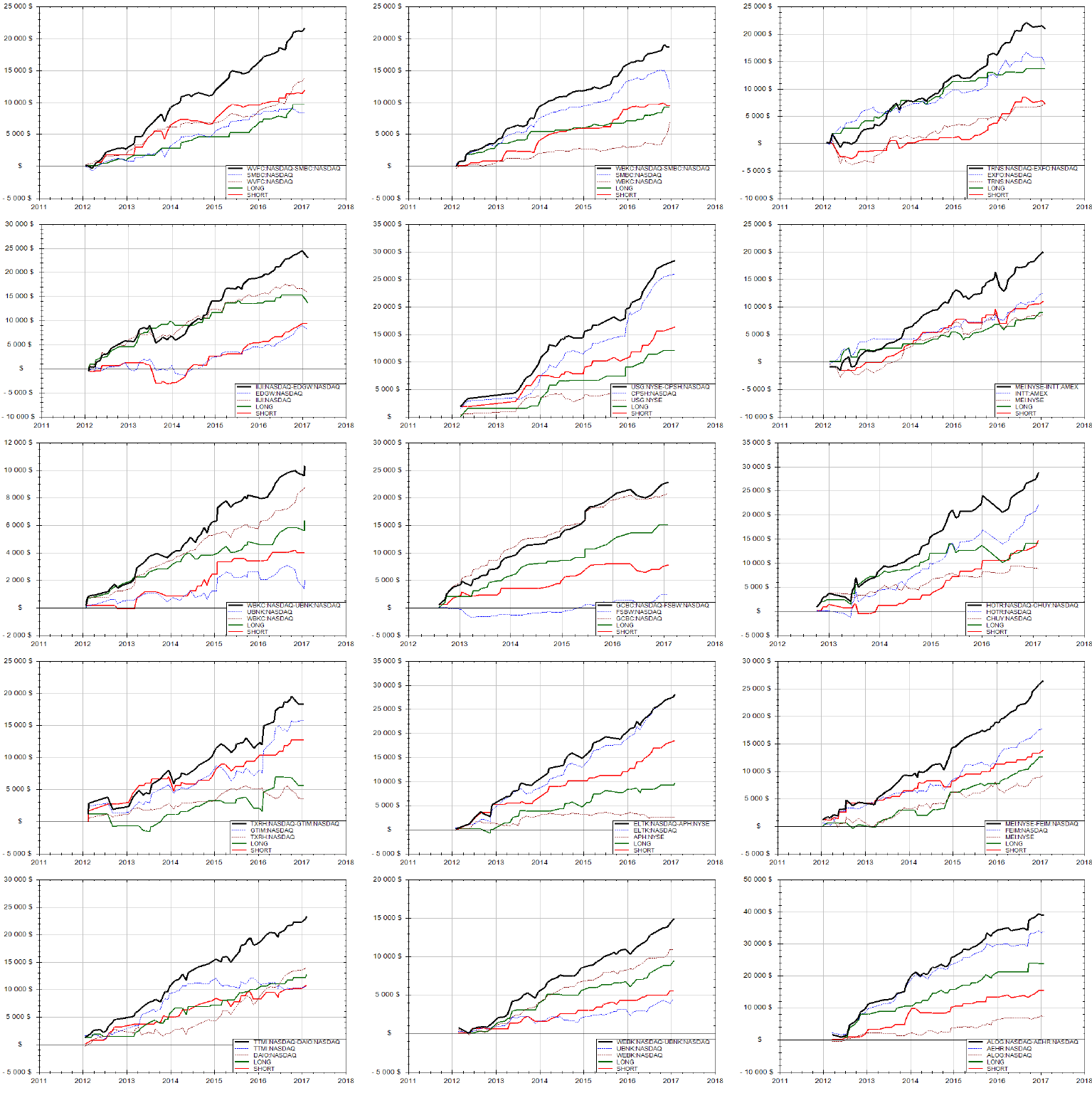

We can easily put together lists of stocks divided by sector, using public resources. Using stock traded on the NYSE and NASDAQ, we can identify from 8 to 140 sectors, depending on the level of detail chosen, comprising some 6500 stocks. Even with the finest resolution (the largest number of sectors), we get 340,000 potential stock pairs!

Sample equities of stock pairs

Trading automation

Pair trading is simple in principle, but it requires very high gross calculation capacity. At one time, one must monitor dozens or hundreds of stock pairs, assess their trading model and execute the relevant orders precisely and flawlessly in the event of a signal for entry / exit. The good news is that there is software available that will do all this work for you. Trading after the initial set-up of the program is not time consuming at all – usually, 10 minutes a day, before the markets close, will do.

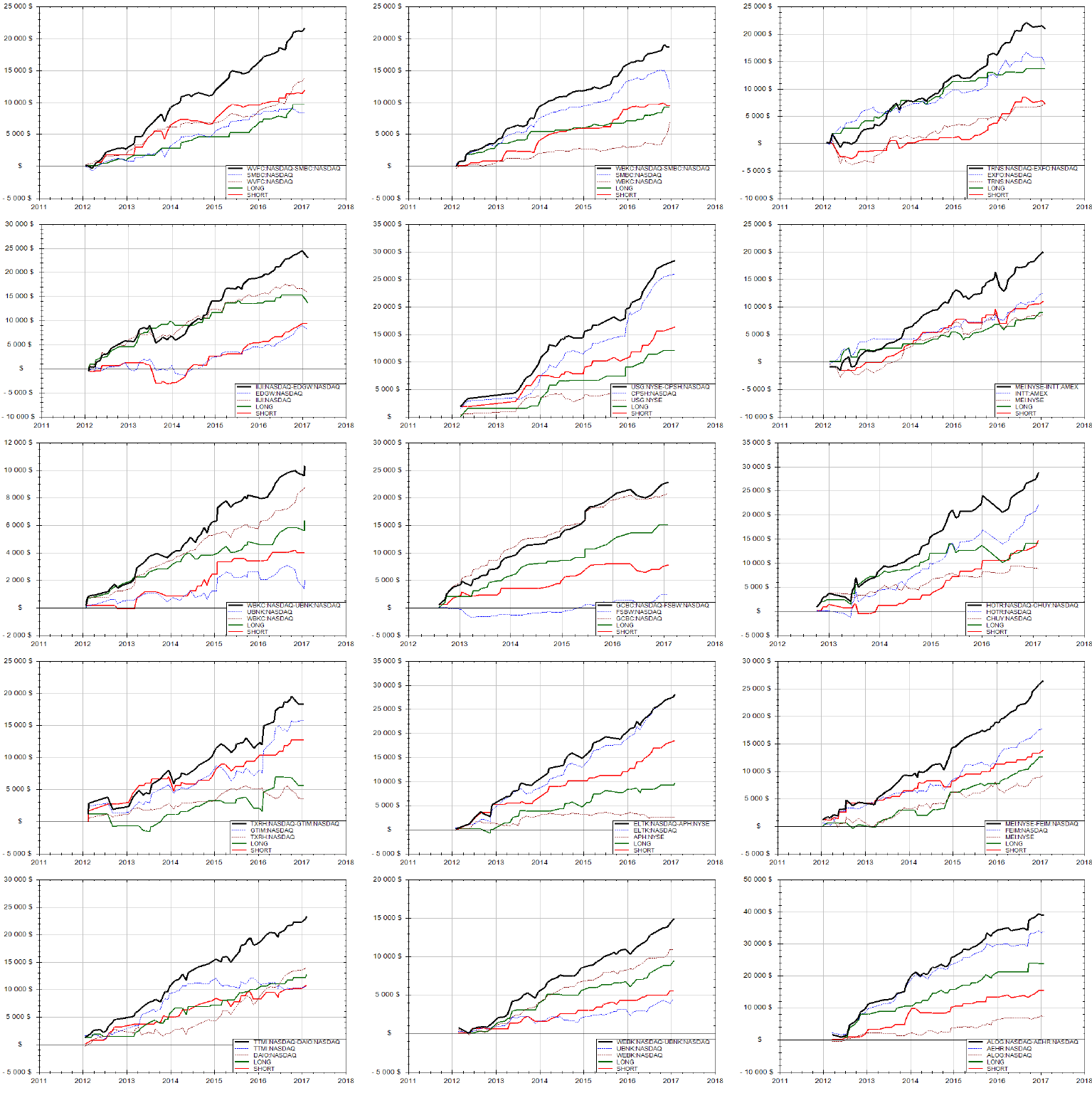

In the

next part of our series, we will describe the edge of this method, show you the possible equity curves of stock pair trading, and summarize the pros and cons of trading using this method.

For more articles by Stock Pair Trading check him out here on StockPairTrader.net and follow him on Facebook and YouTube.