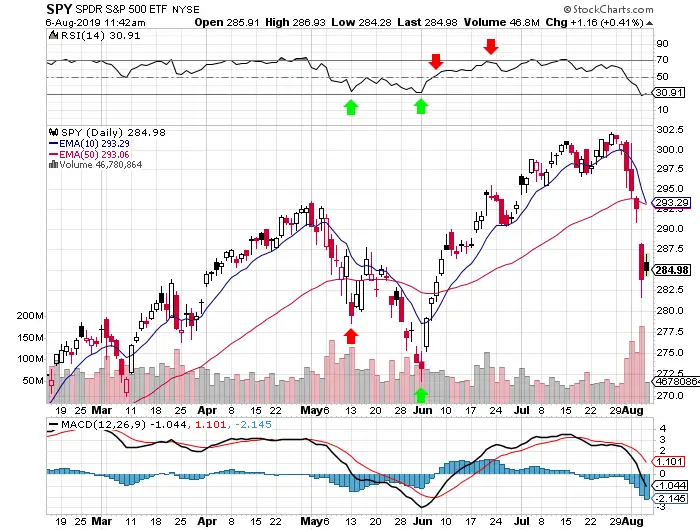

Markets only trend a small amount of the time, they spend most of their time going sideways or become volatile and go no where. While catching a big trend can be profitable after a break out or break down of a range there are other ways to make money. Swing trading is a trading method that tries to capture gains in a market over a period of a few days to several weeks. The goal of a swing trader is to capture a large part of a potential move in price. There are many different types of swing trading signals, buying the dip into oversold levels, buying the momentum of a swing back to the upside, or buying the dip into a key moving average support. Here are a few examples of my favorite swing trading signals to buy.

Moving average crossover signals can get you back into a swing back to the upside in price based on backtested signals that put the odds in your favor. You can decide to lock in profits at the 70 RSI overbought level or let your winner run for as long as possible by using the cross under of the moving averages as your exit signal.

Buying price dips to the oversold 30 RSI level can create great risk/reward ratios in the stock indexes and leading stocks as many times you will find buyers at those levels ready to step in and send the price back higher. The 50 RSI and 50 day moving average are good profit targets when you enter at the 30 RSI. A good initial stop loss is to exit if price closes below the 30 RSI.

Many times markets in long term uptrends will bounce near their 200 day moving averages creating a good risk/reward entry or when a market breaks back over the 200 day moving it can be the first sign that a new swing higher in prices could be underway.

These signals are not perfect and they don’t work every time, the key to making money with swing trading is keep your losses small with stop losses when they don’t work out and let your winners run with trailing stops when they catch a swing.

*This post is for informational purposes only and is not investment advice.*