Win Rate and Drawdowns Cheat Sheet

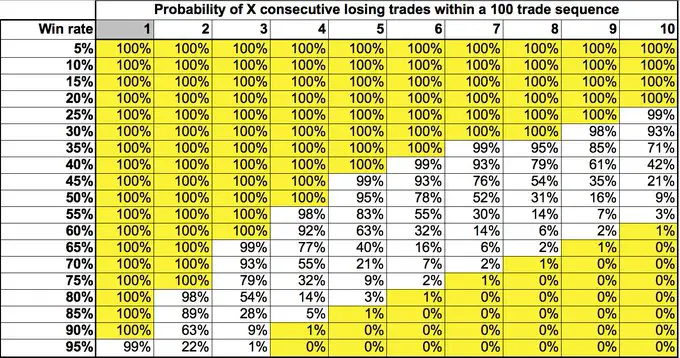

This table shows the probability expressed as a percentage for the odds that you will have a certain number of consecutive losing trades in each 100 trade sample of your trading. For example if your win rate is 50% then 9% of the time you will have 10 losing trades in a row for each […]

Win Rate and Drawdowns Cheat Sheet Read More »