Do you want to drastically improve your trading? Simple, TRADE SMALLER, risk less, cut losses sooner, but still let winners run. The 1%-2% maximum risk per trade rule can dramatically improve your trading by limiting draw downs and still leaving the upside open for big winners.

-

When you risk smaller amounts of your capital per trade you remove much of the stress of trading. 1% of capital risked per trade makes every trade just one of the next 100 trades. 2% of capital risked per trade makes every trade just one of the next 50 trades.Divide your stress by 50 or 100 it will greatly improve your odds of success.

-

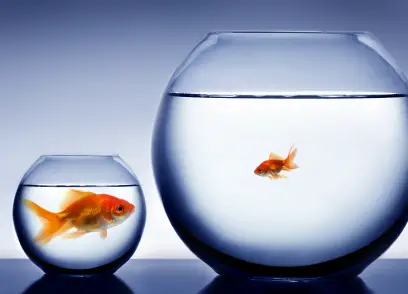

Small trade risk takes much of the ego out of trading, you are no longer going all in trying to get either hit a home run or strike out, you are just trying to consistently get on base.

-

Good risk management decreases the amount of your draw downs which makes trading a much easier proposition. Consistently growing capital is a much more pleasant process when you are not trying to come back from 25%-50% draw downs, trust me on this, been there done that.

-

Trading smaller gives a trader a much better chance of not allowing emotions to over take the brain in making the right trading decisions. Trading size is like the volume dial on emotions, the bigger the trade the louder the emotions.

-

It is easier to follow a trading plan when each trade is not a make or break proposition. It is just one trade.

-

It is easier to take stop losses when the losses have less financial sting. A 1% or 2% loss of trading capital is not as hard to accept as a huge loss that traders are more prone to keep holding and hoping it comes back.

-

Huge trades draw a trader into watching every tick, it saves a lot of time and emotional capital when you can simply trade the opening hour or end of day prices instead of watching every tick from the open to the close if you are a swing trader or trend trader. The bigger the trade the more attention and time the trader gives to the market. This usually does not increase profitability or winning percentage just stress and the consuming of time.

// ]]>