This is a Guest Post from Rolf @Tradeciety (He has some of the best content and trading graphics on twitter).

“You only learn from your mistakes” is a very dangerous and misleading statement. And at the same time, it is totally wrong. In fact, there is so much you can only learn from your winning trades that not using this opportunity will cost you a lot of money as a trader. In the following article we will take a look how you should analyze your winning and your losing trades and what to focus on when evaluating your trades.

Not all winning trades are good

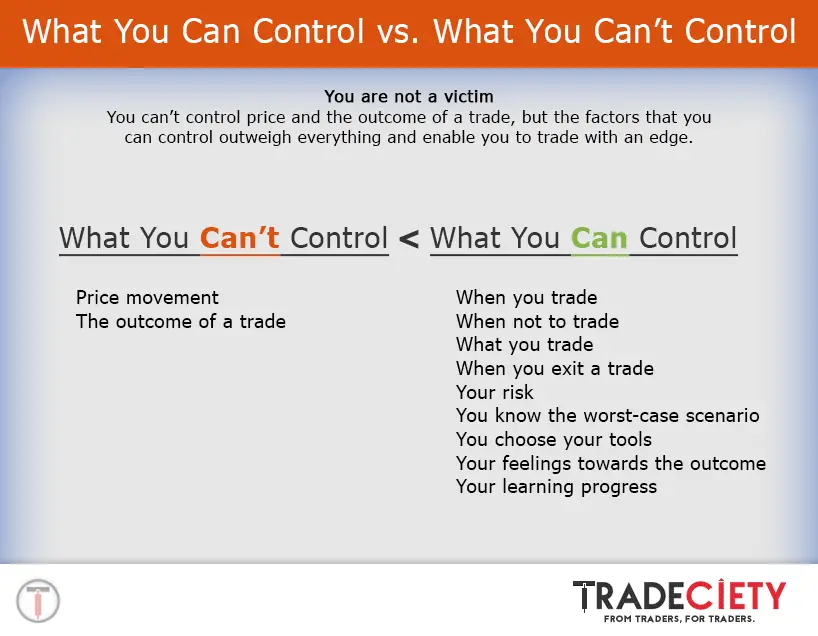

In the first step you have to understand that you can make a bad trading decision, violate all your trading rules and still come out ahead. Having a winning trade while breaking trading rules is very dangerous for the development of a trader because it might lead to sloppy trading behavior and a mindset that trading rules should not be taken too seriously. On the other hand, the best setup can turn into a losing trade, and there is nothing to worry about. It is the nature of the game that not all trades will be winners. The graphic below illustrates the connection between the outcome of a trade and the adherence of trading rules.

How to learn from winning trades

There are mainly three things that you have to ask yourself when it comes to analyzing your winning trades when it comes to increasing your trading performance.

1. Were you just lucky?

“In trading, it does not matter whether you are right or wrong; the only thing that matters is whether you are making money”.

The quote above wanders around trading forums and on social media, but it could not be further from the truth. The previous diagram shows, you can easily end up in a winning trade while having violated all your trading rules; a winning trade would then be the result of pure luck.

Inexperienced and ignorant traders might start to believe that they don’t need trading rules and that their ‘gut feeling’ tells them what to do. Dead wrong. Winning trades, when violating rules, can be very harmful for a trader’s discipline and his overall development. It is therefore important to analyze whether your winning trades are the result of accurate planning and following the plan, or whether you were just lucky.

2. How to make more money?

If you have followed the rules and price made it to your take profit order, you did what a trader is supposed to do. But, did you execute your plan in the best possible way, or was there something you could have done better? There are two things you should analyze when it comes to optimizing your trading performance:

• Was my entry good? Could I have entered later for a better price and, therefore, had a bigger winner?

• Could I have used a smaller stop loss or a wider take profit target?

Although analyzing these two points is crucial for a trader to increase his performance, it is even more important to avoid knee-jerk decisions. Only after you have collected data on a big enough sample size, the numbers can tell you what to do.

3. What do your winning trades have in common?

Finally, you should evaluate your winning trades and find things they have in common. If you are able to find a common denominator you can take more of those trades that already work. Pay attention to the time of the trade entry, a certain indicator setting if you use any, the prevailing market conditions or just whether you have more winning trades on certain instruments than on others.

How to learn from losing trades

It is great when you can find ways to turn winning trades into even bigger wins, but finding out how to eliminate losing trades is equally important for your overall success. And keep in mind, you will never be able to avoid all your losses. They are just part of the game. The following three points can serve as a guideline when analyzing your losing trades.

1. Could the loss have been avoided?

This is probably the most obvious question and the one you have to ask yourself first. Did you violate your trading rules, or was there any way that the loss could have been avoided? Besides breaking trading rules, going against the overall trend and ignoring the impact or release of important news usually fall into this category. But be honest, you cannot avoid all losses and even the best setups will fail over and over again.

2. Could you have lost less?

If you rule out the possibility that the loss was avoidable, you have to answer the question whether it would have been possible to minimize the loss. Did you see early signs for a potential losing trade or was it even your mistake, due to wrong trade management decisions that caused the loss?

Traders sell winners at a 50% higher rate than losers. 60% of sales are winners, while 40% of sales are losers.- Odean (1998): Volume, volatility, price, and profit when all traders are above average

Finding ways to cut losses early is one of the fastest ways to increase trading performance. Evaluate your losing trades to find patterns that signal early when the trade goes wrong. Most trades do not head straight to your stop loss order, but provide opportunities to get out for a smaller loss.

3. What do your losing trades have in common?

In the last step you have to evaluate your losing trades and check whether you can find similarities. Often traders find that they lose a disproportionate amount of money on a specific kind of trade, setup or instrument. Some traders even report that they are better at trading long trades than short trades. An easy way to avoid losses is to find what is not working for you and stop doing it. It seems so obvious, but not many traders follow this advice.

Conclusion: There are several ways to increase your trading performance

Most traders do not see the bigger picture and only focus on finding a ‘better’ indicator that can tell them how to find better trades, whereas the answer is so often right in front of them. By analyzing how to win even more on your winning trades and how to cut losses in an effective way, you can become a profitable trader much faster than believing in the Holy Grail of trading.

You can find more of Rolf’s great articles at www.Tradeciety.com