This formula for profitable trading was shared in my Facebook trading group by professional trader and money manager Richard Weissman author of Trade like a Casino.

What is positive expectancy? Here’s a .xlsx friendly formula: Expectancy = ((PW*AW) – (PL*AL))*F

Where PW = % Win; AW = Average Win; PL = %Losses; AL = Average Loss; F = Frequency

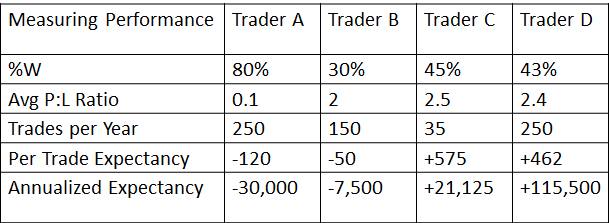

Trader A: Negative Expectancy despite 80% wins!

PW = 80%; P:L ratio = 0.1 (+100:-1,000); Frequency = 250 per year

Trader B: Negative Expectancy despite AP:AL ratio of 2:1

W% = 30%; P:L ratio = 2:1 (+1,000:-500); Frequency = 150

Trader C: Best per trade expectancy

W% = 45%; P:L ratio = 2.5:1 (2,500:-1,000); Frequency = 35 (would we have confidence if Frequency was 2 per annum?)

Trader D: Best Annualized expectancy

W% = 43%; P:L ratio = 2.4:1 (2,400:-1,000); Frequency = 250

Be sure to read the formula plus Richard’s examples A, B, C and D… everyone wants A in the beginning because they’re afraid to lose. Later, they imagine key is big wins, small losses so they want B. Then they realize they need to look at %W and avg P:avg L ratio so they choose C. Finally the mature trader understands the math and chooses the correct answer, D.