Options trading is when you buy and sell contracts that give you the right to purchase or sell a block of an underlying asset at a set price during a specific time frame. Options are not assets they are bets on a potential asset moving in price. An option chain gives you prices on different strike prices and different time frames for expiration on a stock or commodity.

Option contracts are created when someone writes to open a contract and then it is sold to close. Option sellers and buyers are always equal and options are a zero sum market with an even number of short and long option traders at any time. For every option contract someone is short and someone is long.

| Contract Name | Last Trade Date | Strike | Last Price | Bid | Ask | Change | % Change | Volume | Open Interest | Implied Volatility |

|---|

| SPY200103C00321500 | 2019-12-27 3:58PM EST | 321.50 | 2.56 | 2.23 | 2.29 | -0.08 | -3.03% | 470 | 2,600 | 8.55% |

| SPY200103C00322000 | 2019-12-27 4:04PM EST | 322.00 | 2.05 | 1.91 | 1.95 | -0.21 | -9.29% | 3,079 | 8,699 | 8.34% |

| SPY200103C00322500 | 2019-12-27 4:13PM EST | 322.50 | 1.66 | 1.62 | 1.64 | -0.28 | -14.43% | 2,815 | 3,331 | 8.18% |

| SPY200103C00323000 | 2019-12-27 4:14PM EST | 323.00 | 1.37 | 1.34 | 1.36 | -0.21 | -13.29% | 11,020 | 6,866 | 8.03% |

| SPY200103C00323500 | 2019-12-27 4:11PM EST | 323.50 | 1.12 | 1.10 | 1.12 | -0.18 | -13.85% | 4,177 | 3,918 | 7.96% |

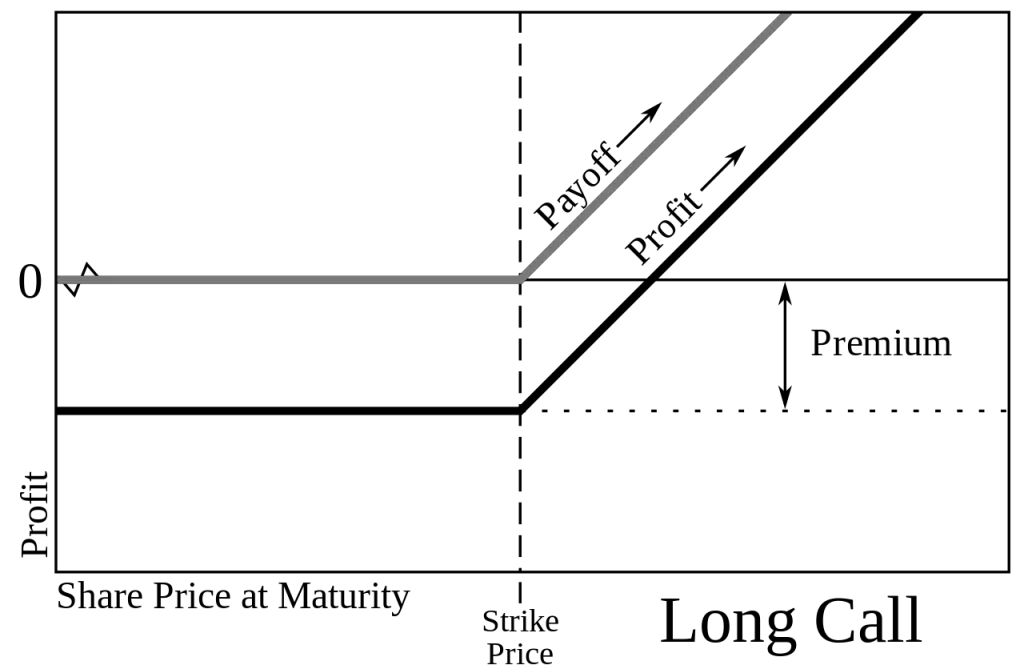

When trading options you have to be right about both the price and the time frame of the move to make money on an option at expiration or trade it for a profit when it has increased in value because the probability of it expiring in-the-money is higher than when you bought it. Option prices go up up when the odds of expiring in-the-money increase and decline when the odds of expiring out-of-the-money increase. When you buy an option you are paying for the time value of the right to the price move of the underlying asset, as time passes an option declines in Theta value. An option will also be priced based on the implied risk of the current and historical volatility of the underlying asset to compensate the writer of the option for the danger they are taking.

Here are some tips on option trading:

- An option buyer can control large blocks of stocks with call options that are going up in value with a small amount of capital.

- People can short stocks by using put options and not have to have find shares to borrow or use margin for selling stock short. The risk is also defined to the size of the option contract.

- Option writes can sell options short to option buyers and get paid for allowing them to place very low probability bets on a price move in a set time frame.

- A stock trader can buy a hedge for their long positions by using put options to protect their long term positions from a downtrend instead of selling their stocks.

- Options can be used to manage risk with a predefined maximum capital at risk limited to the price of an option contract.

- Option traders can both buy or sell option time value.

- Option traders can both buy and sell volatility.

- An option buyer can bet on a stronger trend than the market is pricing in and also bet on both directions at the same time using option straddle of strangle plays with both calls and puts.

- Options allow traders to create synthetic stock positions using options with little capital out lay like selling a put and buying a call option or the reverse.

- With options someone can both sell an option and hedge it with a cheaper option so your short option does not have unlimited risk.

Here are some of the underlying risks to be aware of to manage while trading options:

- Some option chains are thinly traded and lack liquidity. Be careful to look at Bid/Ask spreads and not trade options that are 10% apart from the buy and sell quotes. If you will lose 20% of your capital in a position after both entering and exiting an option trade it will be very difficult to be profitable over the long term. It is safer to only trade high volume option chains with tight bid/ask spreads, like SPY, Apple, QQQ, and IWM.

- Be aware of the expiration date, that is all the time you have for the expected move to happen. If you bet on a strike price that the stock does not reach fast enough you could lose 100% of your capital if you hold until after expiration.

- Options are a bet and a trade not an asset. While they can be traded they are only worth the intrinsic value of the option strike based on the underlying at the time of expiration and nothing more.

- Options are more difficult trading vehicles to let winners run due to their volatility and time decay. Your time to be profitable with options is limited, you have to take profits at the right time.

- You can trade a longer term trend with options by rolling them to a farther out strike after locking in profits.

For more information about option trading you can check out my book Options 101 or my more in depth eCourse Options 101.