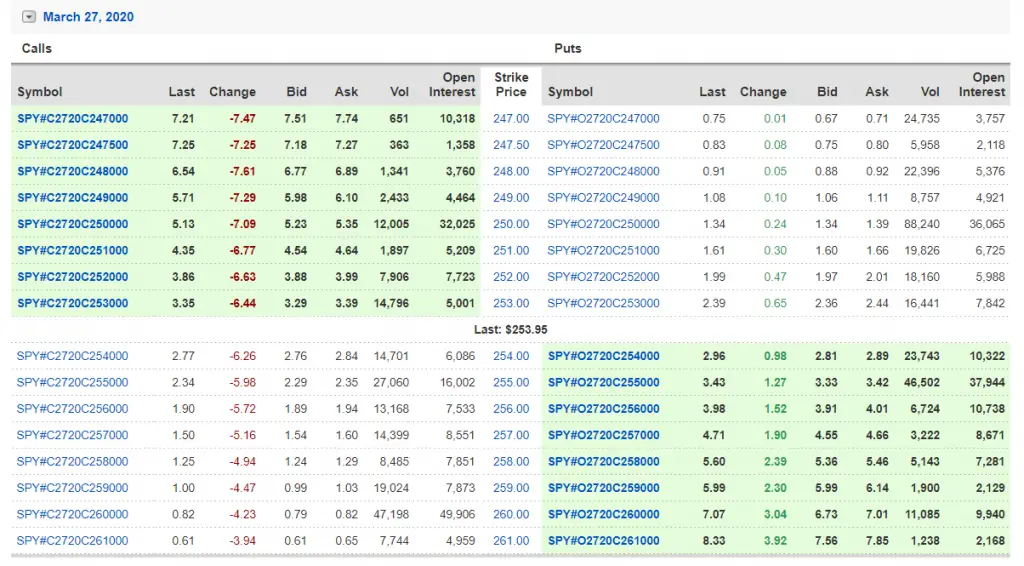

What is a Straddle Option Play?

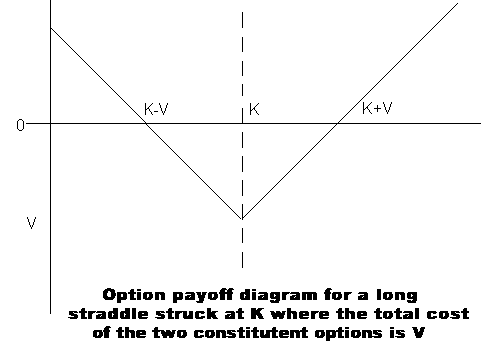

In option trading a straddle play is created when two option trades are opened in the same underlying asset at the same strike price at the same expiration date but with both a call and a put. One side of the option play will become higher priced in an uptrend and the other will move higher […]

What is a Straddle Option Play? Read More »