Dollar cost averaging is an investment process where you invest a set amount of money into a market at regular intervals. The strategy is to put a fixed amount of dollars in a specific investment like an index fund so you get more shares when the price is lower and less shares if the price is higher. The theory is that over time you will be profitable as a market makes new highs as you averaged in over time and got in at lower prices that brought down your average cost of shares.

Dollar cost averaging is a way to avoid market timing on your entries over time and easing into a larger position size and growing an account in the long term. It is a strategy used very commonly for young people just starting out in their careers with access to a 401k account as they distribute money from each paycheck into investments.

This process aims to lower the impact of volatility of price action on large purchases in the stock market by not buying all into a position at one time. Other common names for dollar cost averaging is the ‘constant dollar plan’ in the United States and ‘pound-cost averaging’ in the United Kingdom, and regardless of the specific currency being used it can universally be called: unit cost averaging, incremental trading, or the cost average effect.

The best returns on dollar cost averaging are created when the buying is started near the bottom of bear markets or after market crashes and the position is sold near all time highs. There is an edge in dollar cost averaging as investors do not have to time their entries and exits perfectly they just have to start at a price level and valuation that has a good risk/reward ratio and exit as a market becomes over valued where the risk/reward ratio of returns on new purchases diminishes.

The longer the time period of a holding period is the less important the timing is for a dollar cost averaging program. If you are going to hold an investment for 30-40 years then timing is less important as the odds are that your investments will do well over that time period if diversified in equities as an asset class like index funds.

Dollar cost averaging as an investment process is not stress free as it is not easy to watch years of returns disappear during a bear market or crash. Also the larger your account is the higher the volume of stress in holding during drawdowns in capital.

Dollar cost averaging is a strategy for investors to use to get the best average price on a long term investment and is not recommended for trading as most traders operate on a much shorter time frame and should never add to a losing position.

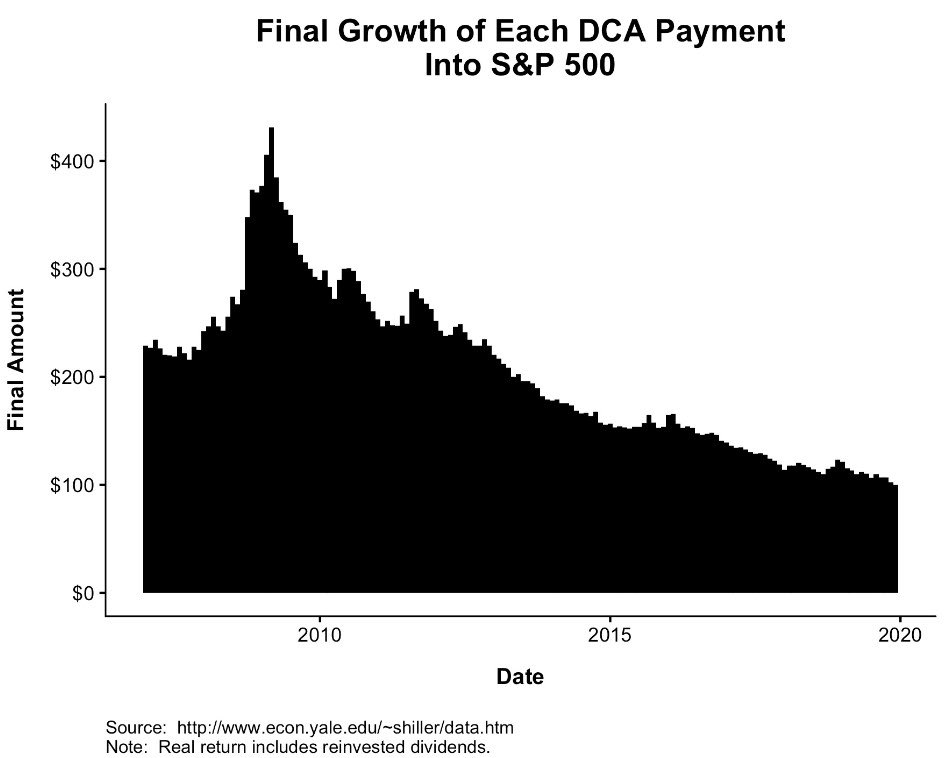

The following image is what $100 invested turned into by 2020 invested in the S&P 500 Index at different time periods.