A put option contract gives the buyer of the contract the right to sell the underlying asset at the strike price of the put on the day of expiration and assignment.

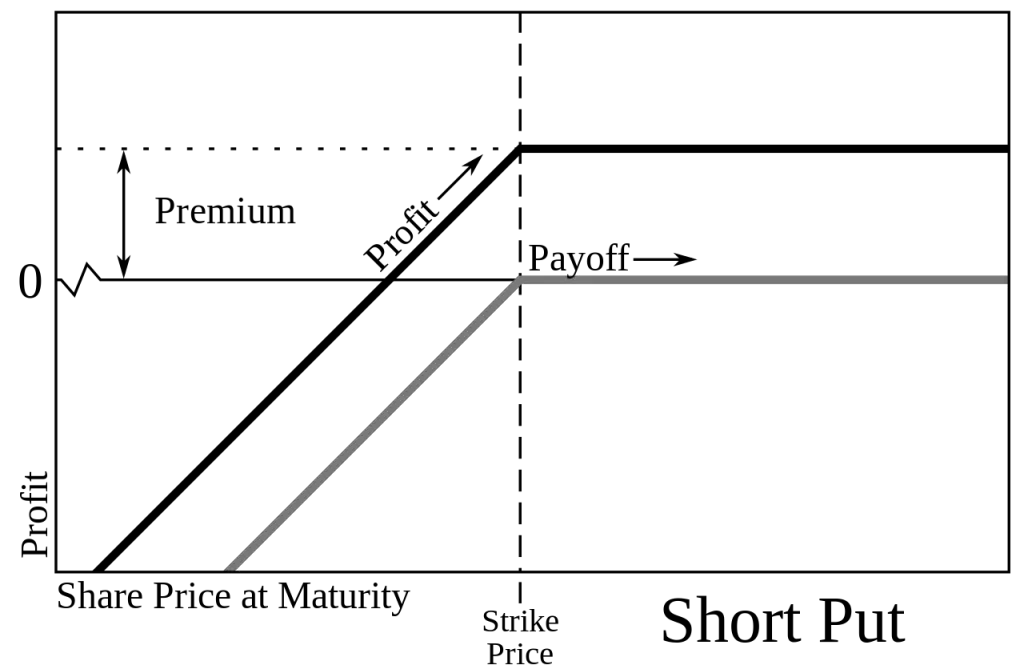

When writing a put option you create a ‘sell to open’ order with your option broker. This is how you sell put options short as a way to get paid a premium to buy a stock at the lower price you want if your put option strike price is reached before expiration. If your buy price is not reached then you keep the premium you collected to sell the put option contract.

A put option contract seller is paid when they ‘sell to open’ a put option and receives a premium for agreeing to have stock ‘put’ on them at a set price by a specific date. The put writer has agreed to buy a stock at the strike price of the put option they sold.

The buyer of the put has the right but not the obligation to exercise the option and ‘put’ the underlying asset on the put option seller by assignment. This would create a long position in the put option sellers account. The buyer of a put option is making a bearish bet on when a stock will close below a certain price.

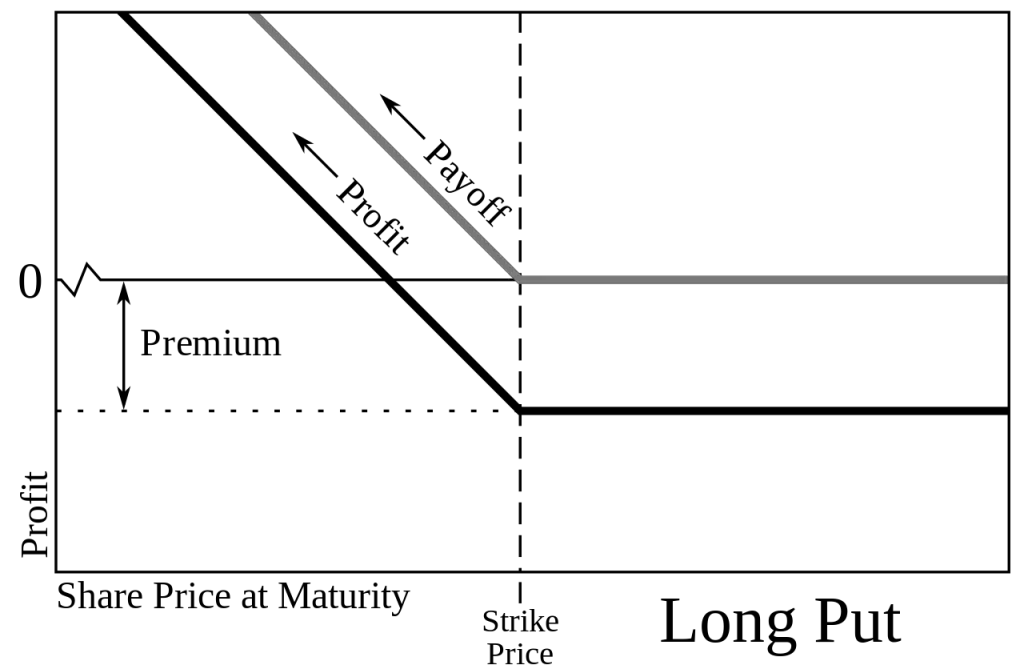

The put option buyer makes money if the underlying stock closes below the strike price by expiration and adds more in intrinsic value than the option cost in extrinsic value. At anytime in the life of the put option it can go higher in value with a strong move down in the stock and be sold for a profit before expiration.

Put option contracts usually trade in contracts of 100 shares of stock. The amount of shares a put option controls can be different if a stock has split or reverse split. Also mini contracts in some option chains have traded in the past that were written on less than 100 shares.

Put options are not financial assets like bonds, stocks, or commodities they are simply trading vehicles. A put option is a bet that a stock will go down to an approximate price in a set time period.

While put options do provide leverage with the ability to control much more stock than if you just bought the shares the level of risk is correlated to your position size. The probability of an option getting to its strike price in your timeframe before the contract expiration should also be a major consideration of the risk of loss.

Similar principles of profitable trading apply to options that apply to other financial markets. The difference is that with long put option contracts you can capture the full downside move of an underlying asset during a trend while the risk of loss is capped to the price you paid for the option contract versus the theoretical unlimited risk of a short position that can theoretically go up to any price.

Put options increase in value as the underlying stock goes lower and gets closer to the option strike price increasing Delta and extrinsic value. If volatility increases the value of Vega the put option price goes higher. If a put option goes in the money then it can increase in intrinsic value.

A put option can drop a little in value each day as time goes by and Theta is priced out unless the underlying stock moves down far enough to offset the time decay with growing extrinsic or intrinsic value.

Traders that are bullish sell put options short. Traders that are bearish buy put options.

Put options are great tools for both leveraging more buying power and at the same time quantifying the risk.

Options can be sold at any time at their current value and don’t have to be held until expiration.

Options are fungible assets and the option contracts are interchangeable and not specific to the original buyer and seller but traded on the open market among different buyers and sellers.

To save a lot of time and searching you can learn more about the basics of trading options by checking out my Options 101 eCourse.