The married put is an option trading play created usually when a trader is bullish on the stock in the long term but also wants to limit the downside risk of loss in the shorter term. This strategy gives the stock owner all the benefits of owning the stock like capital gains and dividends but caps the downside risk to the strike price of a long put bought to hedge the long stock until the option expires.

This option play has the unlimited potential for profit but the risk is limited to the put option premium and strike price. The risk/reward dynamics of a married put is very similar to a long call option as a call gives the potential for unlimited upside of the underlier but the loss is capped at the price of the call option premium, which is what a married put does. A married put play is considered a synthetic call option.

A married put is profitable when the price of the underlying is higher than the entry price for the stock and put premium combined. The put option acts as an insurance policy on the stock and the stock has to rise enough to first pay for that option premium before its starts being profitable but the loss is limited to the strike price of the put option.

A married put is most often used on longer term stock holdings that an investor doesn’t want to sell so they hedge for losses in the short term to limit their drawdown and wait to sell the stock for long term capital gains for a better tax treatment.

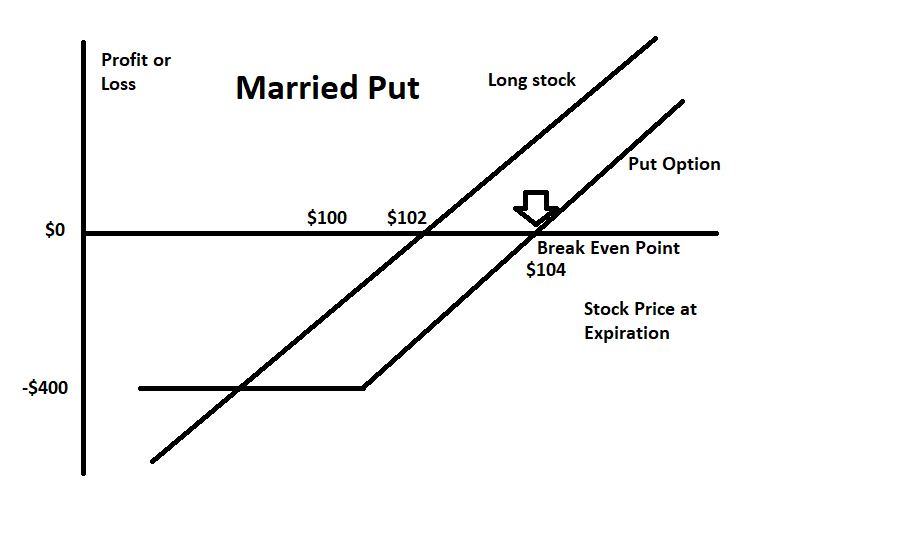

Below is a married put payoff diagram if a $100 strike put option is bought for $4 on a $100 stock. If the stock trades up to $104 it is breakeven, any move higher than $104 is a profit. If the stock drops to $96 then the put can be sold for a profit or exercised to buy the stock for a breakeven on the downside, any lower drop than $96 the hedge works to stop any further loss. The loss is capped at $100 for the underlying stock but the upside is left open for profits.

The break even zone is between $104 to $96, Usually the stock going higher than $104 leads to a profit and the stock falling lower than $96 makes the put option hedge worth the price. If the stock trades between $104-$96 until option expiration it would have been better to have the lone stock position.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.