Here is a link to a great stocks and options tracking spreadsheet template on Google documents that can be used for tracking your trades.

This spreadsheet allows you to keep track of each of your trades and manage them in one place.

Click here to access the Options Tracker Spreadsheet on Google Sheets

Created at www.twoinvesting.com

After opening the spreadsheet in Google docs, you must click “File > Make a copy” to be able to start using it.

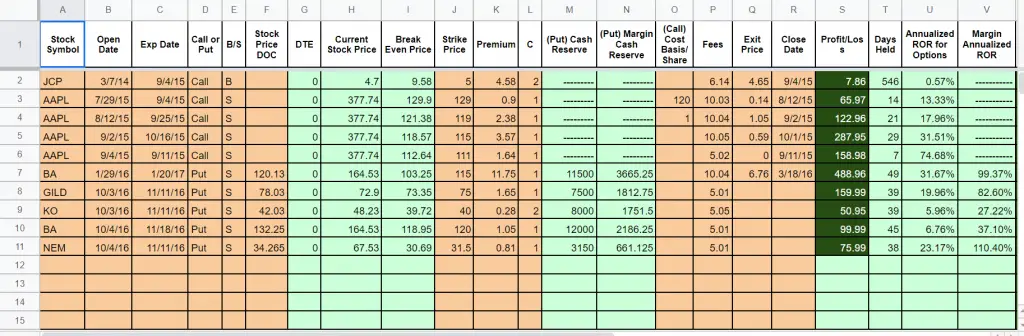

The orange cells can be manually edited, the green cells are calculated automatically.

The orange cells can be manually edited, the green cells are calculated automatically.

The columns are self explanatory.

Stock symbol: Ticker symbol it trades under.

Open date: Day the trade is entered.

Exp date: Expiration date of the option.

Call: or put: What type of option?

B/S: Buy or sell the option?

Stock price DOC: Underlying stock price at the time you opened the contract.

DTE: Days to expiration.

Current stock price: The stock price of the underlier today.

Break even price: The price the underlier has to reach for the option play to break even.

Strike price: The strike price of the option.

Premium: Option price.

C: Quantity of contracts held or sold in the option play.

(Put) Cash Reserve: The amount of money needed in the account to sell the option.

(Put) Margin Reserve: The amount of money needed in the account to open a naked put option sold in an account using margin.

(Call) Cost Basis/Share: This column can be used to calculate the annualized rate of return for selling covered calls (column U).

Fees: All transaction costs for each trade including commissions.

Exit Price: The price you exited your option play.

Close Date: The day you either exited your option play or it expired.

Profit/Loss: How much you made or lost on a trade after it is over. Dark green for profit and red for a loss.

Annualized ROR for Options: Calculates the annualized rate of return on the option play.

Margin Annualized ROR: Calculates the annualized rate of return based on the smaller margin cash reserve.

Status: Whether a current option play is open, closed, or exercised.

Account: The account the option trade is executed in if you have multiple accounts like one for options, one for stocks, IRA, or Roth IRA and trade option plays in each.

This is a great options trading spreadsheet tracker for option traders to manage and have good visibility for each of their trades in real time. Options trading can be complicated and this helps make the option plays more visible.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.