A simple moving average is a technical indicator that you can use to quantify price trends and trading signals.

Moving averages can be used for the following:

- Entry signal

- Exit signal

- Trailing stop

- Stop loss

- Profit target

- To scale into a position

- Trend indicator

- Risk management

- Quantify position sizing

- To measure volatility

- To manage volatility

- Creating good risk/reward ratios

- Trade management

- Quantifying signals for backtesting

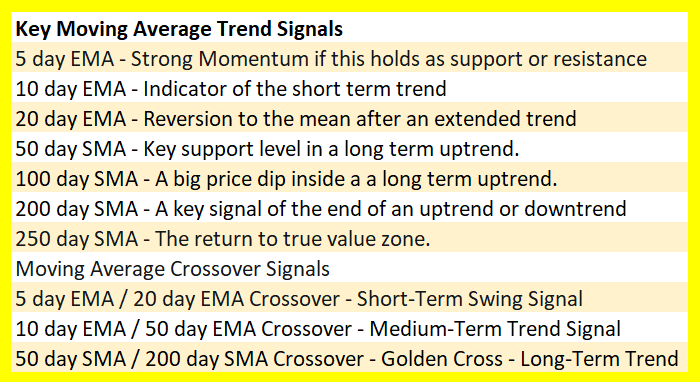

- Entry signal: When price crosses over a single moving average or two moving averages crossover it can be a signal to buy. A loss of a key moving average can be a signal to sell.

- Exit signal: When price crosses under a single moving average or two moving averages cross under it can be a signal to sell. Price over taking a key moving average can be a signal to buy to cover a short position.

- Trailing stop: A short term moving average can be used as a trailing stop loss to allow a winning trade to run until it reverses and closes under that moving average.

- Stop loss: When a trade is entered a loss can be limited by using a moving average as the place to exit the trade if it is lost.

- Profit target: A price rally back to a key overhead moving average can be target where profits are locked in when reached.

- To scale into a position: A trade can be scaled into as key moving averages are retaken. Like after a downtrend buying on a break back over the 250 day moving average then more as the 200 day moving average is retaken.

- Trend indicator: Where price is in relation to the moving average in your timeframe can tell you the direction of the current price trend in a market.

- Risk management: Using moving averages as stop losses, trailing stops, and trend signals you can manage risk by limiting your losses.

- Quantify position sizing: You can size your trade based on your moving average stop loss level for how much you want to lose if the trade doesn’t work out.

- Measure of volatility: How far price is from a moving average in a timeframe can show the level of volatility from the price average.

- Manage volatility: Moving average crossovers of two moving averages as entry and exit signals can filter out much of the noise in price action and focus on the bigger trend.

- Creating good risk/reward ratios: Using moving averages to set a stop loss much smaller than your potential profit target gain can create good risk/reward ratios.

- Trade management: Moving averages can be used to cut losses short and let winners run by managing a trade as it evolves.

- Quantifying signals for backtesting: Moving average signals can be quantified and used in backtesting to see their historical performance if used as mechanical entry and exit signals.

Backtest data courtesy of TrendSpider.com

Here are my three moving average books:

Trading Tech Booms & Busts for QQQ http://amzn.to/2tMRDQ0

5 Moving Average Signals That Beat Buy and Hold http://amzn.to/2tMEhmV

50 Moving Average Signals That Beat Buy and Hold https://amzn.to/2PsYyWW

Moving Averages 101: Incredible Signals That Can Make you Money http://amzn.to/2tHHhNi

Here are my three moving average eCourses:

Backtesting 101 https://newtraderuniversity.com/p/backtesting-101

Moving Averages 101 https://newtraderuniversity.com/p/moving-averages

Moving Average Signals https://newtraderuniversity.com/p/moving-average-signals