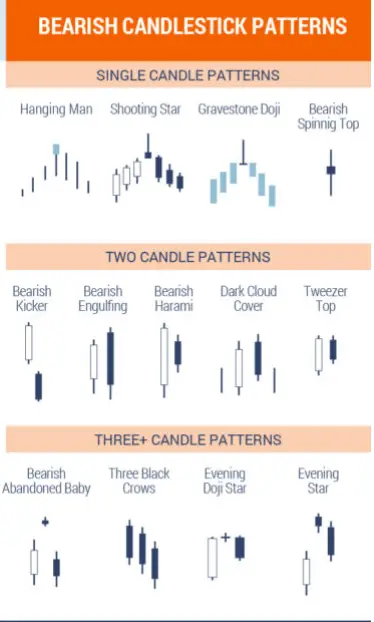

Bearish candlestick patterns on a chart visually show selling pressure. These patterns can show the possibility of a price reversal during an uptrend or the continuation of a downtrend already in place. There can be single bearish candles or bearish candlestick patterns containing multiple candles in row.

Here are some of the most popular bearish candlestick patterns:

- Hanging Man

- Shooting Star

- Gravestone Doji

- Bearish Spinning Top

- Bearish Kicker

- Evening Star

- Bearish Engulfing

- Bearish Harami

- Dark Cloud Cover

- Tweezer Top

- Bearish Abandoned Baby

- Three Black Crows

- Evening Doji Star

- Evening Star

Image courtesy of JB Marwood and his Candlestick Analysis For Professional Traders

Bearish candlestick patterns visually show the failure of buyers to take a price higher and sellers take control of a chart for the timeframe of the price action. These are bearish signals that need confirmation with a down swing in price after the pattern forms.

The meaning and value of bearish candlesticks must be considered taking into the context of a chart pattern and their confluence with other signals. A bearish candlestick pattern that happens when a chart is overbought could signal a reversal of an uptrend. Bearish candles that happen late in a downtrend after a long term drop in price after a chart is already oversold can have a lower probability of success.

Bearish candlestick patterns that have a confluence with other systematic short selling signals increase the odds of trade success.