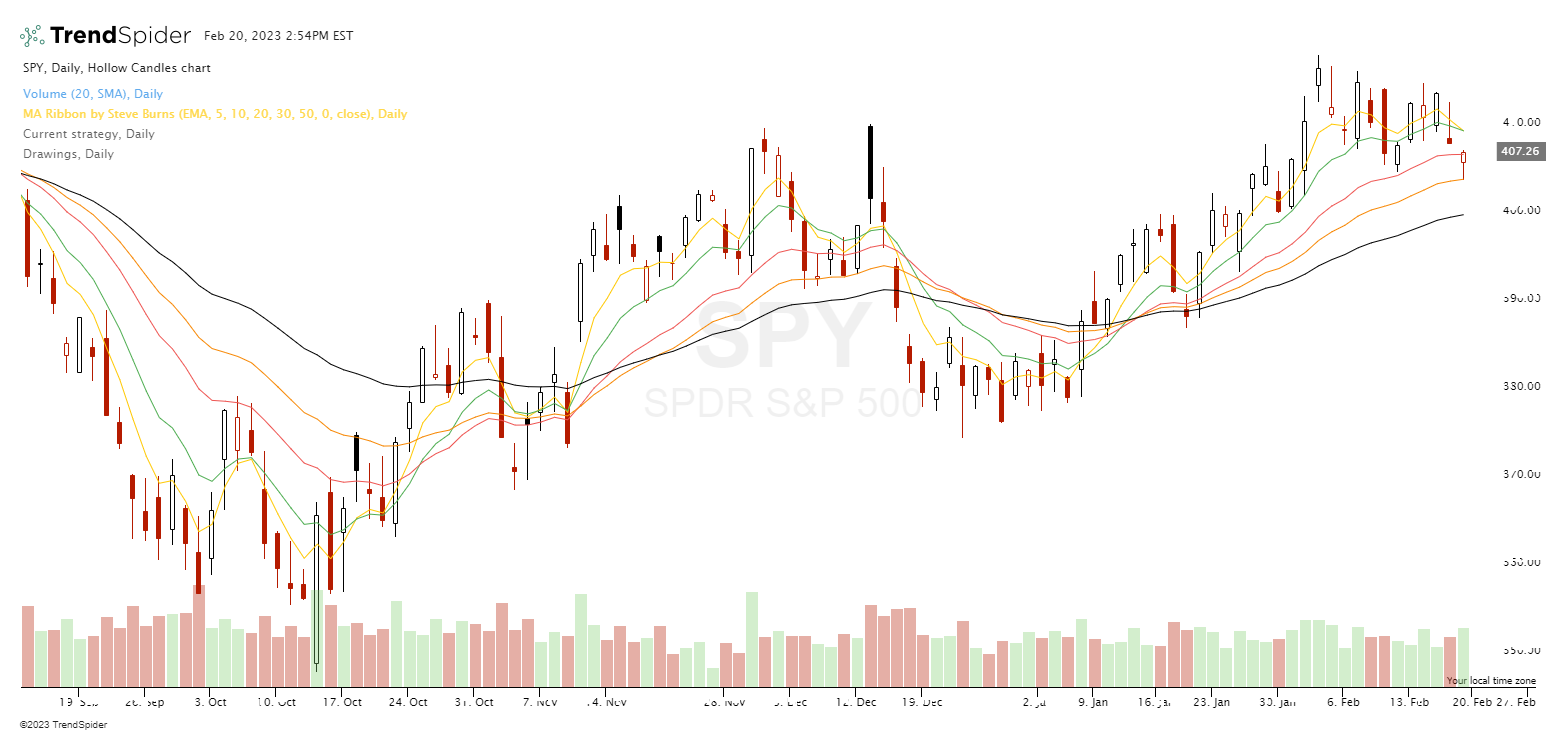

The Steve Burns Ribbon technical indicator is a new tool for the technical analysis of stock trends by combining key moving averages. The MA Ribbon by Steve Burns is currently available on the TrendSpider.com charting platform and can be searched in indicators and loaded onto charts.

The moving averages in the Steve Burns Ribbon can be used as trend and swing trading tools in technical analysis. They quantify the direction and momentum of existing price moves on a chart. They can show trends and swings in price through their confluence of incline or decline in relation to price.

Moving averages filter for market sentiment in different time frames when price remains above one for multiple days. With the ribbon you can see the momentum and trend direction of price action by how many moving averages price is above on the chart.

My Ribbon is built from these moving averages.

5 day exponential moving average – Momentum

10 day exponential moving average – Short term trend

20 day exponential moving average – Reversion to the mean

30 day exponential moving average – Swing Filter

50 day exponential moving average – Pullback in an uptrend

Price becomes bullish in the timeframes of the moving averages it stays above.

The more moving averages price remains above the more bullish the chart is.

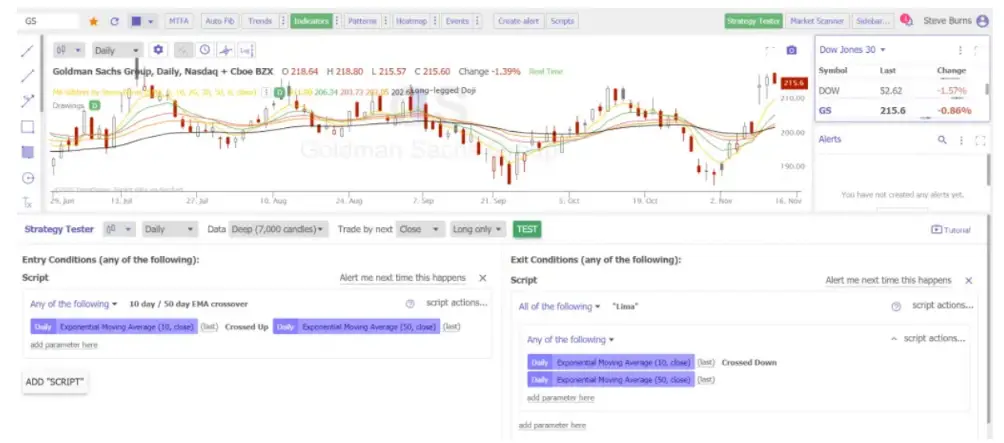

Here are exponential moving average crossover signals that can occur inside the Ribbon that can signal a bullish entry on a chart in a long term uptrend. When the short term moving average crosses and closes over the long term moving average that is the entry signal.

5 day / 20 day ema crossover: Flying Eagle crossover

5 day / 30 day ema crossover: Flying Falcon Crossover

10 day / 30 day ema crossover: Flying Squirrel Crossover

10 day / 50 day ema crossover: Flying Dragon Crossover

The more crossover signals that a chart has at one time the more bullish it is.

If a trend starts running a profit target could be set near the 70 RSI zone.

A stop loss should be placed after entry based on personal risk tolerance:

- A stop loss could be placed on a percentage drop of price.

- A stop loss could be set if price falls below the short term moving average in the crossover.

- A stop loss could be set if price falls below both moving averages used in the crossover.

A trailing stop should be used on winning trades based on open profit risk parameters.

- For swing traders a trailing stop could be set at a loss of the short term moving average.

- For momentum traders a trailing stop could be a loss of the previous day’s low.

- For a trend trader a winner could be held under the short term moving average crosses back under the longer term moving average.

These signals are built for charts in long term uptrends or tend to swing from highs to lows in price like stock index ETFs, market leaders, and leading growth stocks. These are not meant for markets that historically trade sideways or down in price. Also highly volatile charts tend to create too many false signals.

For a higher probability of success with signals they should all be backtested on your watchlist before using them in live trading. These backtests can all be performed on the TrendSpider.com backtesting platform. While all backtests may not beat buy and hold on a chart most will have better risk adjusted returns by having lower drawdowns. The crossover signals can create positive expectancy models for trading by creating small losses and big wins based on the trade management using stop losses and trailing stops, that is where the real edge comes from in trading.

Chart Courtesy of TrendSpider.com

Here are moving average cross unders that can signal a bearish entry on a chart in a long term downtrend. These can be used to go to cash, or signals for short selling based on the long term chart trend.

5 day / 20 day ema cross under: Lame Duck cross under

10 day / 50 day ema cross under: Loch Ness Monster cross under.

The biggest enemy of moving averages is high volatility. Crossover signals help filter out most of the noise of volatility and show the trend.

The new technical indicator the MA Ribbon by Steve Burns is available now on the TrendSpider.com charting and backtesting platform and can be a new trend filtering tool to add to your own technical analysis.