What is a good stop loss percentage?

The answer to this question depends on a lot of the variables of each individual trader.

The two biggest factors are how big position sizing is and how big the winning trades are expected to be inside of a trading strategy. As a trader has to manage their risk of ruin to avoid getting into a drawdown too big to get out of and they must manage their risk/reward ratio to maintain profitability.

There are two types of stop loss percentage, one is the percentage of price movement and the other is percentage of total trading capital at risk.

For example if an account is $100,000 and a stock is $50 then 200 shares would be $10,000 with a $5 stop loss for a 10% stop loss and 1% of total capital at risk.

- Account size $100,000

- Stock price $50

- Position size $10,000 = 10% of capital

- Stop loss -$5 = 10% percentage of stop loss of price

- Total risk with stop loss limit = $1,ooo which is 1% of total trading capital

The stop loss in correlation to total capital percentage at risk should be the biggest determinant of proper position sizing. If you have a small trading account and are all in on a trade with a 100% position size (this is almost always a bad idea) then the most you can allow for is a 1% to 2% move against you as getting losses of 3% or more in total trading capital can lead to big drawdowns during losing streaks. Not to mention the dangers of total risk on an adverse gap down on news. On the other hand if you are managing an investment portfolio then a 1% or 2% position sizing of total trading capital into a position can allow you to let the position run with no stop loss as losing 100% of 1% or 2% of total investment capital will have little effect on your total portfolio but a 10X bagger could make your yearly returns at times.

When considering the dangers of the risk of ruin with losing more than 1% or 2% of total capital in a move against you here is a breakdown of good stop loss percentages to consider based on position sizing:

- A 100% position of your total trading capital gives you a potential 1% stop loss on your position to equal 1% of total trading capital.

- A 50% position of your total trading capital gives you a potential 2% stop loss on your position to equal 1% of total trading capital.

- A 25% position of your total trading capital gives you a potential 4% stop loss on your position to equal 1% of total trading capital.

- A 20% position of your total trading capital gives you a potential 5% stop loss on your position to equal 1% of total trading capital.

- A 10% position of your total trading capital gives you a potential 10% stop loss on your position to equal 1% of total trading capital.

- A 5% position of your total trading capital gives you a potential 20% stop loss on your position to equal 1% of total trading capital.

If you want to increase your total loss to 2% of total trading capital per trade you simply double your stop loss percentage versus the price at entry or keep your stop loss percent the same but double your position size to risk 2% per trade. This is one way to keep your risk steady and also avoid the risk of ruin during a long losing streak. You must consider the volatility of your stock, forex, or ETF when considering your position size, you may be able to hold a 100% position in SPY but only a 10% position size in SPCE to manage price volatility risk. Note that you must have a wide enough stop to account for normal volatility, so the higher the volatility the smaller the position size and the wider the stop loss needs to be.

Note that for price action traders it is smart on a trade entry to target a key technical level where price should not go if a trade is going to work out and set your stop loss at that area and adjust your position size based on the loss percentage if the stop loss is triggered.

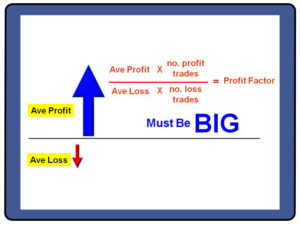

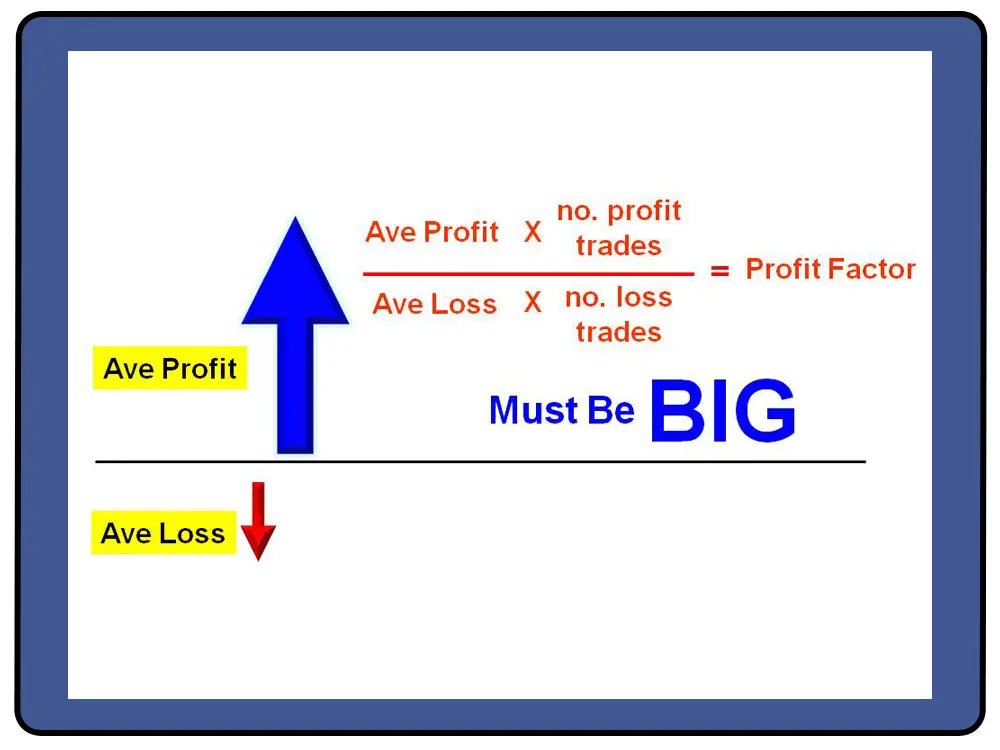

The other important consideration is your risk/reward ratio on a trade. Maintaining a 1:2 or 1:3 risk to reward ratio enables a much easier path to profitable trading. Your stop loss percentage should be in correlation with your expected average win size. If your average win is a 15% price move on a trade then your average stop loss percentage should be approximately a 5% price move against you. If your average win is a 3% gain on total trading capital then your average risk should be a 1% loss of total trading capital. Your losses should be on average half the size or one third the size of your winning trades to maintain a profitable risk/reward ratio.

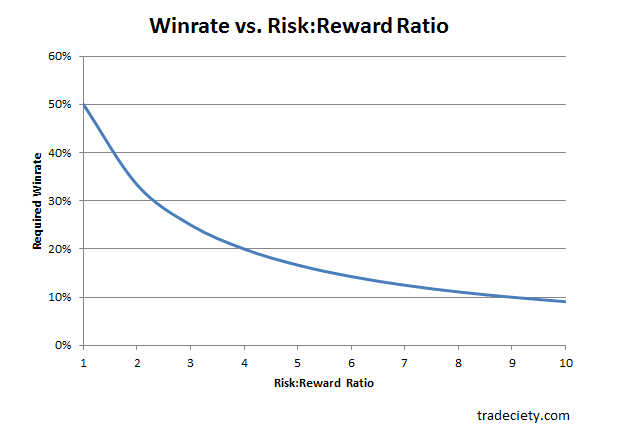

Here is how your risk/reward ratio affects your needed win rate for profitability.

The answer to “What is a good stop loss percentage?” are the questions:

- How big is your position size?

- What maximum percentage loss of total trading capital do you need to manage your risk of ruin?

- How volatile is the stock or ETF?

- What is the size of your expected average winning trade?

- What is your risk/reward ratio target?

- How big can you trade without it interfering with your ability to follow your trading plan?

Check out my book The Ultimate Trading Risk Management Guide for a full explanation of managing risk as a trader.