A cash secured put is created when a put option is sold to open at the same time as capital in an account is designated to buy the underlying stock at the strike price if the put expires in-the-money and is assigned to the option writer.

A cash-secured put can be written as an at-the-money or out-of-the-money put option at a price level where the option trader wants to buy the stock at any way. Many times the cash secured put option write is a way to get paid to buy a stock at the trader’s target price. If the price is not reached or in-the-money at expiration the option writer keeps all the option premium as profit.

Most the time the goal of the cash secured put is to buy the stock at a lower price than it is trading at when the put option is sold. Most put sellers are looking to buy the stock on a dip or pullback. But the option seller is also happy to get paid option premium as they wait if the stock continues to trend higher.

The biggest risk is that the underlying stock a cash secured put is written on gets caught in a strong downtrend or a fast crash in price causing the stock to be put on the seller with an immediate loss of capital with the strike price versus the current price. The premium received for the put option will help offset some of the lower stock price losses.

If the underlying stock price drops below the put option strike price then the short option can be put on the seller and the stock assigned at the strike price using the cash that was secured to sell the put option to buy the stock. If the stock is put on the option seller it becomes a new stock position in the account with a cost basis of the strike price.

Put options that are written on stocks that the trader is bullish on generally have the best odds of success and least risk to the downside. As it will likely either not be assigned or if the strike price is reached and assigned it could bounce for a profit on the stock. A trader wants an assigned stock to be lower only temporarily before a price bounce higher occurs. .

There are two ways to profit from a cash secured put option play.

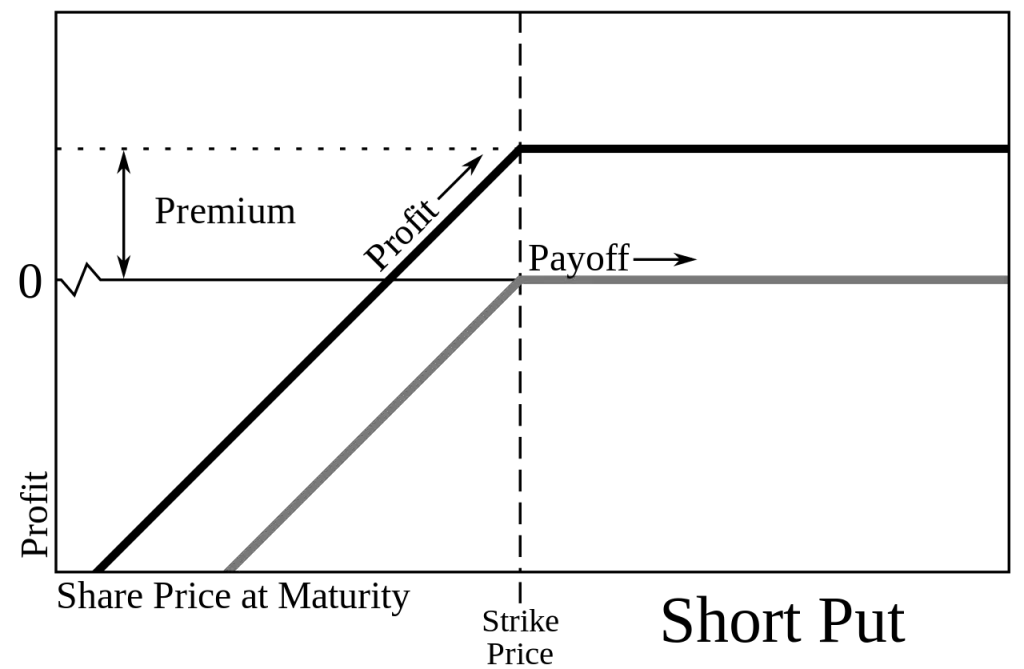

- The underlying stock stays above the put strike price and the short put expires worthless, this is the maximum gain for the option play as the option seller keeps all the premium as profit.

- The stock is assigned when the stock price is lower than the put option strike and the option trader ends up with a stock position that then swings back higher leading to a profit on the stock greater than any loss on the cash secured put.

Be aware that there are two types of option contracts. European style options that can be exercised only on the expiration date and also American style options that can be exercised at any point in time before or on the expiration date.

If you are interested in learning more about option trading I have created the Options 101 eCourse and Options 101 book to give new option traders a shortcut to learning how options work.