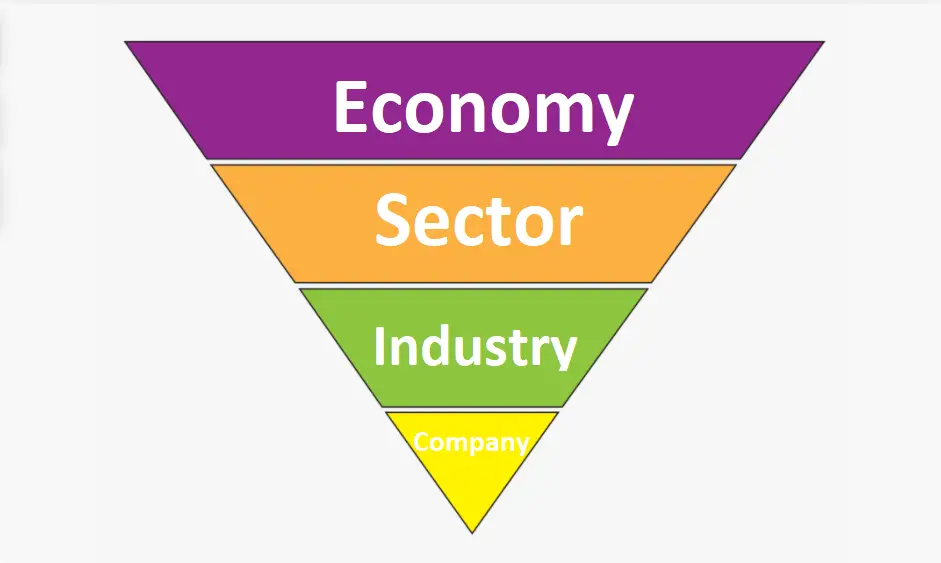

A top down analysis approach to fundamental investing starts with the highest level of macro economic data and works its way down to a specific company by filtering each layer of financial information to find the best place to invest capital.

The top down analysis will start with the current global economy, then drill down to individual countries and their economic environments, followed by sector growth, industry strength, and finally the performance of an individual company. A top down analysis tries to filter through the macro economic data from the highest macro level down to the company micro level fundamentals to locate the best location to put capital to work based on trends at all levels.

The top down analyst wants to check all the boxes for their investment. They want a strong global economy, then to invest in the country with the strongest economy, inside a growing sector, and buy the stock in the strongest company inside a booming industry. They want at least five layers of financial strength for maximum optimization of their capital. If any of these boxes are not checked they may look for other opportunities or wait to put capital to work until the environment is more favorable.

A top down analysis approach to technical trading starts with the highest timeframe and works its way down to the current chart price action. A technical trader would want the monthly, weekly, daily, and intra-day charts to line up for an entry signal. If there is an uptrend on the monthly chart, the weekly chart is making higher highs and higher lows, the daily chart is at short term key support, and the intra-day chart makes a new high price, a top down analyst may take it as a bullish buy signal at all levels and a green light to enter a trade.

A top down analysis starts at the highest level of fundamental investment, financial, economic, or technical price acton information and works its way down through each level from macro to micro ensuring that there is a confluence of data and trends that agree with their buy or sell decision before taking any action with their capital.