A put credit spread attempts to make money through selling put option premium and having the stock price move higher or stay in the profitability zone by expiration. A put credit spread can be closed with a profit at any time until the expiration date of the puts in the option play.

The bull put credit spread option strategy is opened with the goal to achieve a profit by making money with a net credit created by the difference in the put option price sold versus the put option price bought. When a stock is going up or goes sideways, the option trader can make the net credit difference in the put option premiums.

How the put credit spread option play is opened:

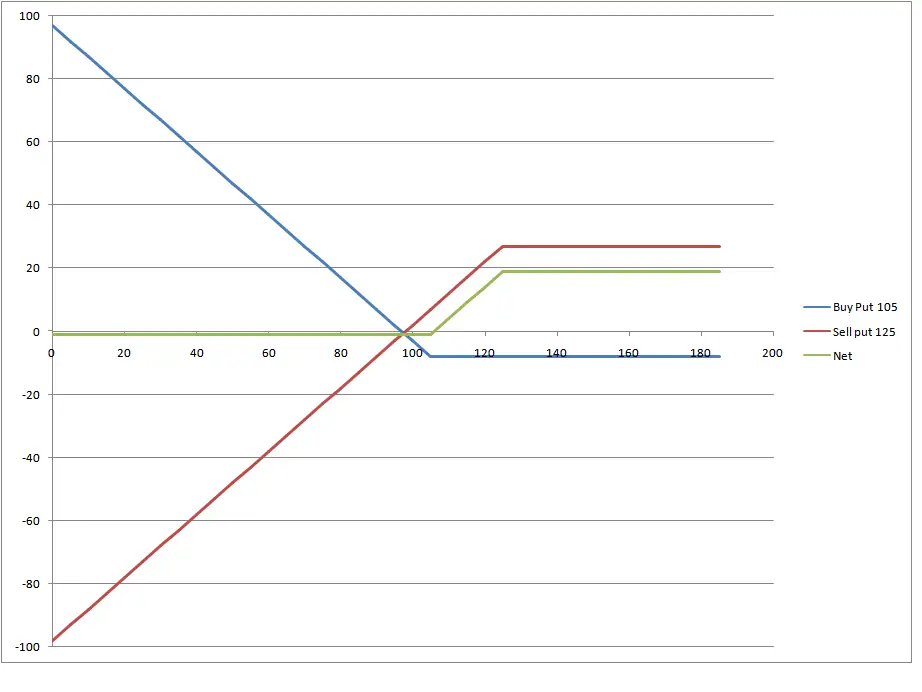

- Bull put option spreads sell to open a put option at-the-money or near-the-money at a higher strike price than a stock is currently trading at.

- Then a put option is bought one or more strikes below the short put option in the same strike month, this is the hedge to limit the losses if the short put option goes deeply in-the-money. The hedge leg of the play is like insurance to avoid any huge losses due to a crash in price.

- Bull put option spreads usually have margin requirement as the difference between the strike prices as that is the risk exposure.

- The maximum risk of this option play is the difference between the long and short strike prices, minus the net credit difference in the premiums.

- The maximum profit zone is for price to expire with the short put options out-of-the-money and the option trader receives the difference in premiums of the net credit minus the debit for the hedge.

- The break even point in this option play is if the higher strike price short options price to buy to close equals the cost of the long options hedge at expiration.

- Profit begins when the stock price rises above the short put options with greater gains than the long put hedge losses.

- An option trader needs both the long and short put options to expire worthless to achieve the entire net credit of the spread.

To calculate the return for the bull put credit spread strategy use the below formula:

Percentage return = (Premium on short put – Premium on purchased put) ÷ (Margin – net credit)

Or more simply:

Percentage Return = (Net credit) ÷ (Margin – net credit)

If you are interested in learning more about option trading I have created the Options 101 eCourse and Options 101 book to give new option traders a shortcut to learning how options work.