Recency bias is a cognitive based bias that gives more meaning to the most recent events that have happened versus older and more distant ones. It is a type of memory bias giving the most weight and importance to things more easily remembered due to the short time frame from occurrence. This can be seen in court when the closing lawyer’s arguments may carry more weight with jurors when they are the last thing heard before deliberation.

Recency bias can effect annual job performance reviews when the supervisor remembers the past two months better than the previous ten months of the year when they were so long ago.

Recency bias can have a powerful effect on investors and traders as a recent strong bull market can lead to a bullish bias with traders not being able to identify a change in a market trend for a long time after it happens. It can also lead traders to be unable to buy into a market after a bear market is over and a new bull market begins when they still have a fresh memory of the plunge in prices. Investors tend to stay with the stocks that did the best in the last run up and unable to reset their portfolios to the newest leaders in a market cycle.

Recency bias in the financial markets can lead to being late for each market move as a view gets stuck on the most recent chart direction, momentum, or volatility and unable to see change when it occurs. Financial markets can be so difficult to profit from as the timing of investors can be too late due to the recency bias based on the last move in price action.

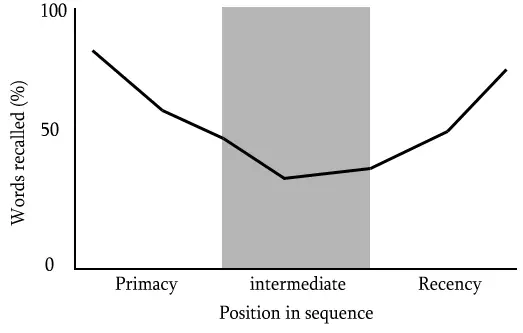

Recency bias relates closely to the recency effect. When asked to recall a list of items in any order (free recall), people tend to begin recall with the end of the list, recalling those items best (the recency effect). [1] This leads to a bias based on memory that few people realize is happening.

The broader view of this phenomenon is the serial-position effect which shows that not only is their a recency effect but also a primary effect. The primary effect is what allows people to remember their first love, their first car, and their first investment so well as more weight is also given to the first items in a sequence as their novelty makes them more memorable being the first in a data series.

This is why quantified data and a systematic process is more reliable than memory when analyzing investments and trades.