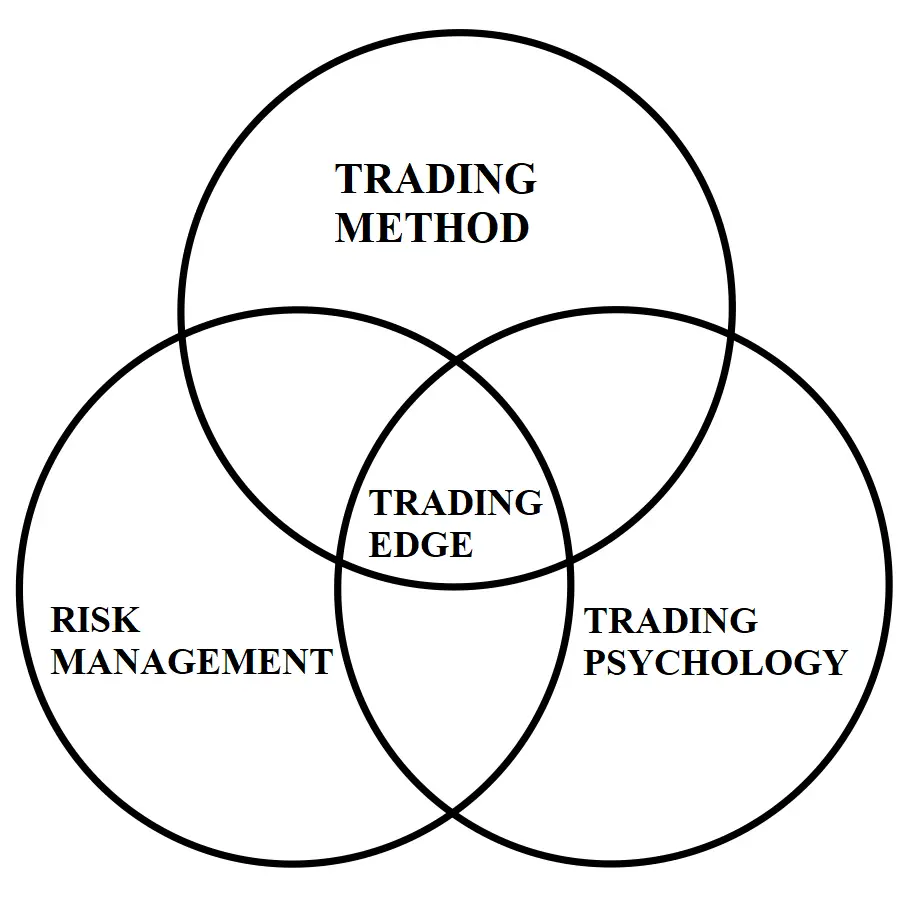

Many traders don’t understand what it means to have an edge in trading. It is simply an advantage in the markets that over time leads to your winning trades adding up to more than your losing trades. There are potential edges in every market and in each time frame from scalping to value investing.

What does it mean to have an edge?

If a trader or investor has an edge, they have an advantage that makes them more likely to be profitable than other market participants, Their profits come many times from the mistakes, emotions, egos or inexperience of other traders and investors. Backtesting trading signals or developing a discretionary rule-based strategy that creates big wins or small losses can give a trader an edge over those that are not prepared. An edge is any type of advantage that can lead one person or system to outperform others over time leading to profits.

What is an example of different types of trading edges?

What is an example of different types of trading edges?

There are many types of edges in the markets that a trader can have with discipline, focus, knowledge, information, backtesting, chart studies, patterns, or perseverance. Anything that leads to profitability by outperforming others is considered an edge. A trading edge doesn’t mean that you win every trade it means that over time your edge plays out and you are profitable. One of the best examples of an edge is the casino versus the gambler. The casino is a business that operates based on a mathematical edge over the gamblers that ignore the odds of success. The casino also has table limits to manage their risk per bet and also will ask any gamblers that have developed their own edge over them in Black Jack by card counting to leave eventually, cutting the casino’s losses short.

Here are ten edges that a trader can develop in the markets:

- A positive expectancy model.

- A profitable mechanical trading system.

- A discretionary rule-based strategy that creates more profits than losses.

- A positive risk/reward ratio on entry.

- Cutting losses short and letting winners run.

- Backtested signals that has wins on average that are bigger than the losses.

- Discipline to follow a good trading plan.

- Risk management that allows survival during losing streaks.

- A high win rate with small losses for losing trades.

- Proper position sizing.

A trading edge is an approach that creates an advantage of any size or dynamic over the people you are trading against. It doesn’t have to be fancy or complex, just something that maximizes wins and minimizes losses to create profits when the edge is allowed to play out consistently over time. If you don’t know what your trading edge is, then you don’t have one. If you don’t have a edge in the markets then you are just a gambler. It is important not to confuse being a lucky gambler with being a great trader.