FAAMG is the acronym for what is thought to be the ideal big tech portfolio that contains the best performing stocks in the market. It was first coined by Goldman Sachs but it is a derivative of the FANG portfolio created originally by Jim Cramer consisting of Facebook, Amazon, Netflix, and Google. The FAAMG portfolio just replaces Netflix with Microsoft and Apple. [1]

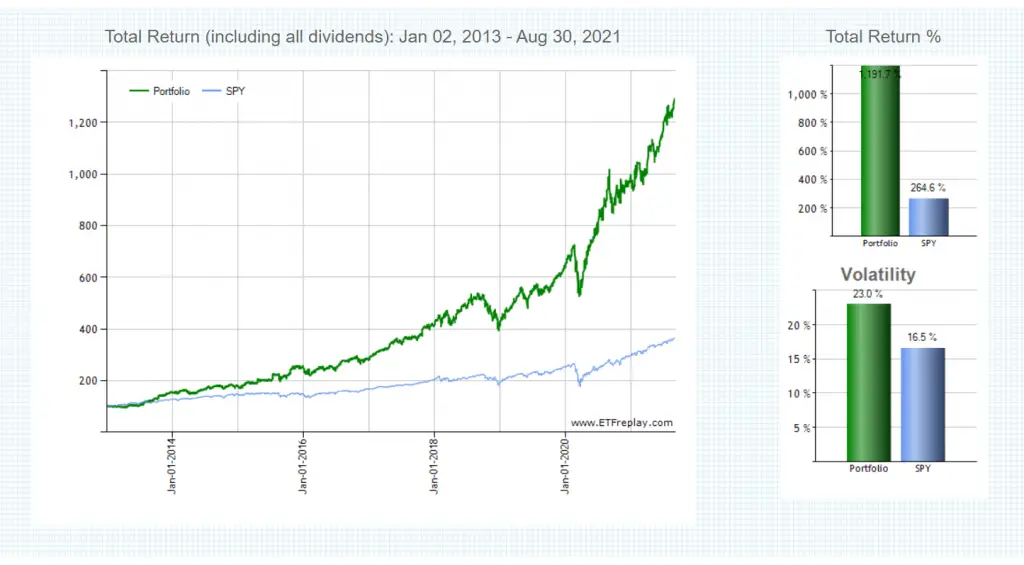

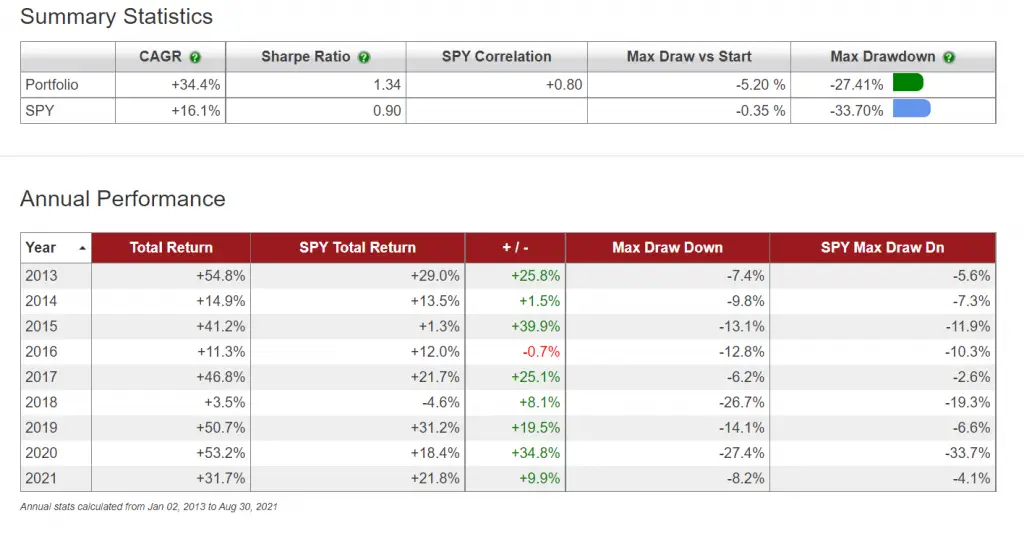

The below backtest data shows the performance of the FAAMG portfolio versus the SPY S&P 500 index ETF from 2013 – August 2021. (2013 was the first full year Facebook was traded).

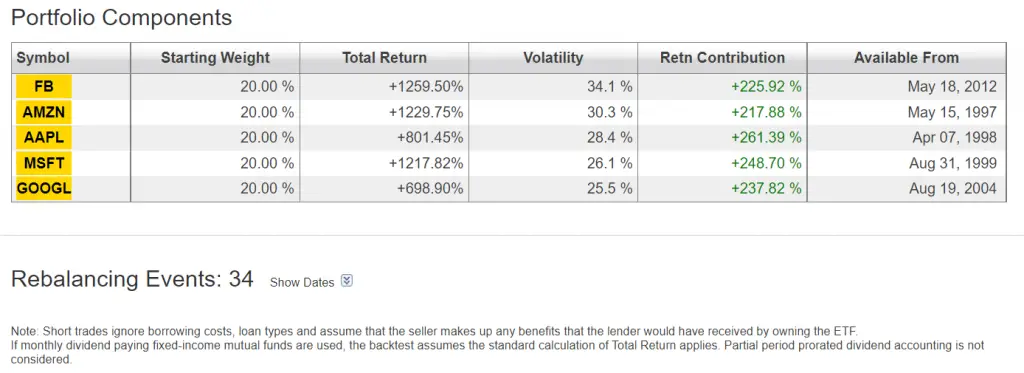

This really shows the power of holding the market leading stocks in your portfolio even when they are big cap stocks. It also shows the potential performance of even a concentrated portfolio in the same sector over a long period of time. This really shows that big cap stocks can still be powerful performers even for a decade after they are household names and seem too obvious. Many of the best performing stocks are right under our noses as customers and are not difficult to find for outsized returns.

Backtest data courtesy of ETFreplay.com