What is a bear trap?

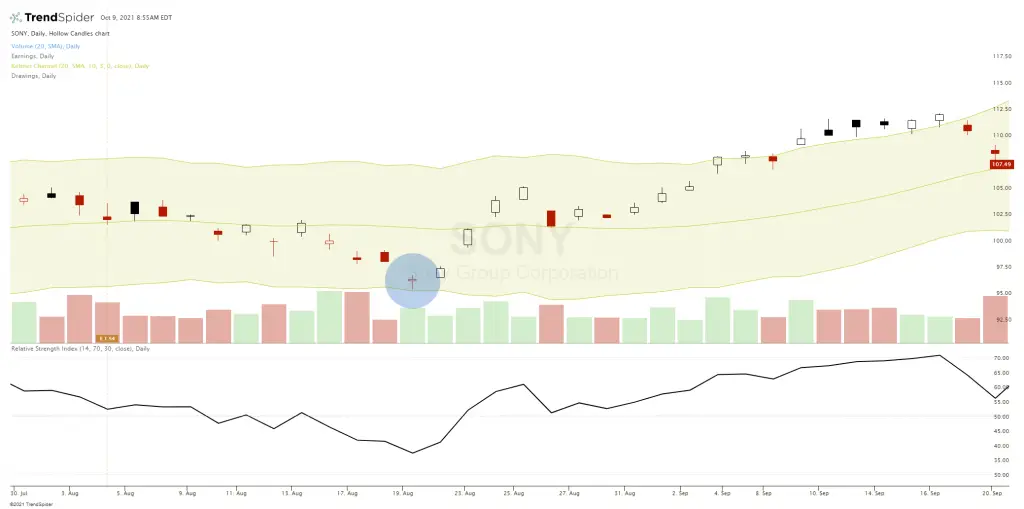

Bear trap stocks are ones that have already fallen a lot in price and traders continue to sell it short believing it will continue to fall and make lower and lower prices. These bear trap stocks can create extreme bearishness luring in more and more short sellers after it has already become oversold (30 RSI), extended far from its 20-day moving average, and near its lower 3rd ATR Keltner Channel.

A bear trap usually starts with price moving lower sharply and creates expectations of a continued downtrend on the chart. Instead, the price of the chart will go sideways in a range and eventually rally higher causing short sellers to be trapped on the wrong side of the move and to receive losses. Short interest being elevated is one warning sign that its downtrend could be over as much of the selling pressure is already reflected on the chart.

A bear trap is more likely to happen in stocks with large amounts of shares outstanding as short interest and a high short interest ratio. Bear traps have a higher probability to happen when a large amount of a stock’s float is short, a market has an extremely bearish sentiment, or sellers simply are exhausted after a long downtrend and the chart finds price levels of support with no sellers left.

- Short interest over 30% can start signaling it is late in the bearish price cycle lower.

- Short interest over 40% can start exposing short sellers to the dangers of a short squeeze or a temporary ‘dead cat bounce.’

Bear traps are usually short squeezes, when a big rally to the upside happens after a downtrend in a stock and a base is formed due to a lack of sellers at lower prices. This combines with the need for short sellers to buy to cover due to the reversal in the market trend creating heat and risk exposure on their open short positions.

Short squeezes in stocks gain momentum as short sellers are forced to buy to cover their positions at higher prices resulting in increased trading volume on the reversal to the upside. The pressure on the short sellers to buy back their positions can be amplified by margin calls, trailing stops, and stop losses being triggered on their trades. The short sellers create buying pressure as they need to buy back the shares they are short to cover during swings higher in price. Most short squeezes that are bear traps result in very fast and powerful moves to the upside.

When a market reaches maximum bearish sentiment at a price level where traders and investors prefer to hold their positions instead of sell and dip buyers step in to buy at the price level they have been waiting for a bear trap could be set to spring. A bear trap stock is one that people enter short too late after the downtrend is already over, a short seller is arriving at the bear party just as the bears are leaving. It is a trap to sell short deep into a hole on a chart. The best time to usually sell short is into an extremely overbought chart or on the initial breakdown of support, not after the downtrend has already taken place.