Trading psychology is the emotional and ego elements that enter into buy and sale decisions during the decision making processes of buying and selling along with how big of a position to take. Humans are emotional beings and don’t always act rationally. Crowd behavior is what causes the huge asset bubbles that become far removed from any fundamental valuation through greed. Most crashes are due to the extreme fear of loss that causes sellers to want out of a market until it drops to absurd low values. It is the psychology of the crowd that moves the market to extremes and it is the psychology of the individual trader that causes them to make huge errors.

What are the emotions in trading?

Anger: Leads to revenge trading and trying to get even immediately after a losing trade.

Fear: The inability to take an entry or hold a winner in a swing or trend in your favor due to the fear of a loss after entry or a winning trade giving back profits.

Disgust: Can lead to loss of a traders confidence after disgust with your own lack of discipline or the market price action.

Happiness: Surprisingly happiness can lead to trading too big and taking on too many positions. This usually occurs after a big winning trade or a winning streak when euphoria starts interfering with a trading plan or trading system.

Sadness: Can lead to having difficulty taking the next trade entry or cutting a loss. This usually happens after a big loss, a string of losses, or a big drawdown in trading capital.

Surprise: Many times a surprise can lead to making decisions based on emotions and abandoning a trading plan when the unexpected happens.

Apathetic: Trading is a lot of work and only passion and energy can move you toward doing the required homework that leads to eventual success. You need the energy of passion to keep your focus and do the work, apathy is not going to cut in with trading.

Anxiety: Can lead to exhaustion due to excessive stress. Confidence in yourself and your system will help overcome internal anxiety.

Love: If you truly love trading the markets then only time separates you from success. If you love trading for the wrong reasons it can be destructive. Like trying to get rich quick.

Depression- Leads to abandoning your trading. You can come back from a financial loss but you can’t come back from emotional ruin.

Contempt: Having contempt for the markets or other traders will result in bias and bad decision making.

Pride- Leads to trading too big, not cutting losses fast enough, and wanting to be right and prove something more than being a rational trader with a plan.

Shame: Makes it difficult to talk to others about your trading and look at your account capital due to your bad decisions.

Envy: Envy leads to external focus instead of the internal focus needed to trade successfully.

Trading is only successful long term when it is done using our rational mind, emotions are only valuable if they create the energy we need to do the work to achieve or goals. Emotions are positive if they protect our psychological boundaries, but they are not an edge if they just support an out of control ego. Emotions can not be avoided so we must be mindful of them. We must be aware of our emotions and understand the message they are sending. Emotions must be felt because suppressed emotions will show up in negative ways later. Emotions are great tools at times but terrible masters.

How do you build a trading psychology?

No profitable trading system can be followed over the long term without self control and discipline no edge will work over the long term as emotions and ego will cause the trader to trade too big, over trade, or abandon the strategy altogether during a losing streak. Trading systems are easier to create and backtest than they are to execute with real money during open market hours as losses and wins can create issues with fear and greed.

The proper thinking pattern for traders is similar to a business owner thinking in terms of executing systems not becoming personally moved emotionally by outcomes of trades. Each trade should be a business transaction inside the parameters of a system not a an attempt to prove you are right about an opinion or prediction about an unknowable future. A trader should know the expectancy of their system and what losing streaks and drawdowns to expect with realistic expectations not trying to get rich quick.

The quickest and most simple way to manage emotions for a trader is to trade a position size that doesn’t effect their ability to execute their trading plan without emotions becoming too loud and stress being too high. A trade should be both meaningful but manageable. If proper position size is right and losses are managed then each trade should only be one of the next 100 and not create a disproportionate need to be right.

How do you manage your trading psychology?

The right trading psychology is built on the foundation of faith in the research and the experience that was used to design a a trading system with an edge that fits you as a trader. Faith in yourself to execute it in real time with capital helps keep emotions under control. All traders will experience emotions and ego during trading, it is not their suppression that manages them it is the mindfulness and awareness of them that allows the trader to continue to follow their plan.

Observing thoughts helps to remove their power as they are processed consciously and put into context. Staying within the context of your trading system and only executing signals on your watchlist, in your time frame, with the proper position sizing is the first step to staying out of trouble and not going on tilt in your trading.

Another important aspect to trading psychology is mentally moving on to the next trade after the previous one is over. Hindsight and regret are two parasites on your current mental energy and mindset if you carry bad trades or losses around with you. Learn the lesson if there is one and keep it, but discard the mental connection with losing trades. Focus on the next trade not the one you lost or won in the past.

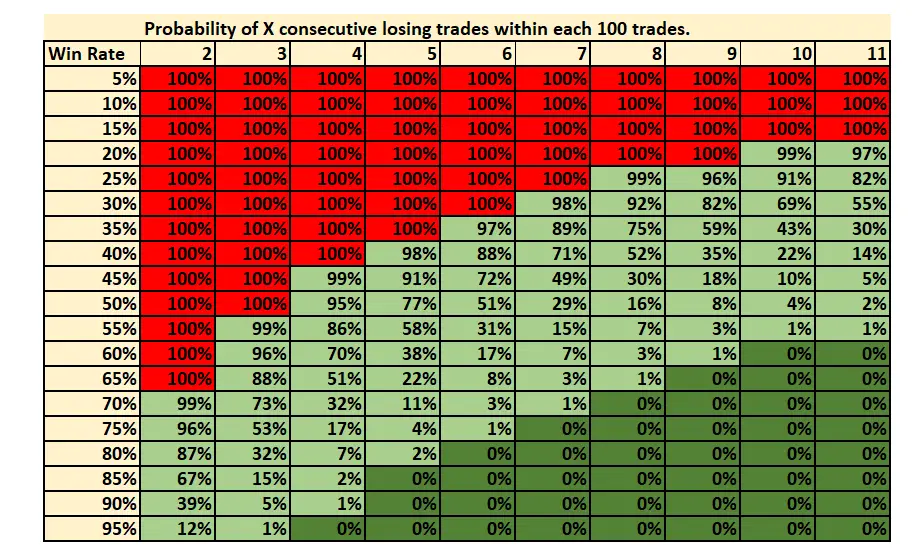

During losing streaks and drawdowns is where many traders have the most trouble with their mindset. Understanding your system’s positive expectancy can help to be ready for consecutive losses as it’s based on the probabilities of your winning percentage. These losses should not be unexpected as no trader wins every time and as markets change so does your trading performance. This is where confidence and expectations should be stronger than short term emotions and not cause a lost of faith.

Managing your mindset as a trader and understanding your own psychology is just as important as developing and managing your trading system. Don’t underestimate this and make it a priority.

90% of traders lose money, this is normal. Being swept away by emotions and ego are what most traders do, destroying their timing. They are fearful to buy breakouts of trading ranges, they are fearful to buy dips in uptrends, and they always have a narrative as to why a trend can’t continue instead of making money in it. Normal doesn’t make money because they are subjectively trading their emotions, opinions, and predictions. Objectively trading signals with an edge is what makes the money.

If you’re interested in learning more about managing your mind and emotions while trading in the markets you can check out my best selling trading books on Amazon here.

I have also created trading eCourses on my NewTraderUniversity.com website here. My educational resources can save you both time and money in your trading journey.

Image created by Holly Burns