The 5 Economic Forces That Make the Middle Class Poorer

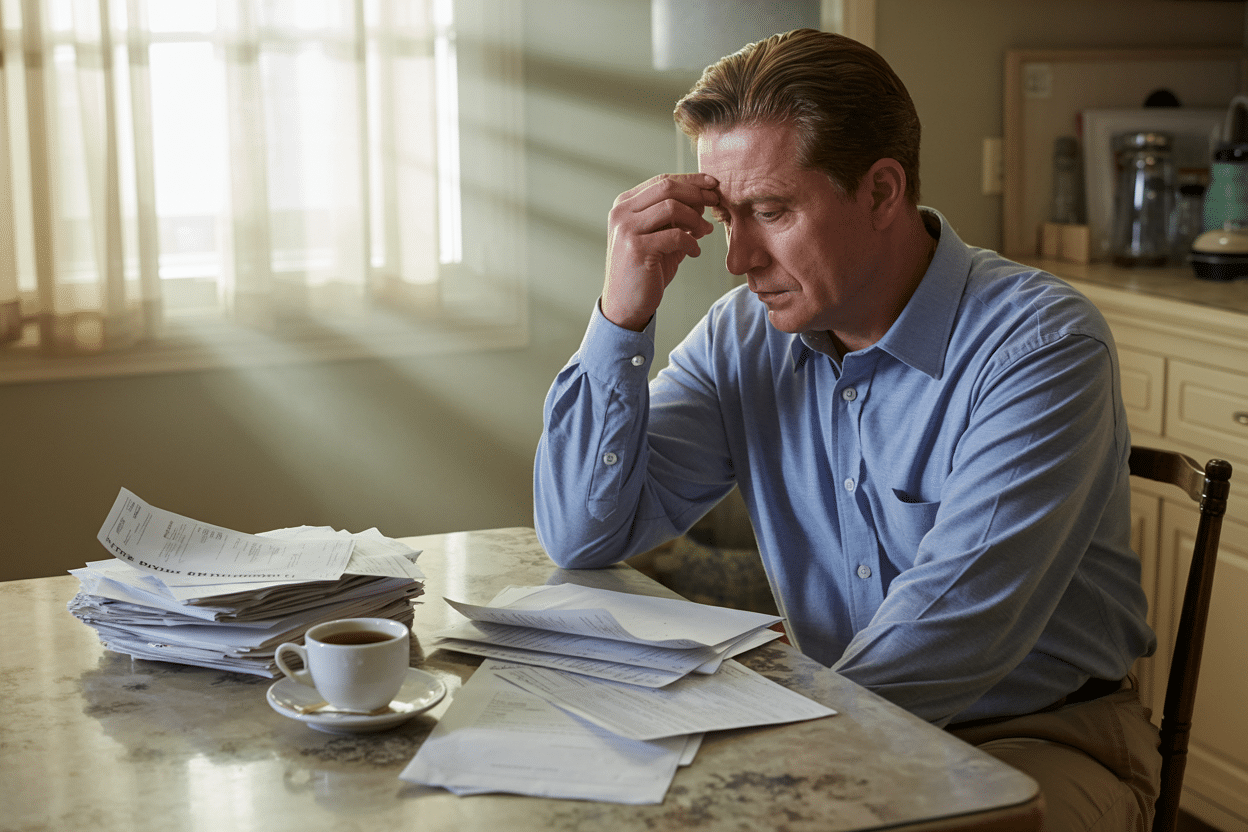

The American middle class has long represented stability and upward mobility, yet over recent decades, something fundamental has shifted. Families who once felt secure find themselves working harder to stay in place. This economic erosion is happening through monetary debasement, asset bubbles, consumer debt, income tax structure, and technological career displacement. Let’s examine each one […]

The 5 Economic Forces That Make the Middle Class Poorer Read More »