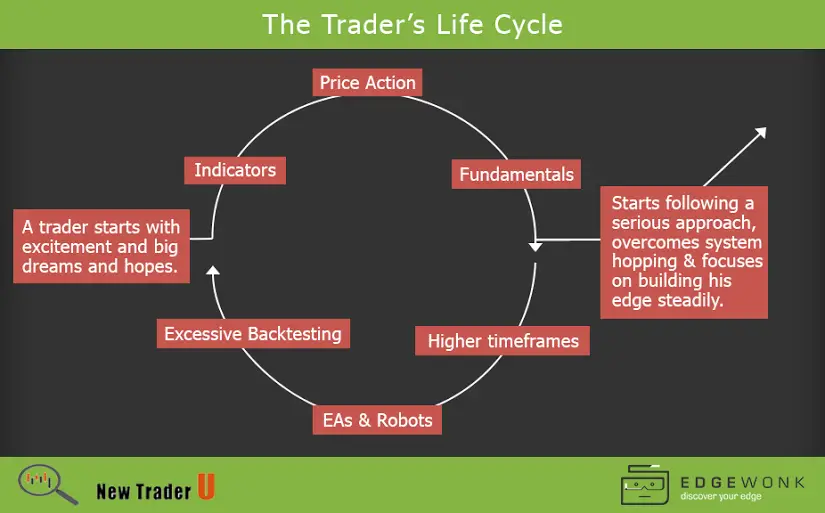

The Life Cycle of the Typical Trader

This is a GUEST POST from Rolf @Tradeciety. The exciting start Do you remember how you got started in trading? Everything seemed possible, and you were ecstatic about the possibilities that trading offered, but what happened afterwards? This article will help you understand the different phases almost all traders will go through, why they are […]

The Life Cycle of the Typical Trader Read More »