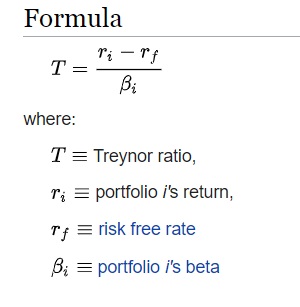

Treynor Ratio

The Treynor ratio is a measurement of the returns earned in excess of what could’ve been earned on an investment that has no diversifiable risk per unit (like U.S. Bonds) of market risk assumed. The Treynor reward to volatility model is also called the reward-to-volatility ratio or Treynor measure it was named for Jack L. […]