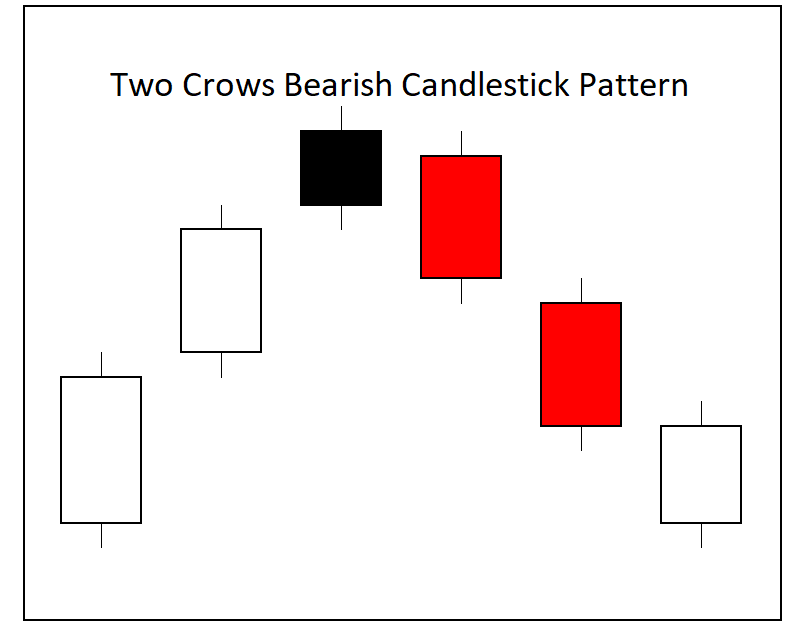

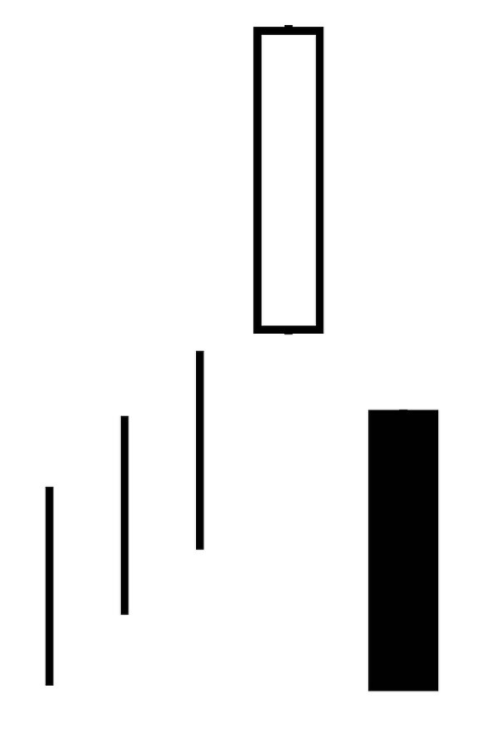

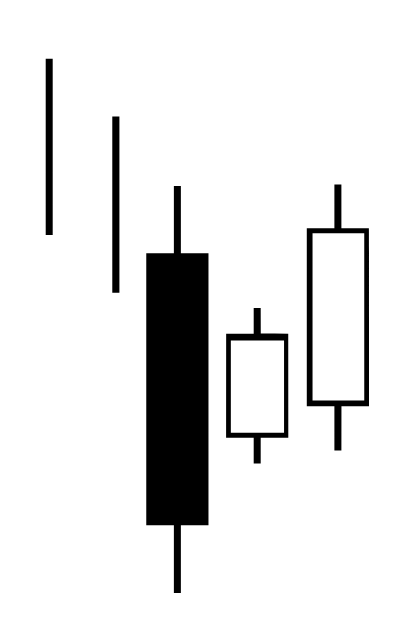

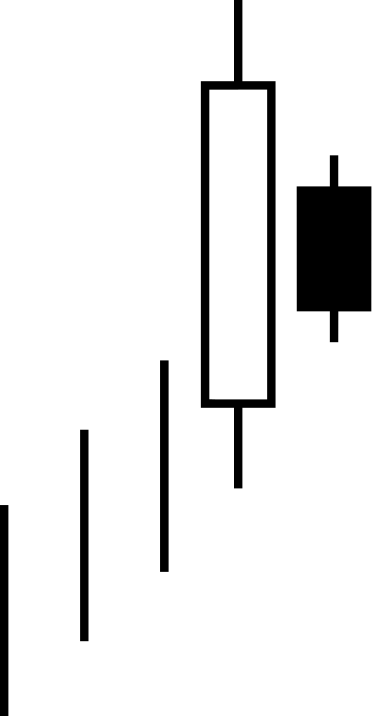

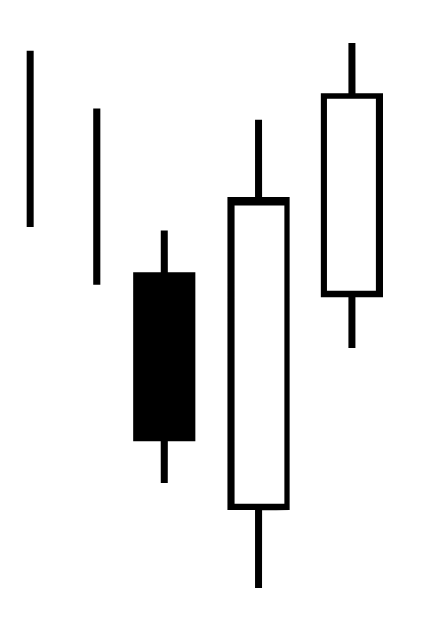

Two Crows Candlestick Pattern

The two crows candlestick pattern is a bearish reversal pattern that appears during uptrends and upswings in price action. It is a three candle pattern that starts with a big bullish candle followed by a second candle that shows a gap up in price action and move higher before reversing and closing lower than the […]

Two Crows Candlestick Pattern Read More »