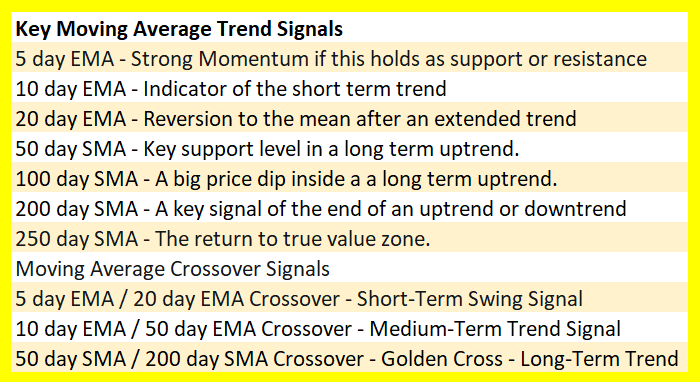

Most Used Moving Averages

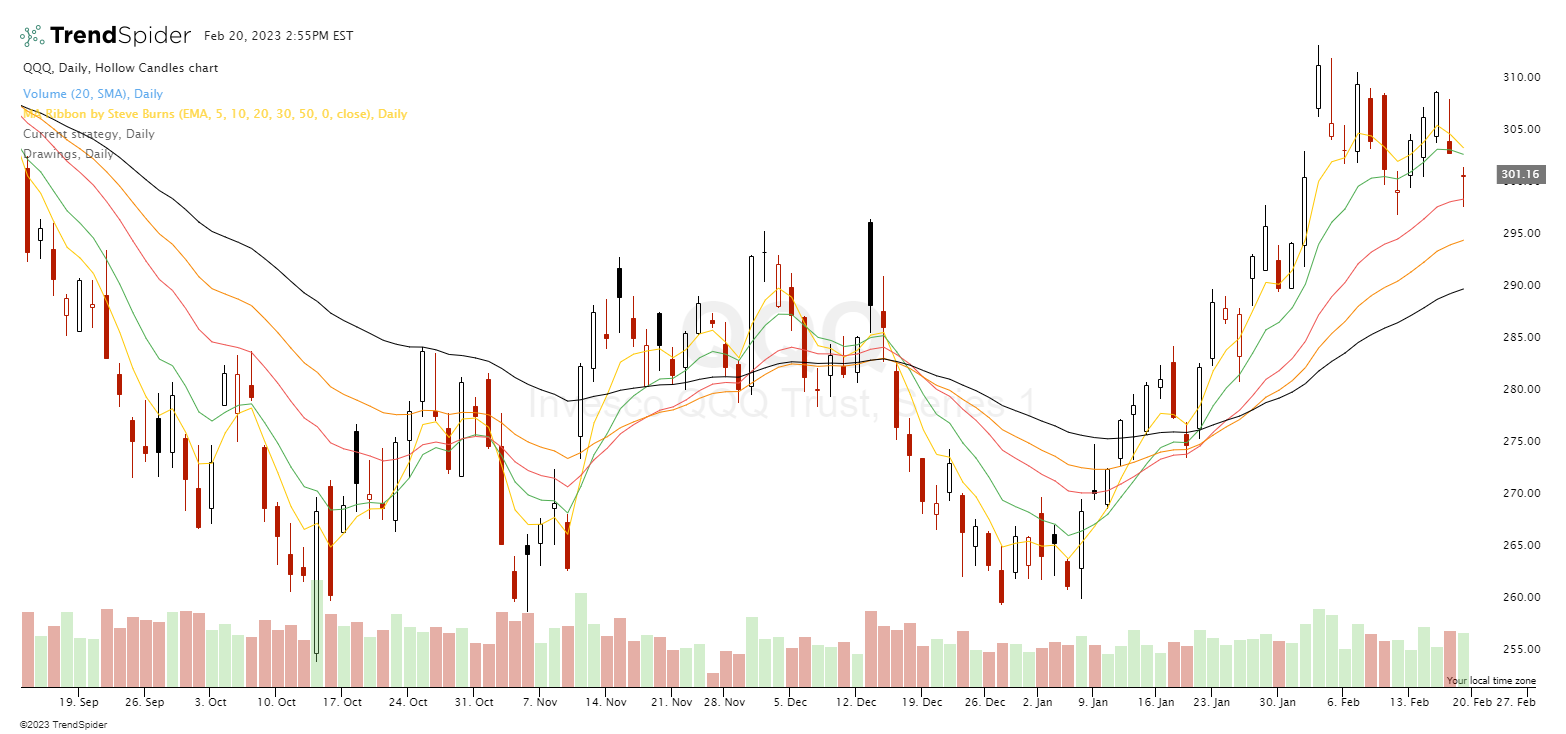

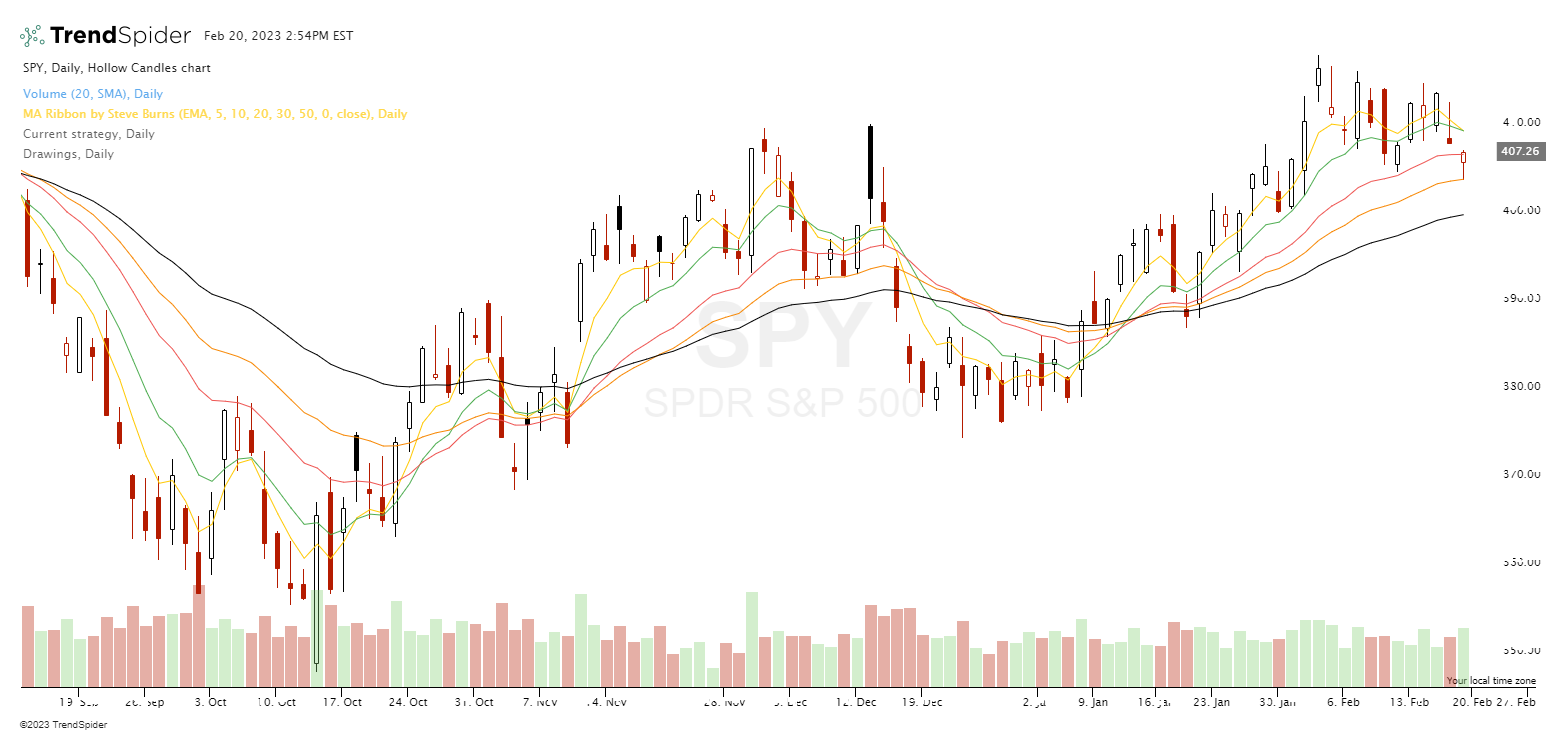

What are the most used moving averages on charts and in technical analysis? The popularity of specific moving averages on different time frames can give them meaning as more people are watching them for signals. They can be self fulfilling prophecies as buyers and sellers take action as price crosses the line. Overall, simple moving […]

Most Used Moving Averages Read More »