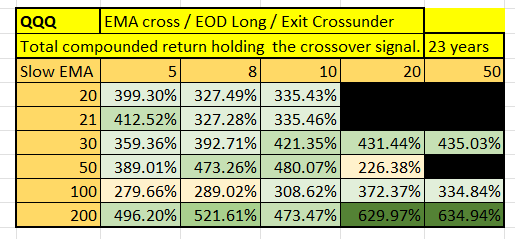

BEST Moving Averages for Crossover Trading Strategies

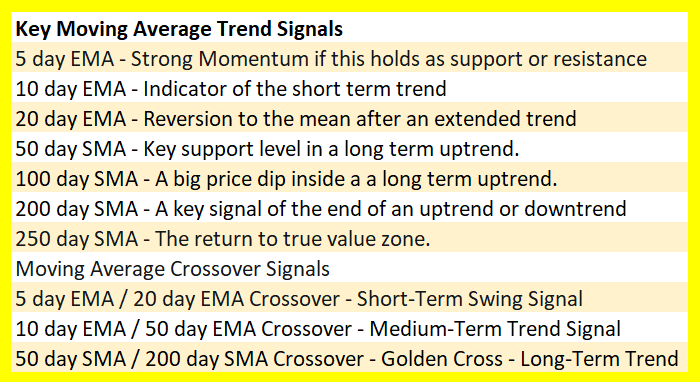

Moving averages are technical trading tools that can help identify trends on different time frames. They can replace opinions and predictions for making trading decisions by being used as signals. Moving averages can identify trends and swings in price action in real time also signal range bound markets when they go flat with no directional […]

BEST Moving Averages for Crossover Trading Strategies Read More »