Which Moving Average is Best?

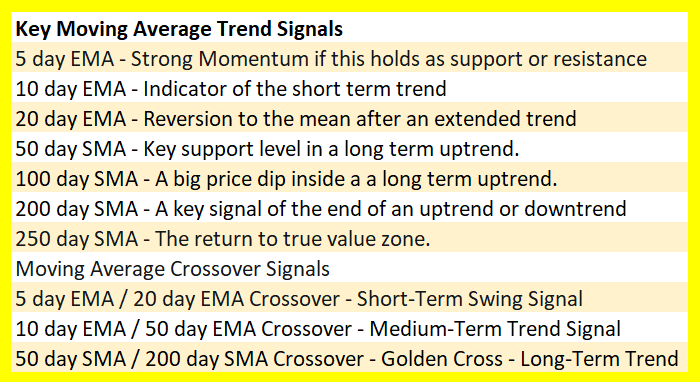

Moving averages are not predictive they are reactive to price action. They show trends on charts when they go vertical and can show that price is in a range when a moving average is horizontal. Moving averages are technical trading tools. The answer to “Which moving average is best?” is the question “What’s your time […]

Which Moving Average is Best? Read More »