How to Use the Relative Strength Index (RSI)

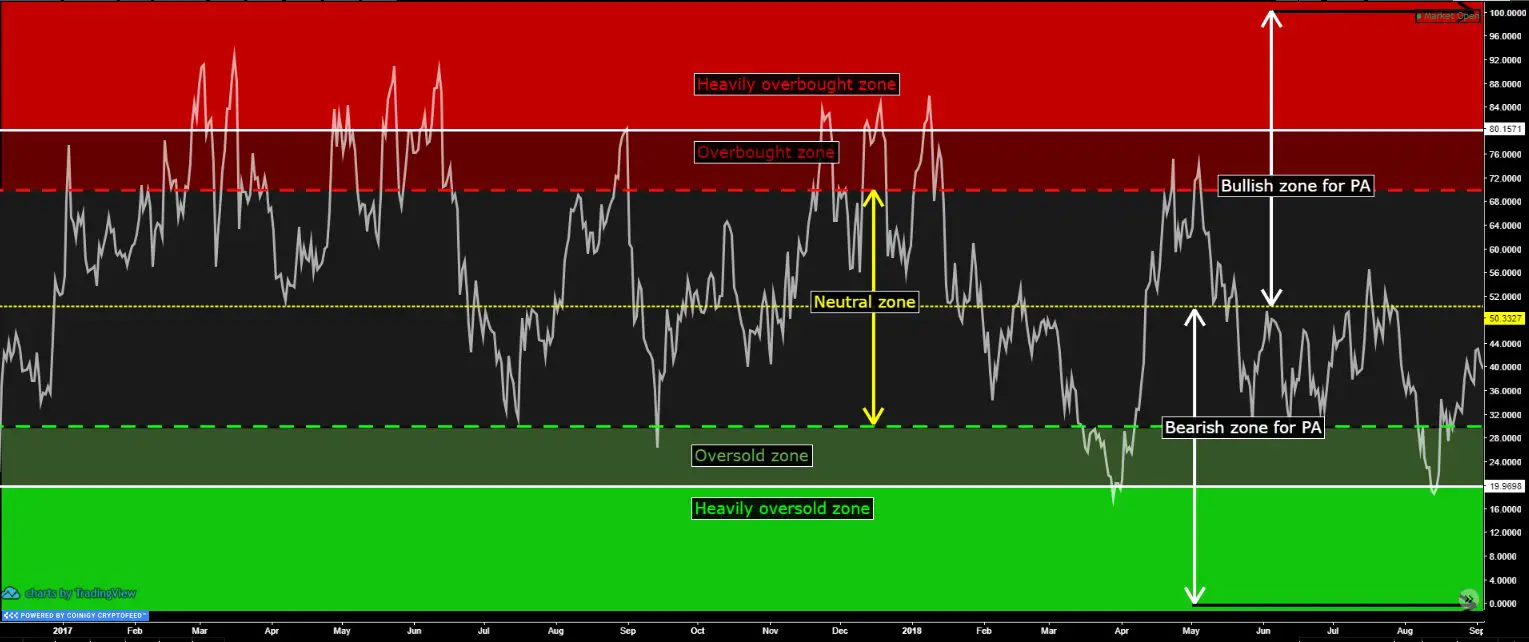

The RSI technical indicator buy and sell signals are based on oversold and overbought conditions on a price chart. The RSI is a measurement of price moving too far and too fast in one direction, and as the RSI gets extended farther from the 50 RSI middle line, the probability of a reversion to that […]

How to Use the Relative Strength Index (RSI) Read More »