When the Volatility Index (or VIX) gets above 20, most traders take their foot off the gas due to heightened uncertainty in the markets. But to options traders that sell premium, higher volatility equals more opportunity. Let me explain why.

Historically, implied volatility (IV) is always greater than realized volatility. Implied volatility is just the annualized expected one standard deviation range of something. And unlike price, volatility is mean reverting. So when implied volatility gets high, options sellers look to get more aggressive since there is a statistical edge in selling higher priced premium. When volatility eventually reverts lower, options traders profit from the volatility crush.

There are many options strategies that can be used in a high IV environment. But today I’d like to highlight the 3 best options strategies that don’t involve picking a direction. All 3 of these neutral direction options strategies have a mathematical edge when volatility is high. The strategies include: the short straddle, the short strangle, and the short iron condor.

Strategy #1 (Most Aggressive)

The most aggressive neutral options strategy in a high implied volatility environment is the short straddle. The short straddle consists of selling an ATM (at the money) naked call and selling an ATM naked put. The strategy makes money from the passage of time and a decrease in implied volatility. The max profit a trader can receive from the strategy is the credit collected from selling the options.

The ideal time to use a short straddle is when an underlying stock’s implied volatility is at the upper end of its range from the prior year (known as IV rank). When an underlying reaches 100% IV rank, it’s a great time to put on a short straddle in anticipation of a volatility crush. The higher the credit collected, the higher the break-even points in case the underlying moves too far up or down. Since implied volatility is statistically overpriced, the underlying security is likely to stay within the range defined by the options prices. Taking profits early further improves the probability of success.

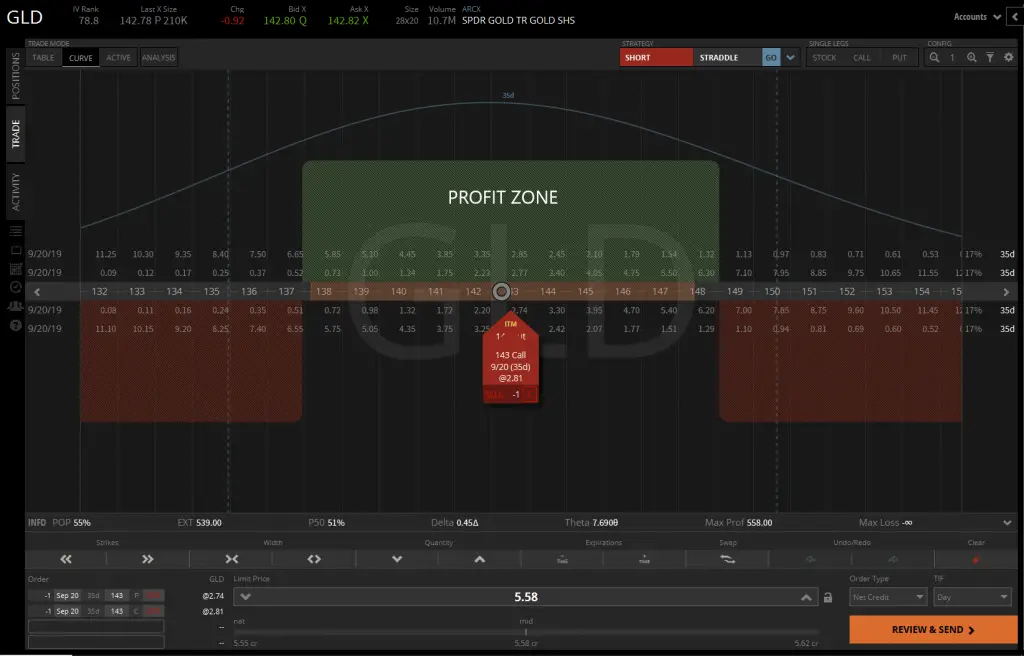

Let’s take a look at an example of selling a short straddle in the gold ETF, GLD. The current IV rank in GLD is 79% and its price is $142.78. Putting on a straddle in the September expiration at the 143 strike can be sold for a $5.58 credit since you can sell the ATM call for $2.81 and sell the ATM put for $2.74. Therefor, the profit zone for the next 35 days lies between $137.20-$148.36 which equates to roughly a +-4% move in either direction without losing money. When profits are taken early, the strategy can have a 80% chance of success.

Source: TastyWorks

Strategy #2 (Moderately Aggressive)

A slightly less risky neutral options strategy for a high implied volatility market is the short strangle. The short strangle involves selling an OTM (out of the money) naked call and selling an OTM naked put. Like the straddle, the short strangle makes money from the passage of time and a decrease in volatility. It’s less risky than a short straddle since there are more opportunities to manage the position during the life of the trade.

The best time to sell a short strangle is when an underlying stock’s IV rank is +50% or higher. The higher the credit collected, the farther out the break-even points. Unlike the straddle which sells ATM options, the strangle gives a trader more flexibility for determining their probability of profit by choosing strike prices. Typically in a higher volatility market, you should sell the 20-30 delta options. Delta is just a measurement of the rate of change in an option’s theoretical value for a $1 price change in the underlying security.

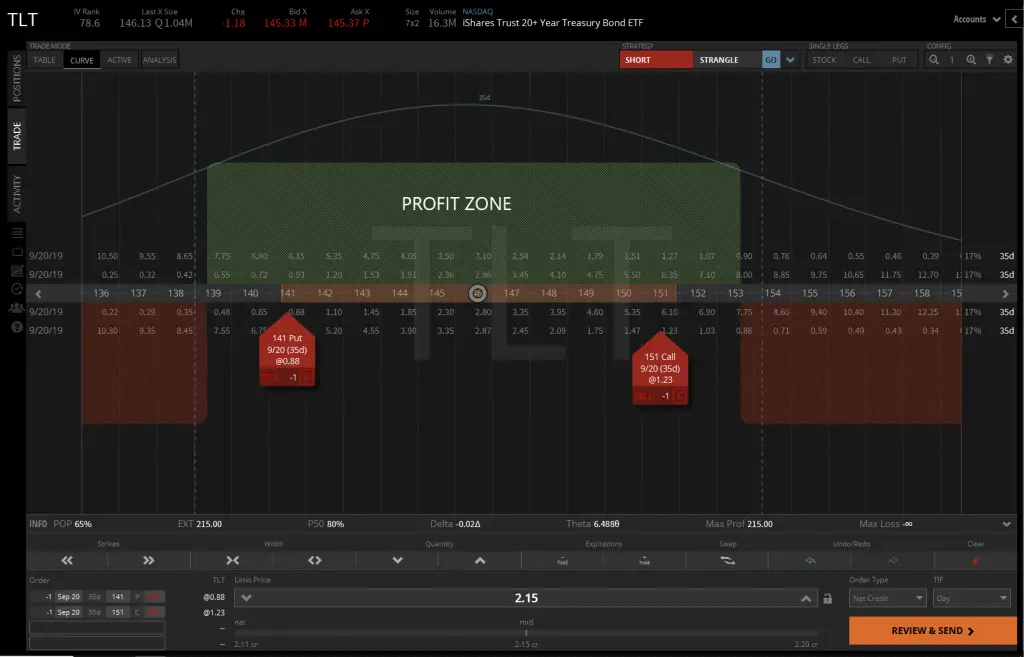

Let’s look at an example of selling a short strangle in the bond ETF, TLT. The current IV rank of TLT is 79% and its price is $146.13. You can put on a short strangle in TLT by selling the 141 put and selling the 151 call in the September expiration for a $2.15 total credit. The profit zone for the next 35 days is $138.85-$153.15 which is roughly a +-5% move up or down. If the price moves outside that range, you can roll up or down either strike to collect an additional credit to offset any loss. But when profits are taken early, the strategy also has a 80% probability of making money.

Source: TastyWorks

Strategy #3 (Less Aggressive)

The last neutral options strategy for a volatile market is the short iron condor. The iron condor is the least aggressive of all 3 strategies because it has defined risk. The trade-off of a defined risk trade is that it has a lower probability of profit. But iron condors are great for smaller accounts or for stocks with a high price. Like the straddle and strangle, the short iron condor benefits from the passage of time and a decrease in implied volatility.

The optimal time to sell an iron condor is when the IV rank of the underlying security is high. Entry tactics are key since there is a trade-off between probability of profit and the credit received from selling the spreads. A trader can create an iron condor by selling an OTM call spread and selling an OTM put spread. A spread is just a defined risk trade that buys and sells either call or put options at different strike prices in the same expiration. You should try to collect at least 1/3rd the width of the strikes in premium when placing an iron condor. So when selling a $3 wide spread on either side, make sure to collect $1 in premium.

Let’s look at an example of a short iron condor in the S&P 500 ETF, SPY. The current IV rank of the SPY is 36% and its price is $288.81. You can sell $3 wide spreads in the September expiration for a $1.09 total credit by selling the 273 put and 299 call while buying the 270 put and 302 call. The profit zone for the next 35 days is $271.91-$300.09 which means the price can fluctuate up +4% or down -6% without the trade losing money. If the price goes outside the break-even points through expiration, the max you can lose is -$1.91. When profits are taken early, the strategy has a 71% probability of profit.

Conclusion

Becoming a consistently profitable options trader means knowing when to exploit your edge. When selling options, the mathematical edge is in overpriced implied volatility. So when volatility picks up and investors start to panic, options sellers need to take full advantage of the higher priced “rich” premium. Depending your risk tolerance, the 3 best high probability strategies for capitalizing on a volatile market are the short straddle, the short strangle, and the short iron condor. Stick to the probabilities and the profits take care of themselves.

——-

If you’d like to learn more about options trading and/or want to follow my daily trade ideas, signup to optionsappetite.com

You can also follow me on Twitter @optionsappetite

About: Chuck McCleary is a professional trader with 15+ years of experience. He founded optionsappetite.com in 2018 to help educate frustrated retail traders to become consistently profitable using options.

***All content, opinions, and commentary by Options Appetite is intended for general information and educational purposes only, NOT INVESTMENT ADVICE.

>