A Monte Carlo simulation is a process used to show all the potential outcomes of a trading system, business model, supply chain, scientific theory, insurance, research and development, or a casino. A Monte Carlo simulation uses the most important available metrics of a system including inputs of size of wins and losses along with win rates and other probabilities to compute all the future possibilities of a system or process.

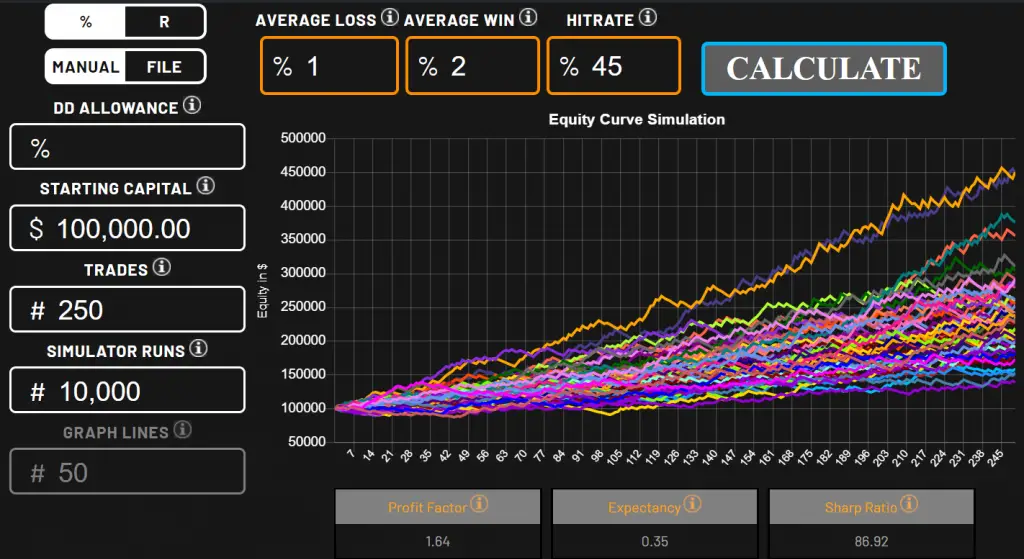

A Monte Carlo simulation does multiple risk and reward calculations by creating potential models of multiple outcomes by processing a wide range of values to create a graphic of probability distribution. It attempts to remove some of the uncertainty of implementing a system by showing the range of potential outcomes based on the factors of the system. It can calculate new results after the parameters of a system are adjusted to look for better potential outcomes. A Monte Carlo simulation can show thousands of potential outcomes based on the input of variables in a system.

The purpose of a Monte Carlo simulation is to create and show the variance of distribution of possible outcome results based on the parameters of a system. It is used for risk management and optimization of rewards for a system with measurable inputs. It seeks to create some clarity around future results.