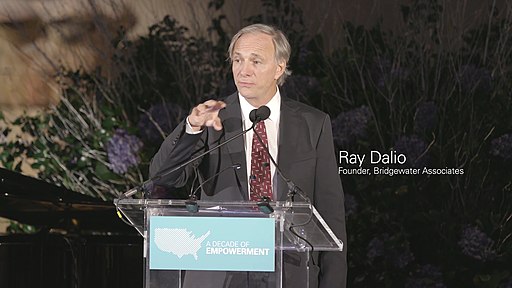

Ray Dalio founded Bridgewater Associates in 1975. He grew it into one of the world’s largest hedge funds by 2005. As of 2021 his hedge fund has over $160 billion in total assets under management. Ray Dalio is the 85th richest person in the world according to Forbes with a net worth of approximately $20.3 billion.

Bridgewater’s Pure Alpha strategy has generated a 12% annualized return since its beginning in December 1991.

Below is the current Ray Dalio portfolio in 2021. This is a breakdown of his Bridgewater Associates Holdings portfolio positions from his fund’s 13F filings as of the 4th quarter after his 2020 Q4 update on February 12, 2021. (Positions under 0.30% of capital in his portfolio have been excluded).

Below are the top 53 Bridgewater Associates holdings in this portfolio with $11.55 billion in assets under management as of the beginning of 2021:

Position ranked by size/Ticker symbol/Company or ETF name/Portfolio percentage

- SPY Spdr S&p 500 11.93%

- VWO Vanguard Ftse Emerging Markets Etf 5.71%

- GLD Spdr Gold Trust 4.61%

- WMT Wal-mart Stores Inc 3.84%

- PG Procter And Gamble Co 3.25%

- BABA Alibaba Group Holding Ltd Sp A 3.22%

- IEMG Ishares Core Msci Emerging Markets Etf 2.89%

- IVV Ishares Core S&p 500 Etf 2.60%

- IAU Ishares Gold Trust 2.43%

- PDD Pinduoduo Inc Sponsored Ads 2.19%

- KO Coca Cola Co 2.15%

- JNJ Johnson & Johnson 2.00%

- PEP Pepsico Inc 1.90%

- EEM Ishares Msci Emerging Index Fund 1.71%

- COST Costco Wholesale Corp 1.59%

- MCD Mcdonald’s Corp 1.43%

- FXI Ishares China Large-cap Etf 1.43%

- VEA Vanguard Ftse Developed Markets Etf 1.39%

- EFA Ishares Msci Eafe Etf 1.35%

- LQD Ishares Iboxx $ Investment Grade Corporate Bond Etf 1.32%

- JD Jd Com Inc 1.30%

- IEFA Ishares Trust 1.25%

- MCHI Ishares Msci China Etf 1.16%

- SBUX Starbucks Corp 1.10%

- BIDU Baidu 0.94%

- EL Lauder Estee Cos Cl- A 0.87%

- ABT Abbott Labs 0.86%

- NIO Nio Inc Spon Ads 0.83%

- TGT Target Corp 0.82%

- DHR Danaher Corp 0.80%

- MDLZ Mondelez International Inc 0.74%

- EWT Ishares Inc Ishares Msci Taiwan Etf 0.68%

- CL Colgate Palmolive Co 0.67%

- CVS Cvs Health Corp 0.48%

- DG Dollar Gen Corp New 0.48%

- ISRG Intuitive Surgical Inc 0.47%

- MNST Monster Beverage Corp New 0.47%

- JPM Jpmorgan Chase & Co 0.45%

- EDU New Oriental Ed & Tech Grp I 0.45%

- TAL Tal Ed Group 0.45%

- KMB Kimberly Clark Corp 0.41%

- BEKE Ke Hldgs Inc Sponsored Ads 0.41%

- SYK Stryker Corp 0.40%

- VEEV Veeva Sys Inc 0.39%

- NTES Netease 0.38%

- STZ Constellation Brands Inc 0.38%

- KHC Kraft Heinz Co 0.38%

- BAC Bank Amer Corp 0.37%

- CMG Chipotle Mexican Grill Inc 0.36%

- YUMC Yum China Hldgs Inc Com 0.36%

- BFB Brown Forman Corp Cl B 0.33%

- SYY Sysco Corp 0.32%

- GIS General Mls Inc 0.32%

Grameen America, CC BY 3.0 <https://creativecommons.org/licenses/by/3.0>, via Wikimedia Commons