Is forex trading profitable? Is day trading profitable? Are commonly asked questions by new traders but the answer can be yes or no depending on how someone trades. Yes, trading is profitable if you have a positive expectancy model where the average win is bigger than the average loss over a series of trades. Profitability is dependent on both the risk/reward ratio and winning percentage when these two things merge into a positive expectancy then over the long term profits follow. Trading is not profitable if you are trading a negative expectancy model which is primarily caused by big losses regardless of other factors.

Profitable trading is not about winning and making money on every trade. It’s not about predicting the future, making a great call, or any one big trade, it is all about the math over a series of trades.

Here is the real path to profitable trading in ten steps:

- You need a quantified trading system with an edge that creates only one of four trading outcomes: a big win, a small win, a break even trade, or a small loss. If you have this type of trading process then you will make money over the long term as your edge plays out. The most important part of the process is eliminating big losses from your system. Big losses take back profits and create a drag on your equity curve. Stop losses and position sizing must be used to minimize losing trades when they occur.

- The purpose of backtesting and historical chart studies is to develop a process of entries and exits that creates the big wins and the small losses. While stop losses keep losing trades small, trailing stops can maximize winning trades by letting winners run. Your system is the strategy you create for managing your trades for profitability.

- The psychology of execution of a trading system is one of the most important aspects of trading. The trader is the weakest link in any system. Ego, stress, and emotions can stop a trader from following their system with discipline and perseverance. A trader must have faith in their system and faith in their self to execute it consistently over time.

- Position sizing is a crucial part of keeping losses small. The size of your trades must be based on the maximum loss you would experience if your stop loss is hit. A loss of 1% to 2% of total trading capital is a safe level to manage. Position sizing of 10% of your trading capital is generally safe in non-leveraged markets. Volatility and trading range is the best guide to how big a trade should be.

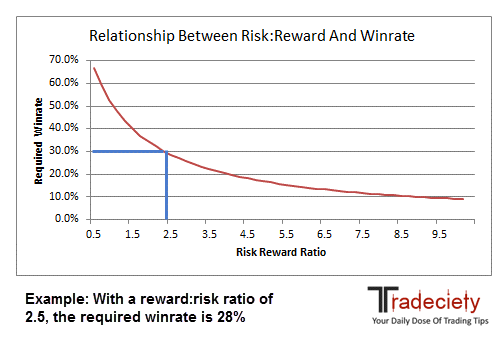

- The risk has to be worth the reward. On entry, the profit target should be at least twice as much as the stop loss placement. Creating good risk/reward ratios at entry is a primary key to profitable trading whether the trades are mechanical or discretionary. The higher the reward to risk ratio, the less winning percentage it takes to be a profitable trader.

- You must know your positive expectancy as a trader, it is defined as how much money, on average, you can expect to earn for every dollar you risk.

- Calculate your profit factor, it is calculated as the gross profit divided by the gross loss (including any commissions and slippage) for a full trading period. This metric of performance shows the amount of profit per unit of risk and values greater than one indicate a system is profitable.