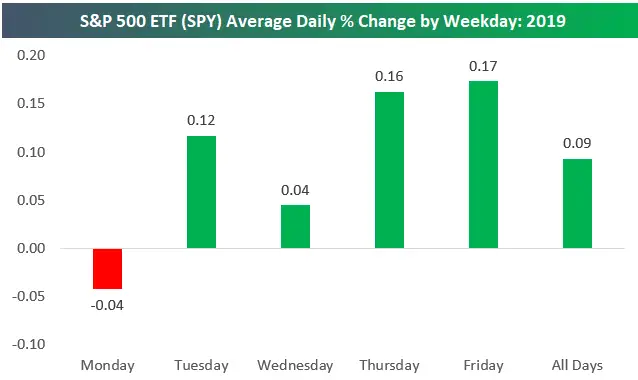

Historically there has been a pattern of stocks selling off on Monday’s. The pattern has varied each year but it remains a pattern even over the past few years. This tendency has been so pronounced that a book was even written about it in 1987, “Don’t Sell Stocks on Monday” by Yale Hirsch. Each day of the week will vary but Monday tends to be a negative day in most years on average.

It’s been called the Monday Effect or the Weekend Effect for its bearish tendency. Many traders believe that the stock market regularly drops on Mondays. One theory is that bad news can be released over a two day weekend. Another theory is that investors’ are in a gloomy mood after the end of the weekend and it being time to get back to work, which appears to be the case many times in Monday morning trading.

In theory based on the price data there is still a slight edge in selling stocks on Friday to lock in weekly gains and buying stocks on Monday after they have sold into the negative. This doesn’t mean that a trader would make money every time they did this only that there is an edge with average gains being larger than the average losses over the long term.

So it is probable that the best day of the week to buy stocks is Monday and the best day of the week to sell stocks is Friday.