The Sizzle Index is a feature on the thinkorswim platform that filters to find stocks that currently have an increase in the number of option contracts traded in relation to the last 5 days’ average of activity.

The Sizzle Index is calculated as the ratio of the current total volume of put and call options to the arithmetic mean of daily put and call volumes over the previous 5 days. The individual call and put Sizzle Index values are also calculated and available to see as watchlist columns on the platform.

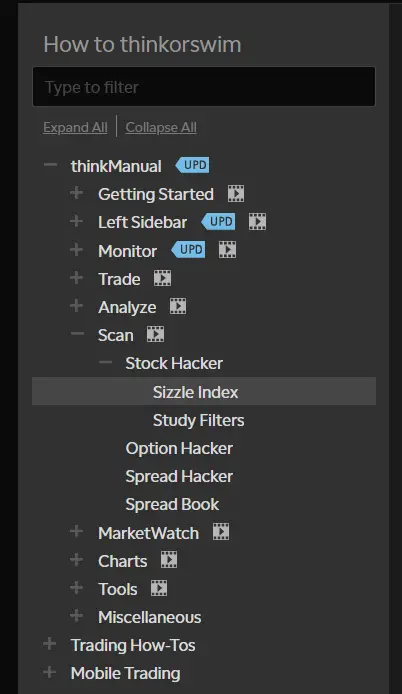

The Sizzle Index feature is a type of Stock Hacker scan template that shows 10 stocks with the greatest Sizzle Index values.

The default settings are:

- Market capitalization of a minimum of 35 million dollars.

- Volume of at least 100,000 shares traded.

- Current price of at least five dollars.

These default value filters and settings can be changed in the Stock Hacker interface on thinkorswim.

How do traders get the Sizzle Index list on the thinkorswim platform?

- Click the scan tab and choose Stock Hacker from the sub-tab row. Click the Sizzle Index button on the right of the Stock Hacker header. This will create the top 10 Sizzling Stocks scanning template.

- The three default stock scan filters are added inside the template: minimum last price, minimum volume, and minimum market capitalization. These filters can be modified. The total number of current matches is displayed in real time on the right. Even though each filter may display matches in pre-scan, the actual final scan may return no current results, any stock that is on the final scan results must match all the quantified criteria.

- More filters can be added to the scan by using the buttons above the filters area. Up to 25 filters can be used in a scan and only one pattern filter is allowed. Filters can be removed by clicking X on its right.

- After clicking scan the results will be displayed in a watchlist-like form. They can be saved as a watchlist by clicking the show actions menu button and selecting save as watchlist. All operations available in watchlists are also available in the search results: they can be added or columns removed, adjust sorting, add orders, and to create alerts.

- Consider saving the scan query for future use. To save a query, click on the show actions menu button next to Sizzle Index and select save scan query then enter the query name and click save.

- Scan results are updated. To be notified of changes in the results, consider adding an alert on the changes. To add an alert:

- Click on the show actions menu button and select alert when scan results change.

- Inside the dialog window, specify which events to be notified if they occur.

- Frequency options can be used if you would like the system to notify you changes in the results or send you a list of changes on an hourly, daily, or weekly basis.

- Click create. The alert will be added to your alert book.[1]

Unusual options activity can provide insight on what smart money, insiders, and big traders are doing with large volume option orders. Unusual options activity can tip a large traders hand and be a sign that a big bet has been placed for a potential move in price for the underlying stock that has a high probability. This option trading activity is usually detected due to its size and increase it causes in open interest on an option chain.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.