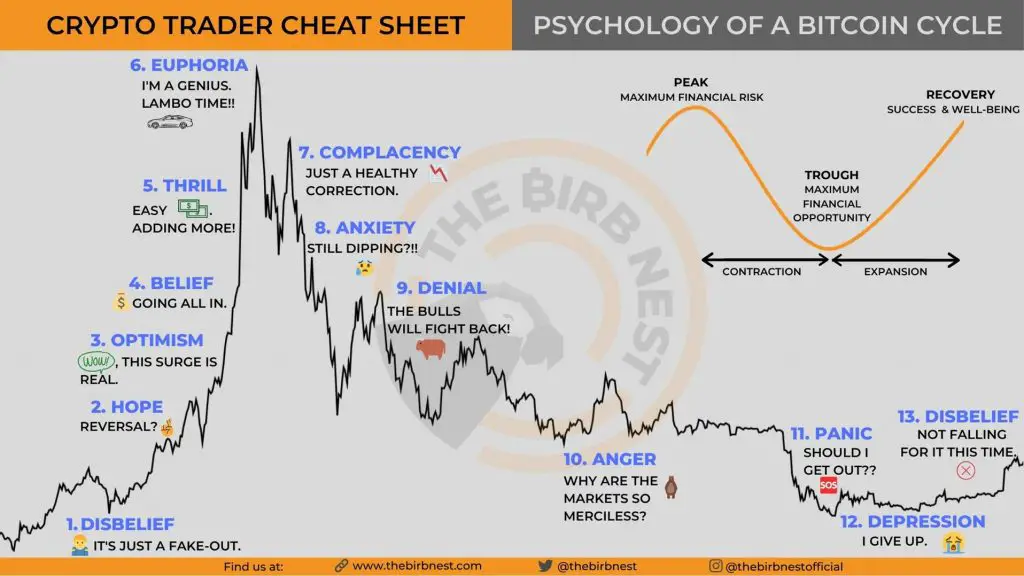

Even though cryptocurrencies like Bitcoin and Ethereum have had huge run ups over time, they don’t go straight up and holding them is not as easy as people think in hindsight. The prices have moved both up and down many times creating a lot of emotions both good and bad at times in the people trying to hold them for the long term gains they expect.

Here is a crypto trader sheet cheat to show people that plan on holding the winning cryptocurrencies what to expect on their journey even if they win in the long term. It’s not as easy in practice as it is in theory to deal with an unknowable future and wild moves up and down in price action over time.

Disbelief: After a bear market the first rallies into a new bull market are not believed to be real. Most people think the rally will fail.

Hope: The first step in beginning a new bull market is that a price recovery from the lows is possible and the move higher holds.

Optimism: The bull market can start trending higher on the optimism that the new upswing in price is real.

Belief: Buyers will begin to act on the faith in the trend higher and begin entering back into the chart.

Thrill: When the thrill of profits and making money begins the sentiment turns bullish and people become vocal about buying.

Euphoria: The peak in prices in bull markets are reached on euphoria as holders start thinking they are geniuses for being long for so long and they start projecting how much money they will make going forward based on previous returns.

Complacency: People don’t believe the recent high prices at the top was the end of the bull run and that the big drop is just going to be a small pullback before making new all time highs in price.

Anxiety: Holders start becoming concerned and worried as the pullback evolves into a long downtrend in price.

Denial: Holders decide to just stay in the market thinking their cryptos are good long-term investments.

Anger: Mad that the expected profits did not happen and money was lost instead.

Panic: Holders panic and think it may be best to just get out of the market and just save the capital they have left.

Depression: Holders are depressed about giving back their bull market profits and feel foolish for not exiting at the right time.

Disbelief: After experiencing a bear market the first rallies into a new bull market are not believed to be real. People think the rally will fail and the market will return to the lows.