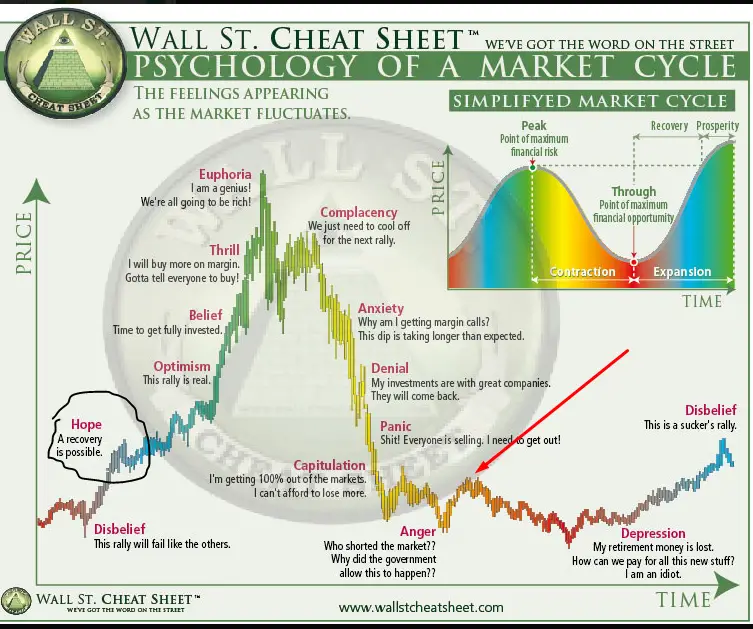

The stock market goes through cycles based on the primary human emotions of greed and fear. There is a wide spectrum and phases of emotional behavior inside these two main drivers of investor behavior. The below stock market cheat sheet shows the impulses that drive each phase of a market cycle.

Here are the 14 stages of the psychology of a market cycle from beginning to end.

Disbelief

After a bear market the first rallies into a new bull market are not believed to be real. Investors think the rally will fail.

Hope

The first step in beginning a new bull market is that a price recovery from the lows is possible and the move higher will hold.

Optimism

The bull market can start trending higher on the optimism that the new upswing in price is real.

Belief

Investors will begin to act on the faith in the trend higher and begin entering back into the market.

Thrill

When the thrill of profits and making money begins the sentiment turns bullish and people become vocal about buying.

Euphoria

The peak in prices in bull markets are reached on euphoria as investors start thinking they are geniuses for being long for so long and they start projecting how much money they will make going forward based on previous returns.

Complacency

Investors don’t believe the recent high prices at the top was the end of the bull run and that the big drop is just a small pullback before making new all time highs in price.

Anxiety

Investors start becoming concerned and worried as the pull back evolves into a long downtrend in price.

Denial

Investors decide to just stay in the market as they are holding good long-term investments.

Panic

Investors start to panic and think it may be best to just get out of the market and just save the capital they have left.

Capitulation

Fear overtakes the original plan with further lower prices and more people sell to stop the pain of financial loss.

Anger

Investors grow angry at whatever they believed caused the bear market and the loss of their bear market gains.

Depression

Investors are depressed about giving back their bull market profits and feel foolish for not exiting at the right time.

Disbelief

After experiencing a bear market the first rallies into a new bull market are not believed to be real. Investors think the rally will fail and the market will return to the lows.

Managing Emotions

The best solution to managing emotions in the stock market is trading a quantified trading system with an edge and using signals over opinions and being emotional moved by big wins or big losses. Lower your trading size to an amount that is enough to be meaningful but not so big that it brings your emotions and ego into a trade.