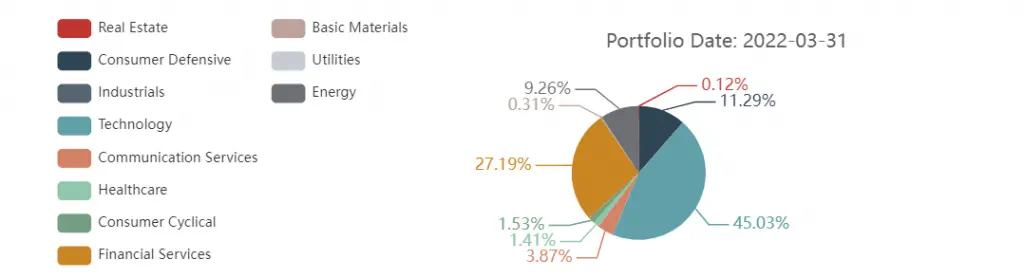

Below are the Berkshire-Hathaway portfolio holdings by sector and industry managed by Warren Buffett that were reported in the 13F filing to the SEC for the 1st quarter of 2022 on March 31st.

Warren Buffett continues to oversee and manage the Berkshire-Hathaway portfolio with approximately $363.5 billion in capital, this is how he has his current portfolio allocated.

What industries does Warren Buffett invest in?

Portfolio holding percentage by sector:

- Technology 45.03%

- Financial Services 27.19%

- Consumer defensive 11.29%

- Communication Services 3.87%

- Healthcare 1.41%

- Consumer cyclical 1.53%

- Energy 9.26%

- Real Estate 0.12%

- Basic Materials 0.31%

Does Warren Buffett have a personal portfolio?

Warren Buffett’s personal portfolio consists of a 16% stake in Berkshire-Hathaway shares that are currently worth approximately $111 billion along with holdings in two banks: JP Morgan and Wells Fargo, the size of these two positions are not known.[2]

What is Warren Buffett’s 90/10 rule?

Warren Buffett’s #1 money tip for retirees is a method that allocates 90% of investment capital into stock-based index funds while the remaining 10% of money is put into lower-risk investments. Buffett’s favorite exchange traded index fund is one that tracks the S&P 500 like the SPDR SPY ETF or Vanguard’s VOO. He has seen that the S&P 500 beats the majority of all mutual fund managers and that the ETFs also save investors a lot of money with much lower management fees that add up over time.

In a letter to Berkshire Hathaway shareholders, Warren Buffett outlined his investing plan to use the 90/10 rule regarding his wife’s inheritance, which will be invested 90% in an S&P 500 index fund and 10% in government bonds. [1]

This keeps 90% of retirees capital growing by tracking the increase in prices of 500 of the best U.S. companies and also keeping 10% of capital safely in short term bonds to be spent on living expenses.

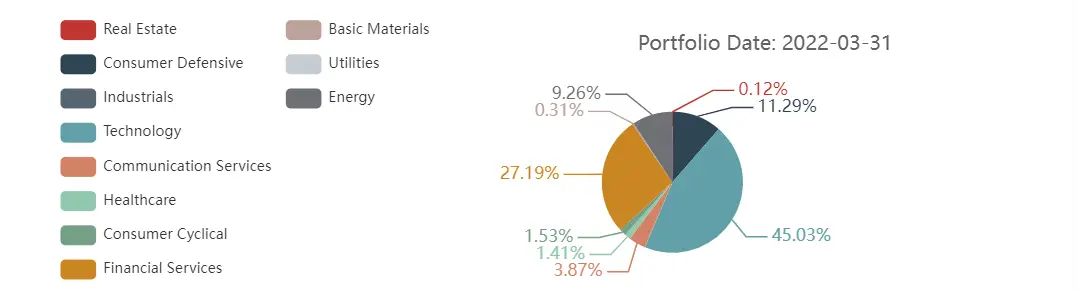

The S&P 500 index is a very diversified by sector for a smoother equity curve.

SPY Sector Weightings (%)

Basic Materials 2.47%

Consumer Cyclical 10.74%

Financial Services 13.39%

Real Estate 2.77%

Consumer Defensive 6.89%

Healthcare 14.45%

Utilities 2.45%

Communication Services 8.80%

Energy 4.79%

Industrials 8.18%

Technology 24.42%