There are two primary methods for investing in the stock market: value investing and growth investing. Value investors want to buy a dollar in value for 50 cents today and a growth investor wants to but a future five dollar value for one dollar today. They are different ways of thinking but both can be profitable when executed correctly.

Growth stocks vs value stocks

Value investors look to buy stocks selling far below the company’s true intrinsic value of assets and future cash flow. Growth investors are looking to buy stocks in companies that growth their value by multiples in new markets, with new technology, or a new business model.

What is a growth stock?

A growth stock is an equity that is expected to grow at a much higher pace than the overall market returns. Growth stocks don’t pay dividends as they are still building their businesses and reinvest all their earnings (if they have any) back into expanding their capacity.

Growth companies are always looking for new cities if they are retail businesses, new markets if they are technology based, and new countries once they saturate their home country. A growth stock is a business that has created a winning business model and is looking to duplicate it as many times as possible to acquire new customers and grow in size. There #1 mandate is to grow in size and scale. This enables the stock to increase in value.

The key to growth investing is knowing if the future growth of a company is accurately priced into the stock or not.

What is a value stock?

A value stock are shares believed to be trading at a good price versus the fundamental value of the underlying company. Value stocks are out of favor in the market and tend to be thought of as having bad future prospects of declining earnings, sales, or an antiquated business model.

Value stocks can be identified by having very low p/e ratios, high dividend yield, and a low price versus asset value. Value investors look to buy value stocks that the market has oversold when they believe that the business is worth more than what the market has priced in.

Value stocks are ones that can increase multiples in price value if the company has a turn around or even just new management and a new narrative. The best value investments are in companies that look like they are going bankrupt but they aren’t and become turnaround stories. The stocks that are really headed to bankruptcy as the math doesn’t show them as viable businesses are not a value stock and should be avoided.

Value stocks also tend to have high short interest and can also see short squeezes on any good news even if it’s short term.

Value investors focus on the underlying business fundamental value versus the stock price metrics when selecting their stocks to purchase. They look for a great risk/reward ratio on entry where little downside risk on price is left.

What is the difference between a value stock and a growth stock?

Value stocks allow the investor to buy a business at a great price, growth stocks allow an investor to buy the future value of a business at a great price today.

Value stock investors primarily look at the value of the company’s current balance sheet, growth stock investors look at the value of future revenue, sales, and profits.

Value stocks primarily focus on a business’s past value versus the current price, growth stocks primarily focus on the business’s future value versus the current price.

Value investors focus on the stock price, growth focuses on the business’s future.

Value stocks are for buying low and selling higher, growth stocks are for buying high and selling higher.

Many value stock prices are near 52-week lows, many growth stock prices are near all-time highs.

Value stocks are usually for companies trying to fix the business’s problems, growth stocks are for companies trying to solve the world’s problems.

Quality value stocks many times pay investors high dividends, quality growth stocks pay investors in capital gains.

Value stocks are used as a flight to safety in bear markets, growth stocks are vehicles for speculation in bull markets.

Value stocks create great risk/reward ratios at entry, growth stocks create great rewards at the profitable exit.

The stocks that investors and traders decide to place on their watchlist or inside their portfolio need to fit their own beliefs about the market. Their entries and exits using these stocks need to be inside the context of a complete market methodology that has an edge.

Are value stocks riskier than growth stocks?

The risk in buying a value or growth stocks depends on the entry price and how far removed it is from intrinsic value.

Deep value stocks have the risk of potential bankruptcy and going to zero if they are not financial solvent with enough earnings to service debt or able to raise money through issuing bonds. The risk in a value stock lies within the price paid versus the true company value.

Growth stocks can become highly speculative with valuations far above any rational future value of the business or future earnings projections. When a growth stock with a high price to earnings (p/e) ratio disappoints on the companies quarterly earnings call the price can plunge 10%-20% or more in one day. Growth stocks can also go down 50% to 90% in price when the market realizes it will never growth to previous expectations. This usually happens in a bear market when speculation in growth stocks end. The risk in a growth stock lies within the price paid versus the true future potential growth in the business.

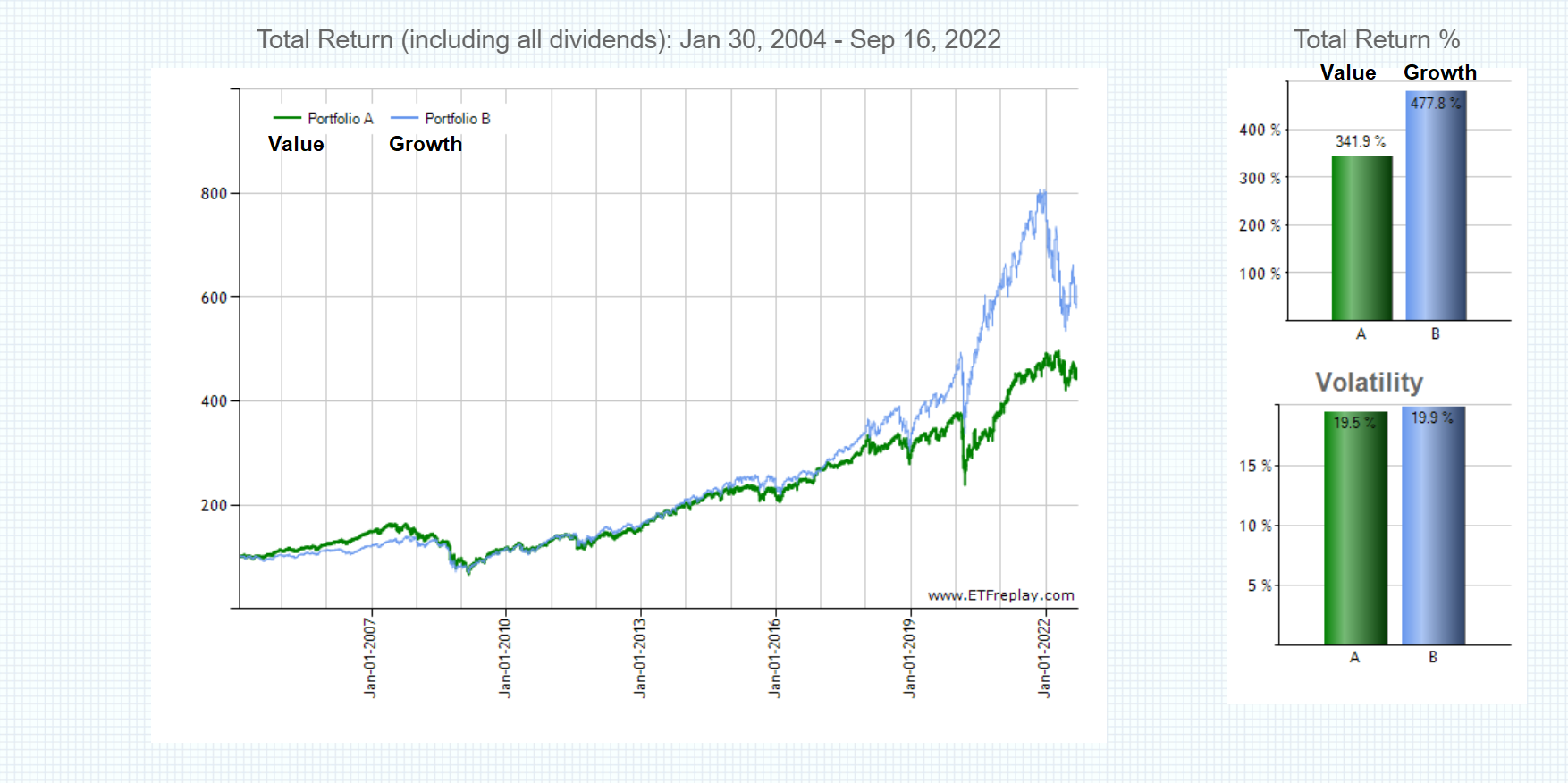

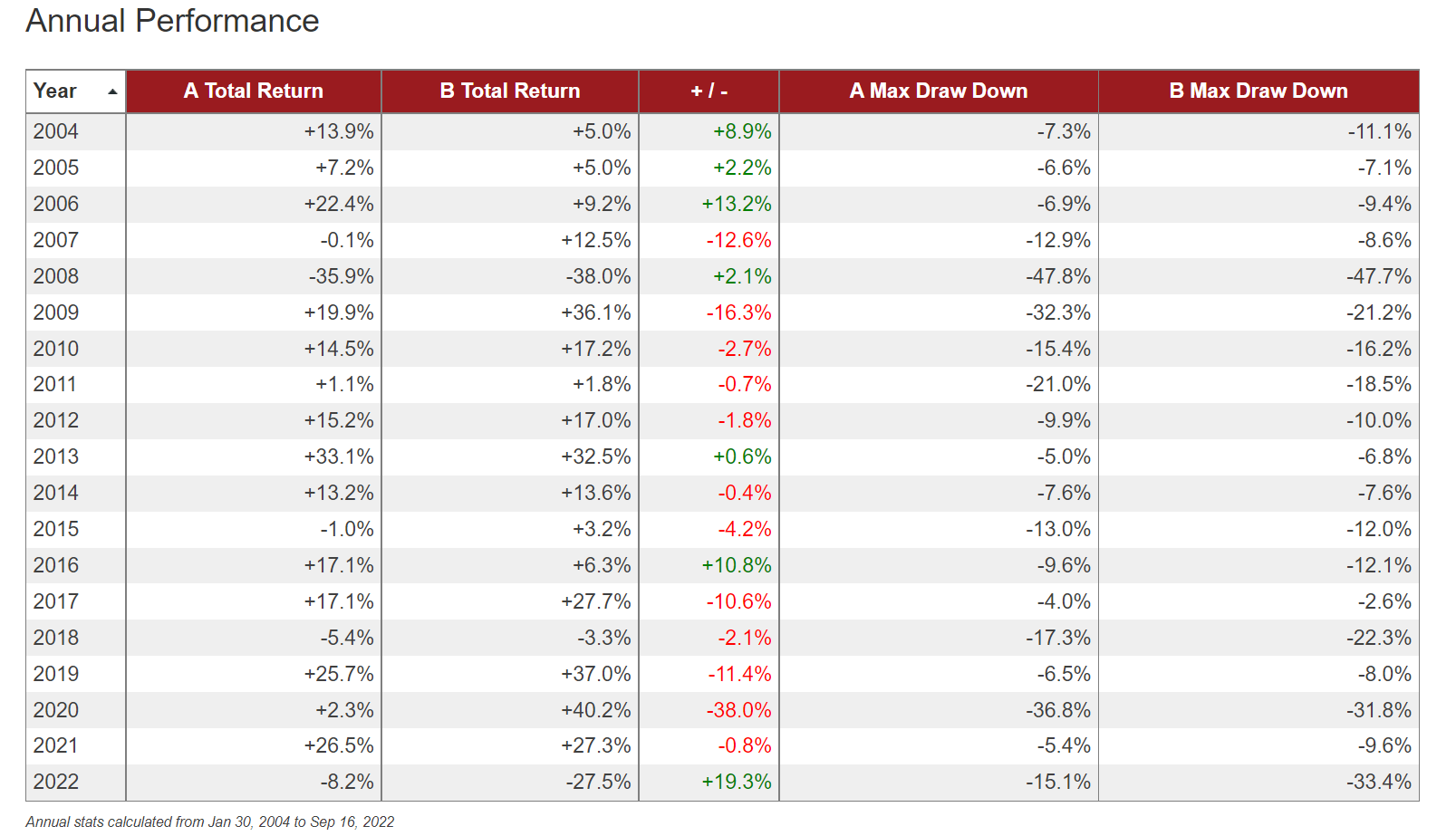

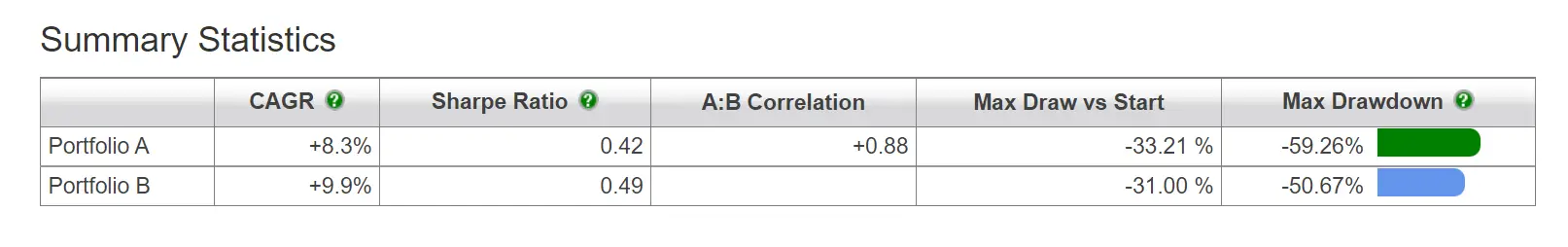

Value vs growth stocks performance chart

Below is a comparison between the Vanguard Value Index Fund ETF ticker VTV (portfolio A) and the Vanguard Growth Index Fund ETF ticker VUG (portfolio B) in the chart and data example from 2005 to 2022.

Value outperformed growth early in this time period, then both returns became similar for years. In the previous six years growth stocks outpaced value stocks by 100s of percent in returns before the recent correction.

Charts courtesy of ETFreplay.com