“Trading” and “hard” are words many novice traders often find synonymous. The intricate dance of numbers, charts, and emotions can be overwhelming. However, the complexity of trading began to become more simplified for me when I delved deeper into three pivotal concepts. In this article, we’ll journey through these transformative insights that shifted my perspective from seeing trading as a frustrating challenge to viewing it as a structured and manageable endeavor. Whether you’re a beginner or looking to refine your trading approach, these principles might be the game-changers you’ve been seeking.

The path to trading success is fraught with pitfalls and challenges. I was no exception. My trading journey was filled with mistakes, losses, and frustration until I grasped three fundamental concepts that changed everything.

Here they are:

Three concepts to understand to make trading easier:

- Establishing Good Risk Reward Ratios

- Through stop losses

- Trailing stops

- Profit targets

- Develop A Positive Expectancy Trading System

- Trade A Position Size You Are Mentally Comfortable With

- Avoid the risk of ruin

- Avoid big losses

1. Establishing Good Risk Reward Ratios

The first and perhaps most crucial concept I learned was the importance of a good risk-reward ratio. This is the balance between what you’re willing to risk and what you hope to gain on a trade. Here’s how I implemented it:

- Stop Losses: Setting a stop loss means determining a price level at which you’ll exit a trade if it goes against you. This ensures that you only lose a predetermined amount of your capital. Setting these based on the market’s volatility and not your emotional comfort level is essential.

- Trailing Stops: These are dynamic stop losses that move with the market. If you’re in a profitable position, a trailing stop will move up (or down, depending on the direction of your trade) to lock in profits while still giving the trade room to run.

- Profit Targets: Just as you need to know when to exit a losing trade, you should also have a clear idea of where you want to take profits. Setting a profit target helps ensure you don’t get greedy and give back your gains.

The risk/reward ratio is a measure traders use to compare the expected returns of an investment (the reward) to the amount of risk undertaken to capture these returns. It’s a way to quantify the potential profit of a trade relative to its possible loss.

How It Works:

- Risk: This is the amount of money you will lose on a trade. It’s typically defined by setting a stop-loss order, a predetermined price level at which you’ll sell a security to limit a loss.

- Reward: This is the potential profit you aim to make on the trade. It’s often determined by setting a target price at which you’ll sell a security to lock in your gains.

Calculating the Ratio:

To calculate the risk/reward ratio, divide the amount you stand to lose (risk) by the amount you stand to gain (reward).

For example, if you buy a stock at $100 and set a stop-loss at $95 (meaning a potential $5 loss) and a target price of $110 (representing a potential $10 gain), your risk/reward ratio would be 1:2. This means for every dollar you’re risking, you’re aiming to make two.

Why It’s Important:

- Capital Preservation: By adhering to a favorable risk/reward ratio, traders can ensure that even if several trades go against them, a few winning businesses can still keep them profitable overall.

- Decision Making: It helps traders avoid impulsive decisions by setting clear parameters for when to exit a trade, whether a loss or a gain.

- Consistency: By consistently applying a favorable risk/reward ratio, traders can achieve more predictable results.

Ideal Ratios:

While the ideal ratio can vary based on individual trading strategies and risk tolerance, many traders follow a minimum 1:2 or 1:3 risk/reward ratio. This means that for every $1 risked, they aim to make $2 or $3 in profit. This approach ensures that even if a trader is right only half the time, they can still be profitable.

Understanding and effectively using the risk/reward ratio is crucial for long-term success in trading. It provides a structured approach to trading decisions and helps maintain discipline, which is essential for navigating the volatile world of financial markets.

By ensuring a favorable risk-reward ratio, I could ensure that even if I had losing trades, my winning businesses would more than compensate for them.

2. Develop A Positive Expectancy Trading System

A trading system with positive expectancy is one where you can expect to make a profit over many trades. It doesn’t mean every trade will be a winner, but it does mean that the system is statistically likely to be profitable over time.

I had to create a complete trading strategy with an edge to develop such a system.

In simple terms, a trading system has a positive expectancy when the average amount you expect to win (when you win) is greater than the average amount you expect to lose (when you lose) over many trades. It means that you can expect to make a profit over many trades.

The formula for expectancy:

Expectancy=(Probability of Win×Average Win)−(Probability of Loss×Average Loss)

If the result is positive, the system has a positive expectancy. If it’s negative, the system will likely lose money over time.

What is a profit factor?

The profit factor is a straightforward yet powerful metric used to evaluate the performance of a trading system, and it’s closely related to the concept of a Positive Expectancy Trading System.

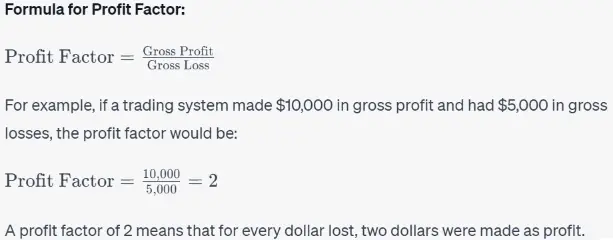

Profit Factor Defined:

The profit factor is the ratio of the gross profit from trades to the gross loss. It tells you how many dollars you earned for every dollar you lost.

The formula for a profit factor:

Interpreting the Profit Factor:

- Greater than 1: A profit factor greater than 1 indicates a profitable system. The higher the number, the better the system’s performance.

- Equal to 1: A profit factor of 1 means the system breaks even. Gross profits are equal to gross losses.

- Less than 1: A profit factor less than 1 indicates a system that is not profitable. For every dollar made, more than one dollar was lost.

Relation to Positive Expectancy:

A trading system with a profit factor greater than 1 has a positive expectancy. It indicates that, on average, the system is making more money than it’s losing. However, it’s essential to remember that past performance doesn’t guarantee future results. A system with a high-profit factor in past data might not necessarily maintain the same performance in the future.

Using Profit Factor in System Development:

- Backtesting: When testing a strategy on historical data, the profit factor can be a quick metric to gauge the system’s effectiveness.

- Risk Management: While the profit factor gives an overview of profitability, it should be used with other metrics, like drawdown, to get a comprehensive view of the system’s risk and reward.

- Comparison: If you have multiple trading strategies, the profit factor can be a valuable metric to compare their performance.

The profit factor is a simple yet effective metric to gauge the profitability of a trading system. When used with other metrics and tools, it can provide valuable insights into the effectiveness of a trading strategy.

How to Develop a Positive Expectancy Trading System:

- Backtesting: This is testing your trading strategy on historical data to see how it would have performed. Doing this lets you know the system’s historical win rate and the average size of wins and losses.

- Define Clear Entry and Exit Rules: Your trading system should have straightforward entry and exit criteria. This reduces ambiguity and emotional decision-making.

- Watchlist: You must have a set list of securities on which you will execute your trading signals that fit your systems strategy.

- Risk Management: Ensure a clear risk management strategy, including position sizing and setting stop losses. This ensures that losses are minimal when trades go against you.

- Forward Testing: Before committing to trading real money, test your strategy in real-time with a demo account or a small amount of capital. This is also known as paper trading.

- Review and Refine: Markets evolve, and what worked in the past might not work in the future. Regularly review your system’s performance and make necessary adjustments.

- Stay Disciplined: Even the best system will have losing trades. Staying disciplined and not deviating from your strategy based on emotions is essential.

- Consider External Factors: Economic news, geopolitical events, earnings announcements, and other macro factors can influence the markets. While your system might be based on technical analysis, being aware of these external factors can add another layer of depth to your strategy.

- Continuous Learning: The financial markets are vast and ever-evolving. Always be open to learning, whether it’s a new trading technique, a different analytical tool, or understanding market psychology better.

A Positive Expectancy Trading System doesn’t guarantee profits on every trade. Instead, it ensures that the system is more likely to be profitable than not over many businesses. Developing and adhering to such a system requires discipline, continuous learning, and regular review. If you don’t have a system with an edge, then you are just gambling, and the odds are against you.

3. Trade A Position Size You Are Mentally Comfortable With

Lastly, understanding position sizing was a game-changer. Trading too large a position relative to your capital can lead to significant losses, and more importantly, it can affect your mental state, leading to poor decision-making.

Trading a position size you are mentally comfortable with is paramount for many reasons, many of which revolve around the psychological aspects of trading. Here’s a deeper dive into its importance:

- Emotional Stability: Trading inherently comes with ups and downs. The emotional rollercoaster can be intense if your position size is too large. Fear and greed, two of the most powerful emotions in trading, can be exacerbated when trading positions are too large for one’s comfort.

- Mental Comfort: Even if a position size is statistically safe, it’s too big if it keeps you up at night or makes you nervous. Trading should be like a business operation, not emotional.

- Better Decision Making: When you’re mentally at ease with your position size, you’re more likely to stick to your trading plan and make rational decisions. Oversized positions can lead to rash decisions, like prematurely exiting a position out of fear or holding onto a losing trade in the hope it will turn around.

- Avoiding the Risk of Ruin: Trading a position size that’s too large relative to your capital can lead to significant losses during a losing streak, potentially wiping out your trading account. Ensuring you’re comfortable with your position size also means you’re likely trading within a risk parameter that won’t jeopardize your entire account.

- Longevity in Trading: Trading is a marathon, not a sprint. By trading position sizes you’re comfortable with, you ensure sustainability in the trading world. It allows you to weather the inevitable losing streaks without severely denting your capital.

- Stress Reduction: Trading is stressful enough without the added pressure of oversized positions. Reduced stress can lead to better overall health and a clearer mindset when analyzing the markets.

- Consistency: One of the hallmarks of successful traders is consistency. Trading a consistent and comfortable position size helps develop a rhythm and routine in trading, leading to more predictable results over time.

- Enhanced Learning: When you’re not overwhelmed by the size of your trades, you can focus more on learning and refining your strategy. This is especially important for new traders who are still navigating the complexities of the market.

In essence, while the mechanics, strategies, and techniques in trading are crucial, the psychological aspect is equally, if not more, important. The size of your position plays a direct role in influencing your mental state. Trading a position size you’re mentally comfortable with ensures that you’re not just protecting your capital but also your mental well-being, allowing for more rational, clear-headed decisions essential for long-term success in trading.

By trading a position size I was comfortable with, I could make decisions based on logic and strategy rather than fear or greed.

Key Takeaways

- Balancing Potential Gains and Losses: Recognize the significance of balancing potential rewards against risks using tools like stop losses, dynamic trailing stops, and defined exit points for gains.

- Crafting a Profitable Strategy: Emphasize the importance of creating a trading system that, over numerous trades, leans towards profitability. This involves rigorous backtesting, real-time testing, and periodic evaluations.

- Mindful Position Sizing: Understand the importance of safeguarding your capital and ensuring your peace of mind by choosing trade sizes that align with your financial and emotional thresholds.

Conclusion

The essence of successful trading lies in the allure of profits and the meticulous management of risks and emotions. By balancing potential rewards and losses, cultivating a consistently profitable strategy, and being mindful of one’s emotional and financial boundaries, one can navigate the tumultuous seas of trading with greater confidence and poise.

Trading is as much about psychology as it is about strategy. Understanding and implementing these three concepts transformed my trading journey from a frustrating equity curve to a more consistent and profitable endeavor 20 years ago. Remember, the key to trading success is not chasing profits but managing risks and keeping your mindset right.