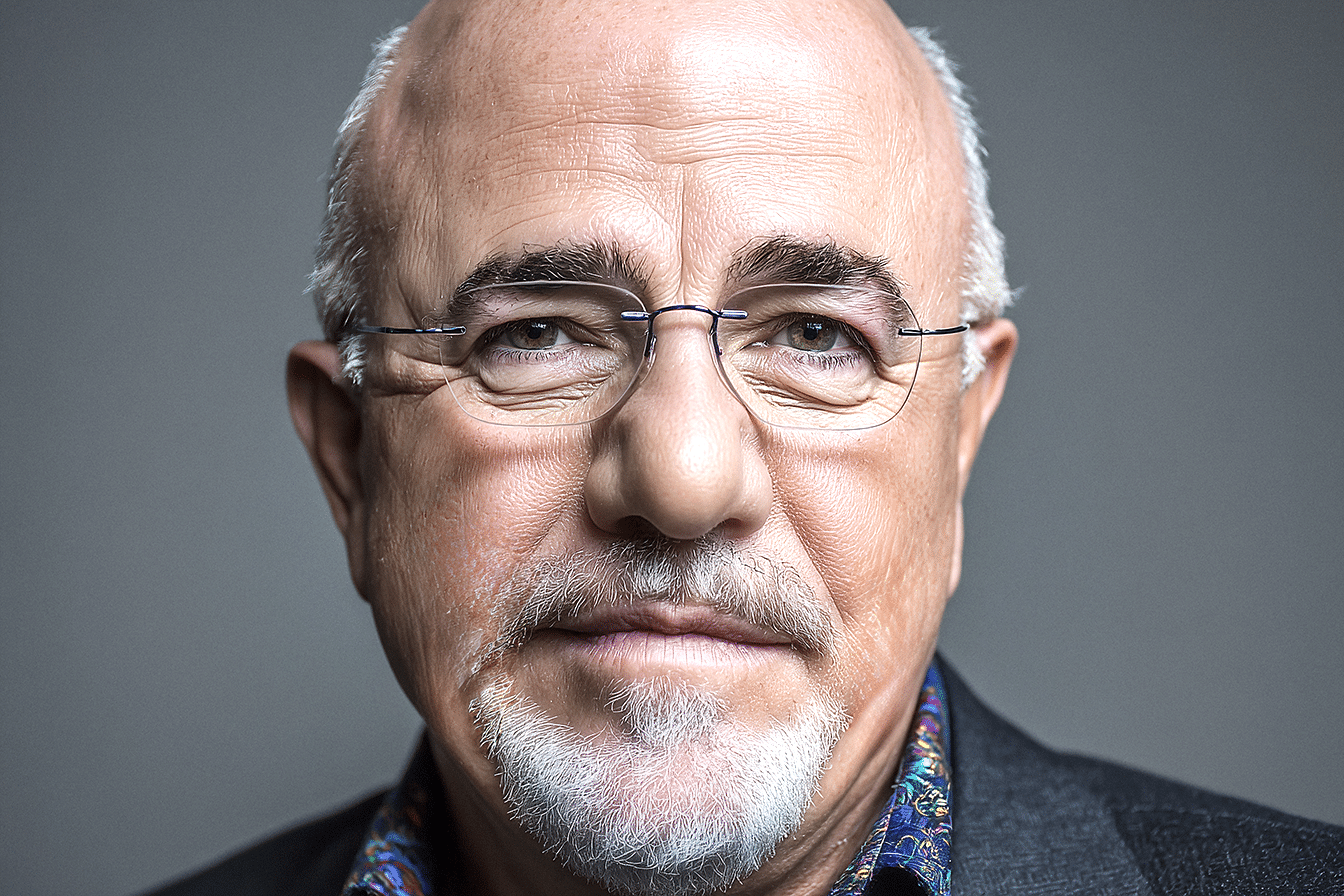

Financial guru Dave Ramsey recently sat down to discuss his economic outlook with the Iced Coffee Hour Podcast. He delivered surprising admissions about his track record while sharing his hopes for the current economy. Known for his no-nonsense approach to personal finance, Ramsey’s latest predictions reveal optimism and humility about forecasting economic trends. Let’s take a look.

1. Dave Ramsey Admits He’s “Generally Wrong” About Economic Predictions

Ramsey acknowledged his limitations as an economic forecaster in a refreshingly honest moment, stating, “Anytime I predict the economy or politics, I’m generally wrong. So, I hesitate to do it.” This admission sets the tone for understanding his economic outlook as hopes and opinions rather than certainties.

Despite his track record, Ramsey has been “unsuccessfully predicting a real estate boom” for six consecutive quarters and admits he’s “about ready for it to happen.” His self-aware humor shines through when he jokes, “If you keep saying it, eventually you’ll be right.”

This humility distinguishes Ramsey’s approach from other financial personalities who confidently make bold predictions. Instead of presenting definitive forecasts, he frames his economic outlook around what he hopes will work under current policies. He focuses on encouraging people to take action regardless of financial uncertainty, emphasizing that waiting for perfect conditions often leads to missed opportunities.

2. The Real Estate Boom That’s Six Quarters Overdue

Ramsey’s real estate predictions reveal both frustration and persistent optimism. He’s been calling for a real estate boom for “six consecutive quarters” without success, leading to his candid admission about prediction difficulties. However, his long-term bullish stance on real estate remains unchanged.

The delay in his predicted boom hasn’t dampened his enthusiasm for real estate investment. He continues to see fundamental factors that should drive growth, though timing has proven elusive. His approach demonstrates the challenge of predicting short-term market movements while maintaining confidence in long-term trends.

This extended period of incorrect predictions hasn’t caused Ramsey to abandon his real estate optimism. Instead, it reinforces his belief that market timing is tricky, even for experienced investors. His persistence in calling for a boom reflects his underlying confidence in real estate fundamentals, despite the frustration of missed timing predictions.

3. When Renting Makes More Sense Than Buying (And Why It Won’t Last)

Ramsey acknowledges current market conditions where “you could rent for half the price it would cost you to buy it” in specific markets. This represents a significant shift from traditional advice, showing his willingness to adapt recommendations to current realities.

However, he maintains his long-term conviction about homeownership with a powerful observation: “I don’t talk to happy 78-year-olds and 83-year-olds on our show who are renters.” This quote encapsulates his belief that while short-term renting might make financial sense, long-term wealth building favors homeownership.

His nuanced position distinguishes between short-term strategy and long-term wealth building. “Long-term, buying a home is a good idea. Buying a home you can’t afford is not a good idea,” he explains. This balance acknowledges current affordability challenges while maintaining his core philosophy about homeownership’s role in wealth building. The key lies in recognizing when temporary market conditions might favor renting without abandoning the long-term goal of homeownership.

4. Trump Economy Predictions: Energy Booms and Tax Benefits

Ramsey is optimistic about Trump’s economic policies, stating, “I hope what he’s attempting to do works.” He identifies several factors that could drive economic growth under the current administration.

Tax policy remains a cornerstone of his optimism. “The middle class got huge tax breaks in 2017, and it was made permanent,” he notes, emphasizing how reduced taxation leaves more money in people’s pockets rather than sending it to “the stupid government.” This policy foundation provides ongoing economic stimulus through increased consumer spending power.

Energy sector development represents another significant opportunity. Ramsey points to “drill baby drill” policies affecting “1/8 of the economy or 17th of the economy, depending on how you measure it,” suggesting that energy sector growth could create broader economic momentum. Combined with potential interest rate reductions, these factors lead him to conclude “there are a lot of reasons to be bullish.”

His surprise that benefits haven’t materialized faster – “I honestly thought some of it would have happened before now” – reflects the complex nature of policy implementation and economic response times.

5. Why Tariff Uncertainty is Freezing the Economy More Than Expected

Ramsey admits being “caught off guard by how all the tariff things…froze everybody,” describing businesses sitting like “deer in the headlights” waiting to see policy outcomes. This reaction surprised him because tariff policies don’t directly affect many companies, including his operations.

The psychological impact exceeded the practical effects. “The waiting to see what’s going to happen did more damage than I thought it would do,” he observes. Businesses that shouldn’t be affected by tariffs still hesitated to make decisions, creating an unexpected economic drag.

This situation illustrates how policy uncertainty can create broader economic impacts beyond directly affected industries. Even companies with minimal international supply chains found themselves postponing decisions, demonstrating the decisive role of business confidence in economic momentum. The widespread hesitation occurred despite many businesses having little exposure to tariff impacts.

6. Commercial Real Estate’s Golden Opportunity During Rate Uncertainty

Ramsey recently put “an LOI [letter of intent] on a piece of commercial real estate” and sees significant opportunities in the sector. His investment strategy targets properties “south of 70% of retail appraisal” with expected returns showing “IRR [Internal Rate of Return] up in the 20s” and “cash on cash would probably be 12% to 14% [returns] most of the time.”

Commercial real estate offers advantages over residential markets because investors compete with “other B2B [Business to business]” rather than emotional retail buyers. This creates a more rational pricing environment where “everybody’s looking for a deal” without the emotional premium of residential purchases.

The absence of emotional buyers eliminates the “white picket fence for my Yorkie in the backyard price” that can inflate residential markets. Instead, commercial transactions focus purely on financial metrics, creating opportunities for experienced investors who understand market fundamentals and can move quickly when opportunities arise.

7. Why This is the “Best Time in Human History” to Build Wealth

Ramsey boldly declares, “This moment in time is the best possible time to be alive in the history of the human race. If you want to build wealth.” His reasoning centers on unprecedented access to information and market opportunities.

Technology has democratized wealth building in ways previous generations couldn’t imagine. People have “information of the entire world in their palm” and can “start a digital application of something, you can go to market with it for free.” This accessibility represents a fundamental shift from traditional barriers to entrepreneurship.

The ease of market entry today contrasts sharply with historical challenges. “It’s like having a magic wand,” he explains, comparing current opportunities to his early days selling “VHS tapes” and carrying “books around the trunk of my car.” Digital platforms eliminate traditional distribution challenges, allowing ideas to reach markets quickly and cost-effectively.

8. The Self-Fulfilling Prophecy That Controls Economic Outcomes

Ramsey emphasizes that “the economy is a self-fulfilling prophecy,” explaining how belief systems drive economic outcomes more than fundamental factors. When people believe economic conditions will improve, they take actions that create prosperity.

Positive economic expectations trigger beneficial behaviors: “If people believe things are going to be good, what do they do? They invest in new people. They bring them on payroll. They give people jobs.” This creates an upward spiral of investment, hiring, and economic growth driven by confidence rather than just data.

Conversely, fear creates the opposite effect: “When you’re scared, you pull back, you build the war chest, and you quit hiring.” This defensive behavior becomes self-reinforcing, as reduced spending and investment create the economic slowdown people feared.

The current tariff uncertainty exemplifies this principle. Businesses hesitating due to policy uncertainty create economic drag regardless of actual tariff impacts. This demonstrates why Ramsey focuses on hope and action rather than fear-based predictions, understanding that economic psychology often matters more than underlying fundamentals.

Summary

- Prediction Track Record: Ramsey admits he’s “generally wrong” about economic forecasting and has unsuccessfully predicted a real estate boom for six consecutive quarters

- Trump Economy: Cautiously optimistic about energy sector expansion, permanent middle-class tax cuts, and potential interest rate reductions

- Housing Market: Acknowledges renting currently makes sense in some markets (costs half of buying), but maintains long-term conviction on homeownership for wealth building.

- Commercial Real Estate: Actively investing in properties below 70% of appraisal value, targeting 12-14% cash-on-cash returns and 20-30% IRR

- Wealth Building Opportunity: Claims this is “the best possible time in human history” to build wealth due to unprecedented digital access and market entry opportunities

- Economic Psychology: Believes economics operates as a “self-fulfilling prophecy” where confidence drives outcomes more than fundamentals; warns tariff uncertainty is freezing business decisions through psychological rather than practical impacts

Conclusion

Dave Ramsey’s economic predictions blend honest humility about forecasting limitations with persistent optimism about opportunities. His willingness to admit prediction failures while maintaining conviction about long-term trends reflects a mature approach to economic analysis.

Whether discussing real estate timing, Trump policies, or wealth-building opportunities, Ramsey consistently emphasizes action over analysis paralysis. His core message remains unchanged: focus on what you can control, take advantage of current opportunities, and don’t let uncertainty prevent progress toward financial goals.

The economy may be unpredictable, but wealth-building principles remain constant despite short-term market fluctuations.