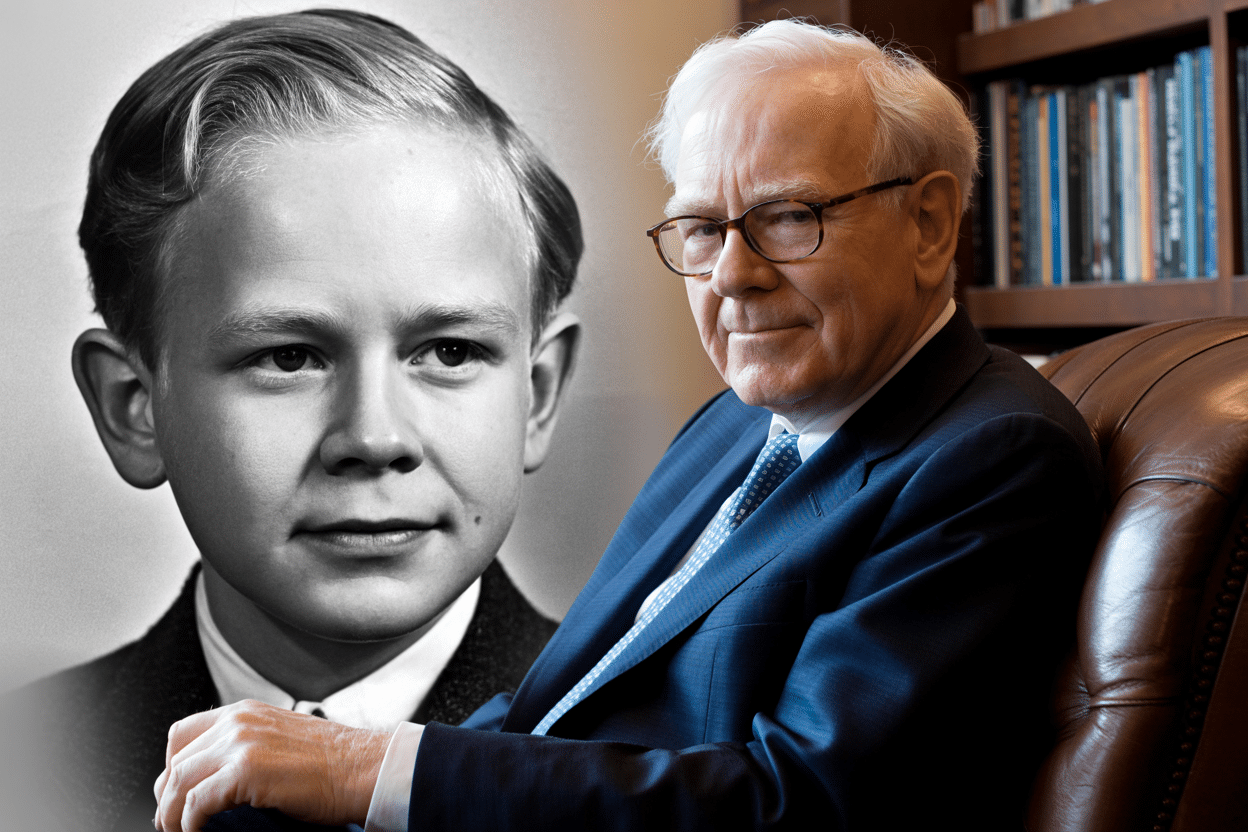

Warren Buffett’s legendary investment career didn’t begin in the Berkshire boardroom or with significant investments—it started on the sidewalks of Omaha, Nebraska, when he was just six years old. The future “Oracle of Omaha” displayed an entrepreneurial spirit that would eventually make him one of the world’s wealthiest individuals. Still, his journey began with nickels and dimes earned through childhood side hustles.

Born in 1930 during the Great Depression, Buffett grew up in a family that valued hard work and financial responsibility. His father, Howard Buffett, served as a stockbroker and later as a U.S. Congressman, providing young Warren with early exposure to business and politics. Buffett was obsessed with making money from his earliest ventures, which went far beyond typical childhood interests.

Alice Schroeder’s biography “The Snowball” documents these formative experiences that laid the groundwork for his later investment philosophy. His childhood businesses weren’t just ways to earn spending money—they were laboratories where he learned fundamental principles about profit margins, customer relationships, and scaling operations.

1. Door-to-Door Entrepreneur: Selling Gum and Coca-Cola at Age 6

Warren Buffett launched his first business venture at age six by selling chewing gum and Coca-Cola bottles door-to-door in his Omaha neighborhood. This wasn’t a casual lemonade stand operation but a systematic approach to identifying and serving customer demand.

Buffett’s product selection showed early market intuition. He focused on Juicy Fruit, Spearmint, Doublemint chewing gum packs, and ice-cold Coca-Cola bottles. These were consumable products with consistent demand, requiring customers to repeat purchases. He bought gum packs for a nickel each and sold them for a small profit.

The door-to-door approach taught him valuable lessons about customer interaction and persistence. He had to overcome rejection, explain his products’ value, and build relationships with neighbors who became repeat customers. This early experience with consumer behavior and product positioning would later influence his investment strategy, particularly his preference for companies with strong consumer brands.

His choice to sell Coca-Cola bottles proved prophetic, as Berkshire Hathaway would later become one of Coca-Cola’s largest shareholders. Even at six, Buffett recognized the appeal of a product that people consumed regularly.

2. The Paper Route That Paid More Than Adult Salaries

When the Buffett family moved to Washington, D.C., thirteen-year-old Warren discovered his most lucrative childhood venture: delivering The Washington Post. This wasn’t just any paper route—it became a masterclass in maximizing revenue from a single business opportunity.

Warren earned $175 per month from his paper route, a substantial sum that exceeded many adults’ income during that era. By age fifteen, his diligent work and intelligent money management had allowed him to accumulate $2,000, demonstrating his early understanding of savings and compound growth.

The paper route taught him about consistency and reliability, as customers depended on receiving their newspapers on time every day. Warren went beyond basic delivery service by identifying additional revenue opportunities along his route. He sold calendars to his newspaper customers and carefully tracked when their magazine subscriptions were expiring, then offered renewal services.

This systematic approach to expanding revenue streams from existing customers became a cornerstone of his later business philosophy. He learned that maintaining strong customer relationships could lead to multiple income sources and that attention to customer needs often revealed new business opportunities.

The young paperboy who once delivered the Washington Post door-to-door eventually became one of its largest shareholders through Berkshire Hathaway and a close friend of publisher Katharine Graham, demonstrating how his early entrepreneurial experiences laid the foundation for his future investment success.

3. Quarters and Nickels: Building a Pinball Machine Empire at 17

Warren Buffett entered the entertainment business at seventeen, partnering with a friend to create a pinball machine operation. This venture demonstrated his growing sophistication in business partnerships and ability to scale successful concepts across multiple locations.

The partnership began when they purchased a used pinball machine for $25, refurbished it, and negotiated placement in a local barbershop. Their business model involved splitting profits with the shop owner, creating a win-win arrangement that gave the barbershop additional revenue while providing customers with entertainment.

The first evening generated $4 in nickels, proving immediate market demand. Rather than being satisfied with one successful location, Warren and his partner quickly expanded their operation to multiple barbershops throughout Washington, D.C. This scaling strategy showed his early understanding of how successful business models could be replicated.

The pinball business taught Warren about cash flow operations, partnership dynamics, and location-based companies. He learned that businesses generating consistent daily cash flow could be highly profitable, and that strategic partnerships could accelerate growth while reducing individual risk.

4. Turning Golf Ball Recovery Into Profit

During his teenage years, Warren operated “Buffett’s Used Golf Balls,” a business that evolved from a simple retrieval operation into a sophisticated supply chain management venture. This enterprise demonstrated its growing understanding of sourcing efficiency and profit margin optimization.

Initially, Warren attempted to retrieve golf balls from water hazards and rough areas on golf courses, cleaning and refurbishing them for resale. However, he quickly realized this labor-intensive approach wasn’t the most efficient source of inventory. He discovered he could purchase refurbished golf balls from a Chicago supplier for $3.50 per dozen and resell them for $6.00 per dozen, creating a reliable profit margin without physical demands.

This strategic shift from manual labor to supplier relationships illustrated his developing business acumen. Warren learned that the most obvious approach to a business challenge isn’t always profitable. He maximized profitability while minimizing operational complexity by focusing on aspects that generated the highest returns on his time and investment.

The golf ball business taught him about inventory management, pricing strategies, and the importance of supply chains, lessons that became fundamental elements of his later investment evaluation process.

5. Mail-Order Business Mastery

Through “Buffett’s Approval Service,” Warren entered the collectibles market by selling stamp sets to out-of-state collectors. This mail-order operation showcased his ability to identify niche markets and manage complex logistics operations extending far beyond his local community.

The stamp business required Warren to understand collector preferences, manage specialized inventory, process mail orders, and handle shipping and payment collection. This was significantly more complex than his previous face-to-face businesses and demanded new marketing, customer service, and operations management skills.

Working with collectors taught him about specialized markets where knowledgeable customers willingly paid premium prices for quality products. He learned that niche markets could be highly profitable with proper customer understanding and reliable service.

The mail-order aspect gave Warren early experience with scaling beyond geographic limitations. Unlike his local businesses, the stamp operation could theoretically reach customers anywhere, providing lessons about market expansion and remote customer relationships.

Lessons That Built a Fortune

By age sixteen, Warren Buffett’s various side hustles had reportedly generated around $53,000 in total earnings—an extraordinary sum for a 1940s teenager. These early ventures weren’t just successful businesses; they were educational experiences teaching fundamental principles he would apply throughout his legendary investment career.

Each business taught specific lessons: the gum and Coca-Cola venture showed product selection and customer relationships; the paper route demonstrated consistent effort and multiple revenue streams; the pinball operation illustrated partnership dynamics and scaling; the golf ball business taught supply chain optimization; and the stamp service provided niche market experience.

These childhood experiences instilled core principles defining Buffett’s investment philosophy: understanding customer behavior, focusing on businesses with predictable cash flow, recognizing competitive advantages, and leveraging compound growth through reinvestment.

The entrepreneurial skills Warren developed—identifying market opportunities, managing costs and revenues, building customer relationships, and scaling operations—became the foundation for his later success in building Berkshire Hathaway into one of the world’s most successful investment companies.

His story demonstrates that business acumen can be developed early and that even childhood ventures provide valuable lessons for future success.