The ‘Dogs of the Dow’ investment strategy first became popular when of Michael B. O’Higgins’s published the book, “Beating the Dow,” in 1991 where the phrase “Dogs of the Dow” was first used.

The ‘Dogs of the Dow’ strategy is a very simple strategy based on the theory that a high dividend yield means a stock’s price is oversold. Using the Dow Jones Industrial Average Components as a filter for the watch list is an attempt to only buy the safest most durable stocks with the least possibility of real long term fundamental trouble. The system tries to create a good risk/reward ratio and margin of safety on entry by buying the ones with the best yield for income and also the relative lowest prices.

The quantified system is when the stock market closes on the last day of the year, filter the DJIA for the 11 highest dividend yielding stocks by percentage versus stocks. Then the buy signals are triggered on the first trading day of a new year. You skip the lowest priced because that one probably does have fundamental issues versus being a value and good income generator. There are three different position sizing strategies suggested in the book. The author suggests you can either put all your money in the second to lowest priced with the best yield, or 20% of your money in each of the 2nd-6th stocks, or 10% of your money in the 2nd to 11th stocks that are the lowest priced with the best yield. The strategy is to rotate your holdings once a year based on the 2nd through 11th highest yielding DJIA components.

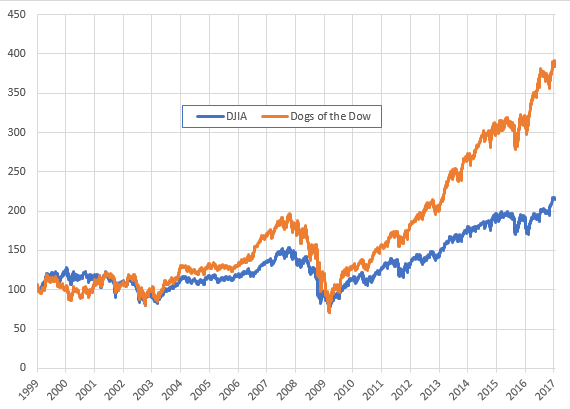

He shows the back tested history of this method as delivering huge gains. It is a system to think about or use it to develop your own depending on your own risk tolerance and return goals.

Original Image Source here.