A bearish credit spread refers to an option play constructed so the value of the spread position increases if the price of the underlying stock falls. A bearish credit spread is constructed with two call options.

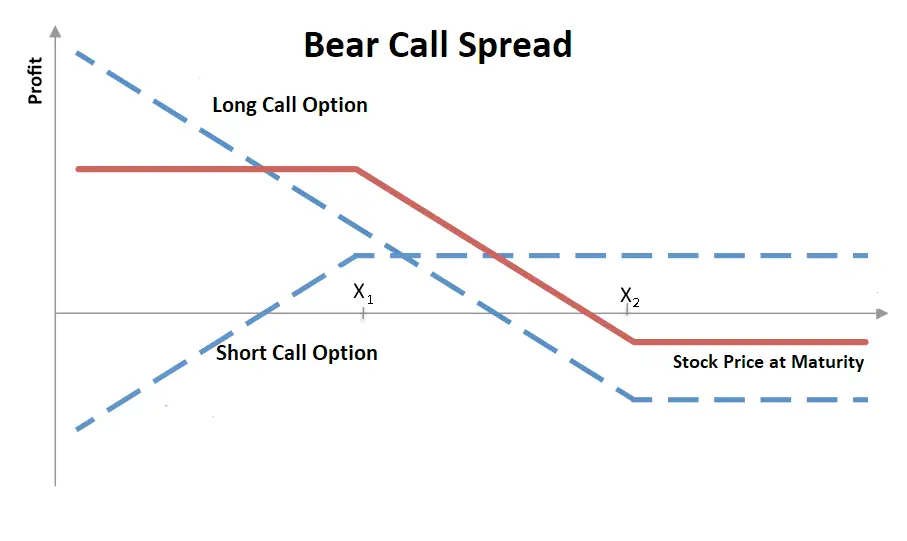

A bear call spread or credit call spread is an option play that is one kind of vertical spread. A bear call spread play is created with two call options that have the same expiration date but are at different strike prices. This play is built by selling one call option short and buying another call option. The short call strike price is lower than the strike price of the long call option so this option play is opened for a net credit. The goal of this option strategy is to generate income from option premium.

An option brokers margin requirements for option credit spreads are generally much less than they are for uncovered call options or naked puts that have theoretical unlimited risk. A credit spread is an option play with defined risk as the long option acts as a hedge for the short option. It is not possible for the account to lose more money than the margin that is required at the time the play is opened because the loss is capped.

This type of bearish option play is best suited for range bound or falling markets and the profit comes from the variance in premium between the long option contract and the option contract sold short.

The short call leg of this option play is to create income through selling premium and the long call leg is just a hedge to quantify the risk if price moves against the option you sold short.

This option play will make money if the option premium is kept as profits until it both options are closed or expires. This is a bearish play so maximum profit happens if the underlying stock remains under the lower strike price through the life of the options.

With this option play even a strong market up swing in price will not create a big loss as the hedge limits the losses if the bearish sentiment is proven incorrect.

The maximum gain for a bear call spread is equal to the net credit kept if both call options expire out-of-the-money.

The maximum possible loss is the difference in strike prices minus the net credit that occurs if both the options expire in-the-money. The maximum loss happens when the stock price is at or above the strike price of the long call option leg on expiration.

I have created the Options 101 eCourse for a shortcut to learning how to trade options.