Charts are visual representations of the prices where buyers and sellers agreed to trade over at different periods of time in the past. In markets there is a buyer and seller for every trade execution, a stock quote is the price where the buyer and seller agreed and made a transaction.

Buyers and sellers are always equal in trading it is the price that changes where they are willing to exchange a position for cash. Saying that there are more buyers than sellers in a market is incorrect as price is always set where equilibrium is met. There may be different quantities of buyers or sellers at different price points at the bids and asks in markets but the quote is where they met.

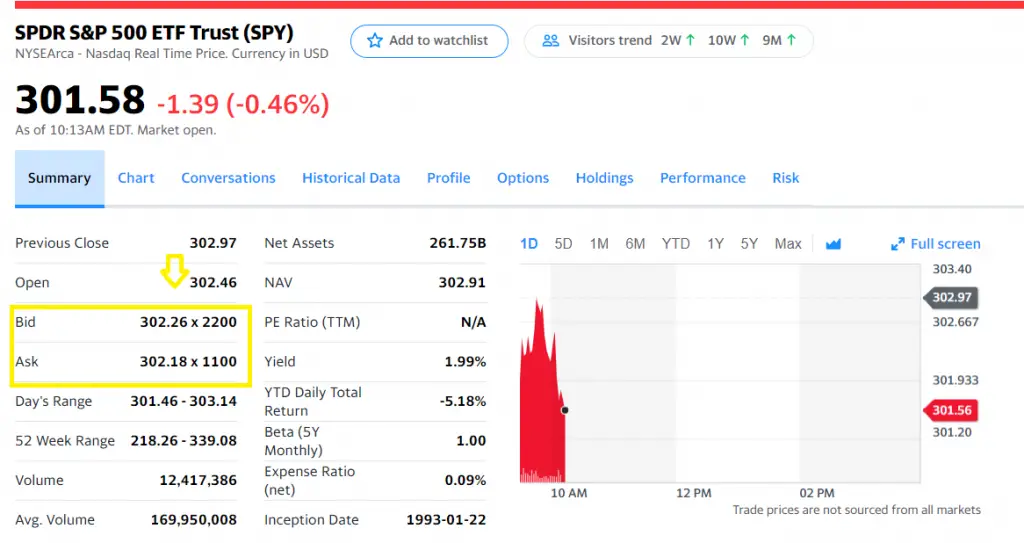

The level that trades take place before a stock is quoted is called the bid and the ask prices. The bid price is the current highest price that a buyer is willing to purchase a stock if someone is willing to sell it to them. This is called the ‘bid’. The ask price is what a seller is offering to accept to sell their position for. This price is referred to as the ‘ask’.

The gap and distance between both the best current bid price and the best current ask price is called the spread. The greater the spread the less liquidity and volume their likely is in a market. The higher the amount of buyers and sellers in a market the greater the odds of having enough people willing to buy or sell at different prices to have a tighter bid/ask spread. The wider the bid/ask spread the more money that is lost getting in and out of a market as the gap in prices causes slippage on both entry and exit.

In trading you can see the bids and asks with your broker when you go in to place a trade with the current quote. You can see a more detailed list of the current bid and ask prices along with volume if you have Level 2 quotes.

The bid prices are the willing buyers and the ask prices are the willing sellers and where they meet is the prices you see quoted.

Image from Finance.Yahoo.com