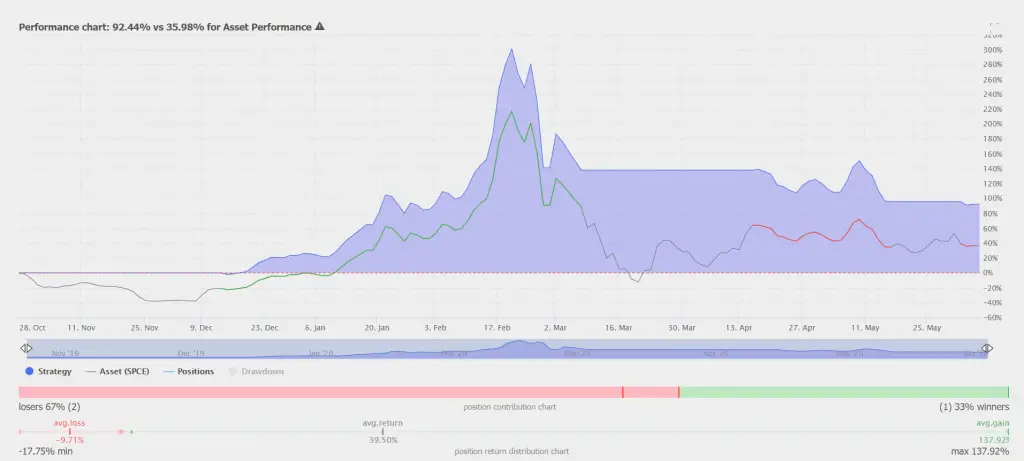

Backtesting is the process of applying entry and exit signals to time periods of past historical price data to quantify through an equity curve whether the system would have lead to overall profits in the past. A backtest is a look back at how a quantified trading system would have performed in the past. While a profitable backtest does not guarantee that the same signals will make money in the future, if it did not work in the past it most likely will not work in the future either.

A good backtest does raise the probabilities that since it worked on past data it may work on future price action because the signals did navigate volatility to create bigger total profits compared with the losses. The principles of the trading system could be valid and what allowed for profitability if that is what the backtest shows.

Trading systems that create good risk/reward ratios with bigger wins than losses or a high winning percentage of trades with no large losses will backtest as profitable. Most backtested systems attempt to capture trends in markets and limit losses by not being on the wrong side of a trend.

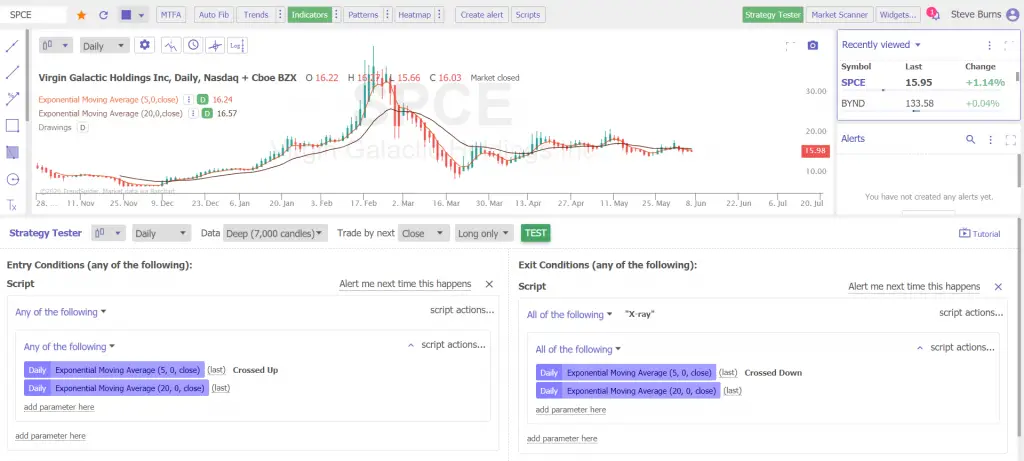

A backtest is usually done on a software platform that has the historical data and the ability to enter signals and then test to see how it did. Some traders do use Excel spreadsheets to backtest their price action systems. For a backtest input is given with entry signals and exit signals that create dynamics of where to get in and where to get out based on price action or technical indicators. Backtests should create the quantification of an entry signal for when to get into a trade. Also a stop loss signal for a losing trade to keep losses small and also a trailing stop signal to maximize gains for the winning trades has to be part of the input process.

Some people will also input profit targets for trades. A stop loss in comparison to a hypothetical profit target does create a quantified risk/reward ratio. A risk/reward ratio along with a high enough win rate can create a profitable system as long as losses are kept small and position sizing is managed properly based on volatility and open risk.

A backtest of signals should be performed on a watchlist of stocks, ETFs, currencies, or commodities you plan to trade. Markets have different levels of volatility with trends and each should be backtested for validity of signals on historical data.

All a backtest is attempting to do is use repeatable mechanical signals that give profitable entry and exit dynamics to create bigger wins and smaller losses over the long term. The primary driver of a profitable backtest is by cutting losses short and letting winners run. A system has to have signals that filter out a lot of the price action noise that causes over trading and instead signal the opportunities to capture trends and swings in price action.

Trading quantified mechanical backtested signals also filters out much of the emotion of trying to decide what to do each day from your own opinion and prediction. You change from an opinionated predictor to the follower of a systematic process. Your job becomes to follow signals and ignore your own feelings when you quantify your process.

There is no perfect backtested system there is just the system that you can confirm that worked over multiple markets in the past and has a great potential for working in the present and future. It has to be a process that makes sense that you can follow with discipline over the long term.

“The moral is simple: Don’t draw any conclusions about a system (or indicator) on the basis of isolated examples. The only way you can determine if a system has any value is by testing it (without benefit of hindsight) over an extended time period for a broad range of markets.” – Jack Schwager

For a shortcut and time saver on learning the basic principles of backtesting, check out my Backtesting 101 eCourse here.